Choosing the right buyer intent tools can be critical to your B2B marketing and sales success. This article rounds up the top 10 buyer intent data tools for 2024, each included for its ability to boost your leads, pipeline, and sales through actionable signals.

A Quick Overview of Top 10 Buyer Intent Tools for 2024

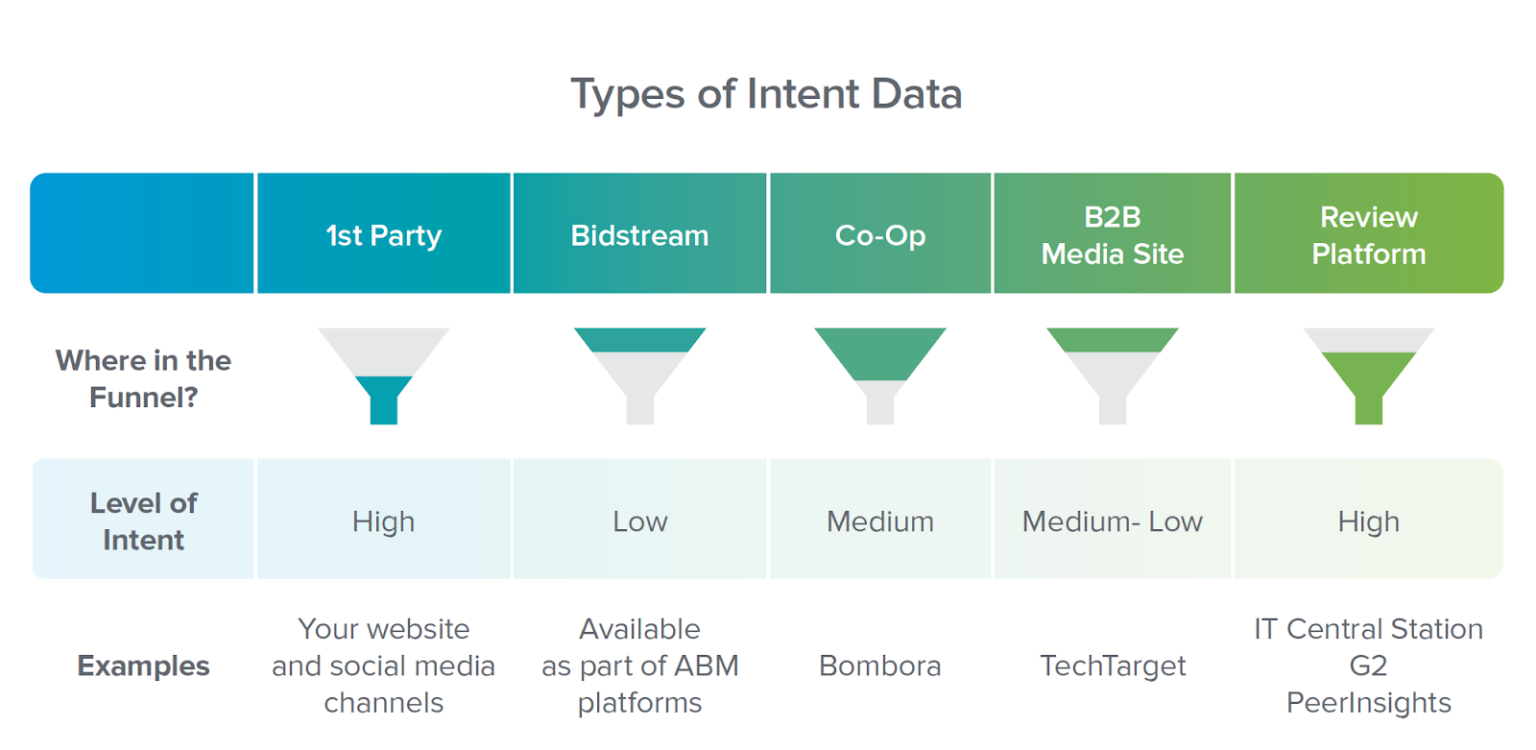

As we explore the top buyer intent tools, it’s essential to grasp the three types of buyer intent data:

-

First-Party Intent Data comes directly from your digital channels, like your website. It offers insights into how your prospects interact with your content. Tools like Leadfeeder use this data to reveal who’s interested in your offerings.

-

Second-Party Intent Data is another entity’s first-party behavioral data shared with you, providing a direct glimpse into a prospect’s interests through their interactions in another place. Platforms like G2 share their user review data, expanding your intent pool to another source.

-

Third-Party Intent Data is collected from various sources, offering a broader view of potential buyer behaviors across the web. Tools like Bombora analyze this data to uncover an even wider pool of buyers showing interest in your solution.

Understanding these differences is key to selecting the right intent data provider to align with your sales and marketing strategies.

Here’s a quick overview of the top 10 intent data providers to help fill your sales pipeline in 2024:

- Leadfeeder: The Best for First-Party Intent Data

- ZoomInfo: Best for Buyer Intent Integration Into Sales Workflows

- Cognism: The Best for Targeted Prospecting

- G2: For Full Funnel Second-Party Intent Data From

Reviews : G2 - TrustRadius: Great for Downstream Educated Purchase Decisions In Mid-Market and Enterprise

- PeerSpot: For Second-Party Intent Data In Enterprise IT, DevOps, and Cybersecurity

- Gartner Digital Markets: For Capturing In-Market SMB Demand

- Bombora: Ideal to Capture A Large Pool of Third-Party Intent Data

- 6sense: The Best To Combine Buyer Intent Data Sources For Account-Based Marketing

- TechTarget: For Larger IT Sales and Marketing Teams Seeking A Targeted Pool Of Third-Party Intent Data

Diving Deeper into the Best Buyer Intent Tools

Having provided a brief overview, let’s now cover the specifics of each B2B intent data provider. By familiarizing yourself with the key features, benefits, and use cases of these providers, you’ll be better equipped to pick the one that best suits your business needs.

Here’s your guide to b2b intent data.

Leadfeeder: The Best for First-Party Intent Data

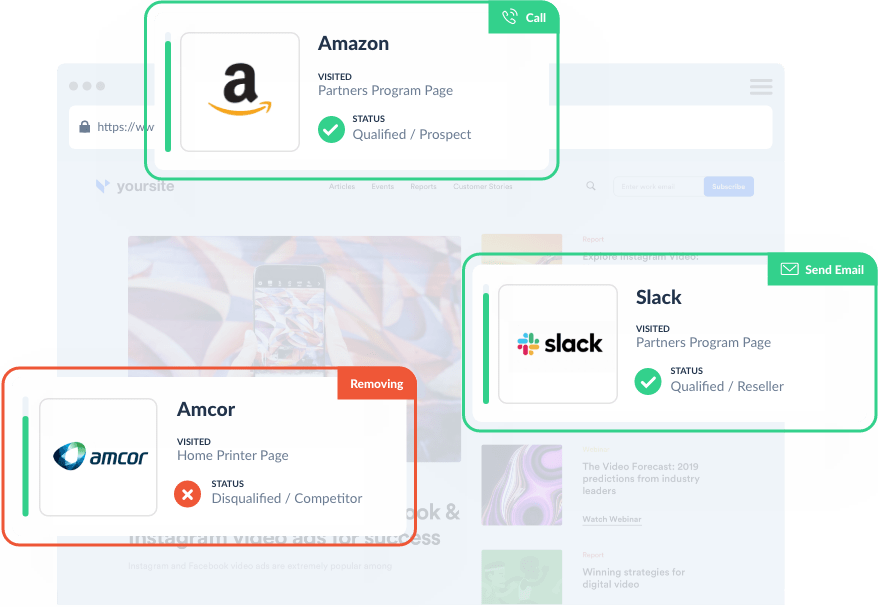

Leadfeeder, with its focus on first-party intent data, acts as a powerful radar for businesses, tracking the movements of visitors on your website by their IP addresses. It offers real-time insights, allowing businesses to identify potential leads and take immediate action.

However, its utility is limited to businesses that can rely on website traffic for lead generation. But for businesses with a significant online presence, Leadfeeder can be a powerful tool in their arsenal.

How It Works:

- Tracking Website Visitors: Leadfeeder identifies which companies visit your site and what actions they take, even if they don’t fill out a form.

- Analyzing Visitor Behavior: It assesses the pages viewed, time spent, and overall engagement to determine interest level.

- Lead Scoring: Visitors are scored based on their activity, helping prioritize leads that show strong buying signals.

- Integration: The tool integrates with CRM and email marketing systems, allowing for automated follow-up and personalized outreach.

Pros:

- Excellent for gathering first-party intent data

- Provides valuable insights on website visitors

- Real-time tracking allows immediate action

- Price: Leadfeeder offers two pricing plans: a Free plan and a Paid plan that starts at $139/month.

Cons:

- Only captures the buyer intent from your website traffic

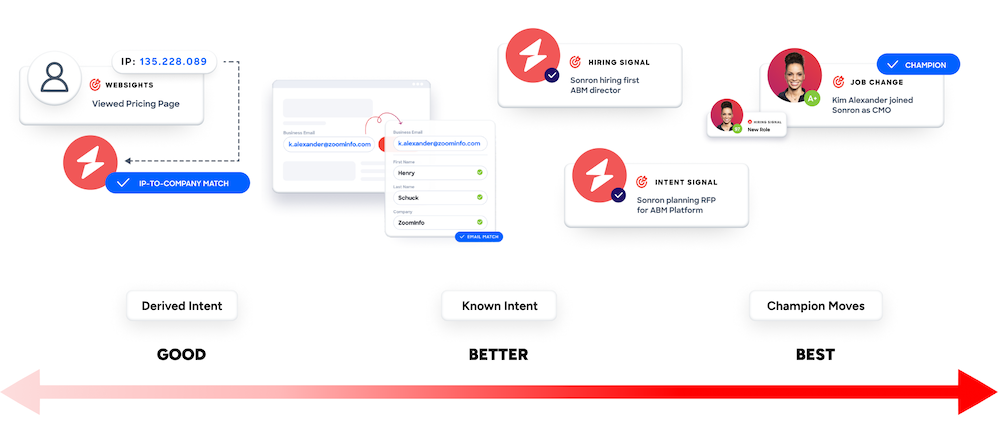

ZoomInfo: The Best for Buyer Intent Integration Into Sales Workflows

ZoomInfo is a dominant player in sales data and is a prominent B2B intent data provider. With its integration capabilities, ZoomInfo help weave buyer intent data into sales workflows, enabling sales teams to gain insight into relevant information on active buyers through tools like FormComplete, Scoops, and third-party intent data. With ZoomInfo, it’s not just about the data; it’s about making the data work for your sales team.

However, it’s not all smooth sailing. The high price point may be a deterrent for some businesses. Additionally, to truly unlock the potential of ZoomInfo, the learning curve can be steep. But once you’ve overcome those challenges, ZoomInfo’s intent solution can satisfy your sales team.

How It Works:

- Digital Signal Tracking: ZoomInfo monitors web activity, including content consumption and search behavior, across thousands of sites to identify companies showing interest in specific topics.

- Intent Data Analysis: It analyzes these digital signals to pinpoint companies likely in the buying process for products or services like yours.

- Lead Prioritization: Based on the intent data, ZoomInfo scores and prioritizes leads, highlighting those most engaged and ready for outreach.

- Integration and Action: The platform integrates with sales and marketing tools, enabling targeted campaigns and outreach to these high-intent leads.

Pros:

- Smooth integration of buyer intent data into sales workflows

- Ability to identify relevant contacts within a buying team and provide their contact details

Cons:

- Their market leadership comes with a high price

- Requires training to get the most from it

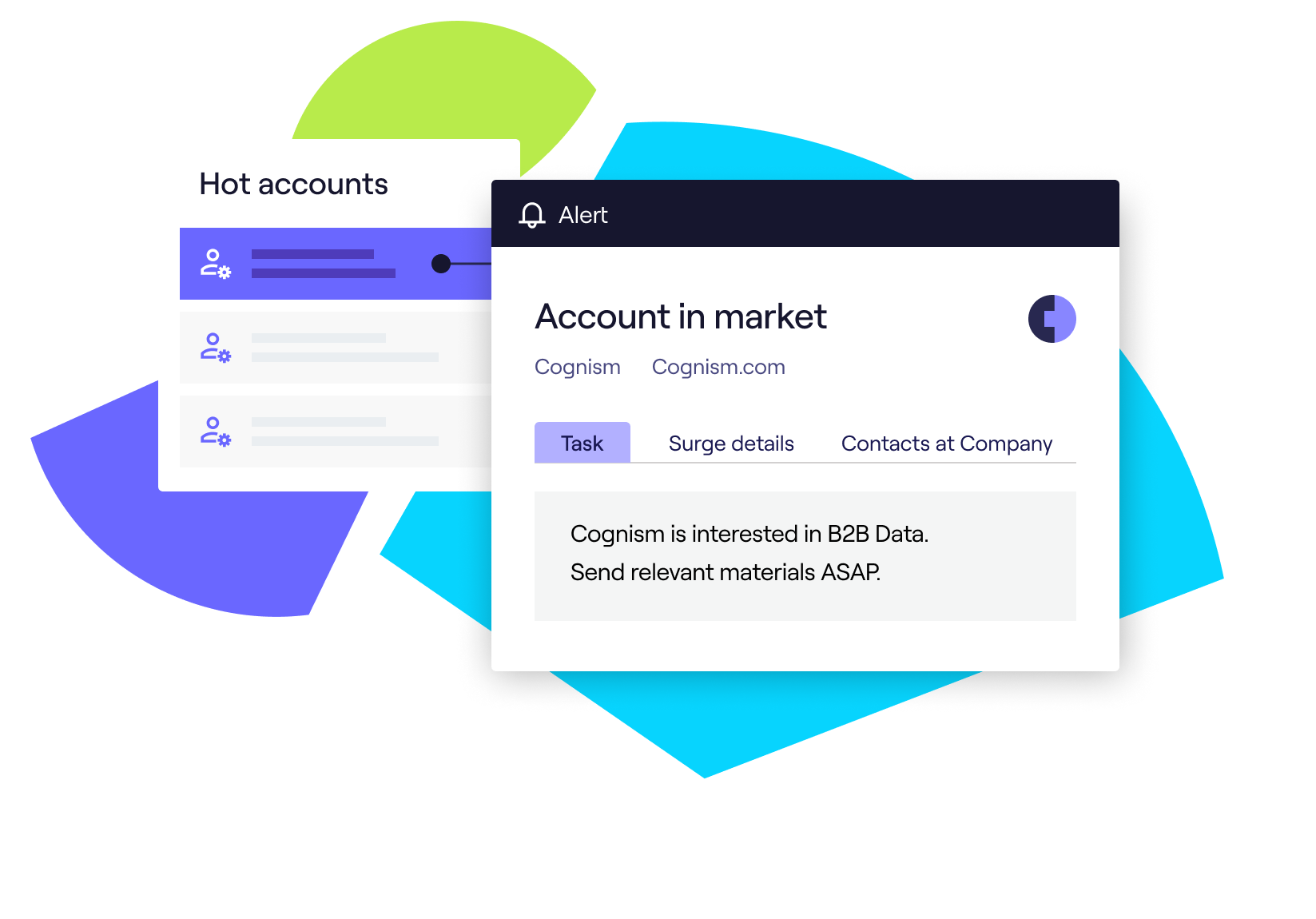

Cognism: The Best for Targeted Prospecting

Cognism acts as a compass directing sales teams towards their most promising leads, specializing in targeted prospecting. Its AI-based recommendations and actionable customer insights enable businesses to tailor their messaging and target their efforts accurately.

However, intent data with Cognism does come at a price. Intent data (embedding Bombora) is not part of its Diamond Tier pricing; only the Platinum Tier. But for sales teams looking to streamline their prospecting efforts, Cognism can help action buyer’s intent to generate more quality leads.

How It Works:

- Signal Detection: Combines Cognism’s detection of online behaviors with Bombora’s wide-reaching dataset on B2B website interactions, offering a fuller view of market interest.

- Intent Analysis: Employs AI to assess signals from both sources, pinpointing companies researching or considering solutions like yours for a more informed analysis.

- Prioritization: Uses the combined strength of Cognism’s and Bombora’s data to score and rank companies by buying interest, guiding sales teams to the most interested prospects.

- Engagement Tools: Delivers insights and key contact information, enhanced with Bombora’s data, for targeted and effective outreach.

Pros:

- Excellent for targeted prospecting

- Provides valuable customer insights

Cons:

- Requires a significant investment

- Limited utility for non-sales sectors

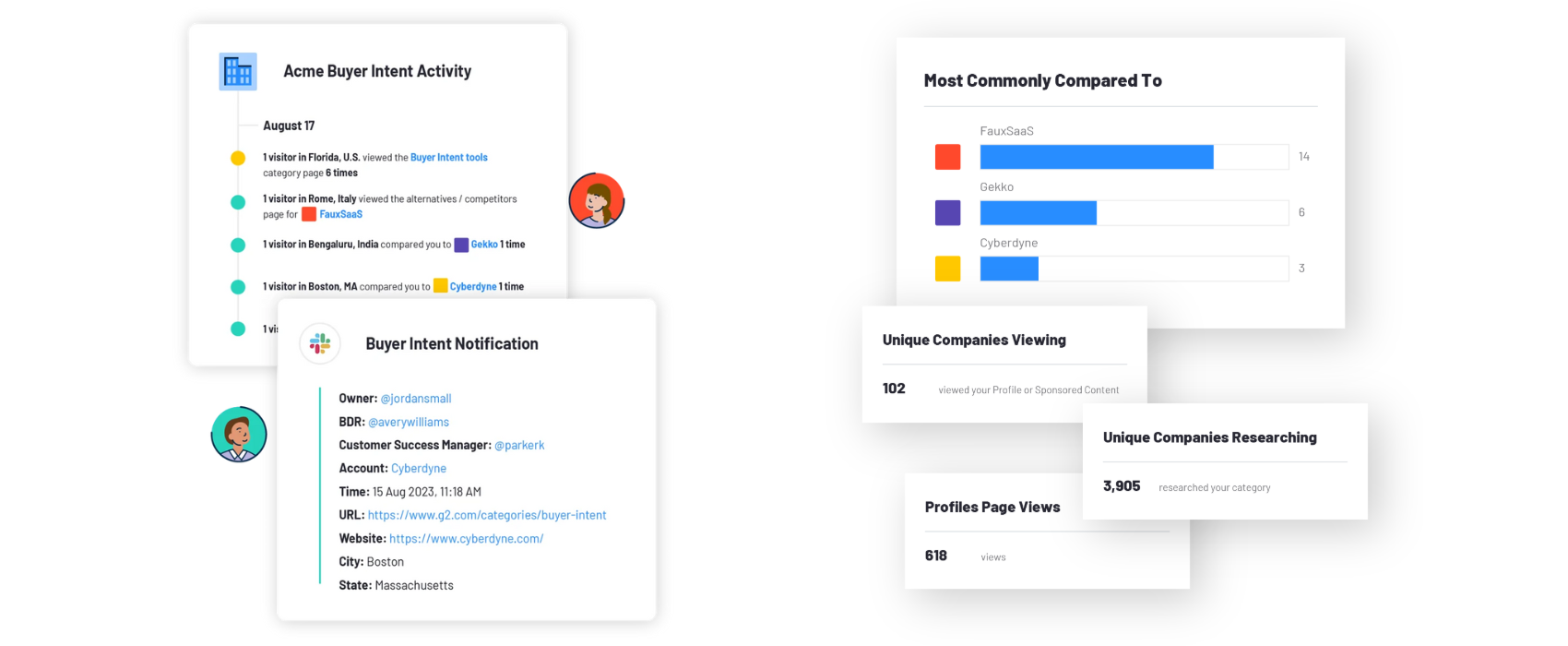

G2: For Full Funnel Second-Party Intent Data From Reviews

G2 is the most visited software review site. With more than 90 million annual visitors to 2,100 categories covering 145,000 products and services, there’s an excellent chance that they have data on who’s actively seeking your solution.

While the site is free to software buyers, one of G2’s main solutions for vendors is its second-party intent data derived from

However, to truly benefit from G2 intent data, businesses need to have the willingness and ability of marketing and sales to action the intent. For example, Sales needs to take the data on which companies visit their company’s product profile and turn it into a relevant message sent to the right people at the account, which can be a challenge for some. Also, it’s only for software solutions and more recently B2B service providers. Nevertheless, for B2b software and service businesses with the right team in place, G2 intent can provide actionable data across your buyer’s journey.

How It Works:

- Activity Tracking: Monitors visitors to specific categories, product profiles, and comparisons to capture company-level buyer intent.

- Intent Analysis: Uses algorithms to pinpoint businesses researching software and their purchase readiness.

- Outreach Insights: Offers data on company-level behaviour on who’s viewing your categories, products, and comparing you to the competition.

Pros:

- Identifies many companies researching software solutions on its site

- Get real-time notifications via email or Slack

- Easily filter and sort by intent types — category page, product page, or comparison — and intent quantity to prioritize accounts showing the most intent

- Integrates with over 20 partner solutions to specifically extend its buyer intent data functionality

Cons:

- Price; can add up, especially if you’re listed in multiple categories

- Limited to software solutions (mostly; recently started to serve B2B services)

- Company-level only data; needs to be integrated with another system to help find the right contacts to reach out to at the accounts showing intent.

TrustRadius: Great for Downstream Educated Purchase Decisions In Mid-Market and Enterprise

TrustRadius, leveraging its buyer decisioning platform, serves as a guide for businesses to make well-informed decisions in the world of mid-market and enterprise procurement. By providing in-depth

However, the utility of TrustRadius is limited for companies targeting smaller companies. Also, the volume of intent is low in some categories in which they don’t rank highly in search results. Nonetheless, for mid-market and enterprise vendors looking to reach their desired audience while they’re in purchase decision mode, TrustRadius is a great option.

How It Works:

- User Interaction Tracking: Observes how users engage with product

reviews and information. - Intent Identification: Analyzes engagement to highlight users with strong purchase intent.

- Lead Scoring: Scores leads based on engagement depth, indicating readiness to buy.

Pros:

- Valuable insights from customer feedback found in their in-depth user

reviews - Integrates with CRM, ABM, and paid media channels

- Ideal for mid-market and enterprise sectors

Cons:

- Limited utility for companies targeting small businesses

- Lacking in volume of traffic in some categories

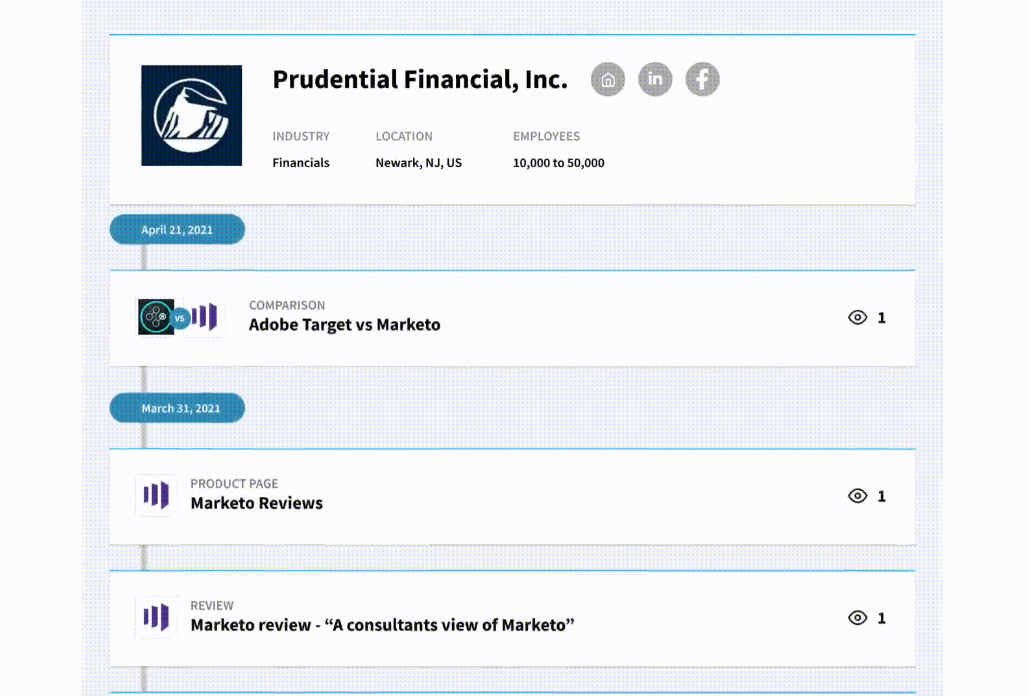

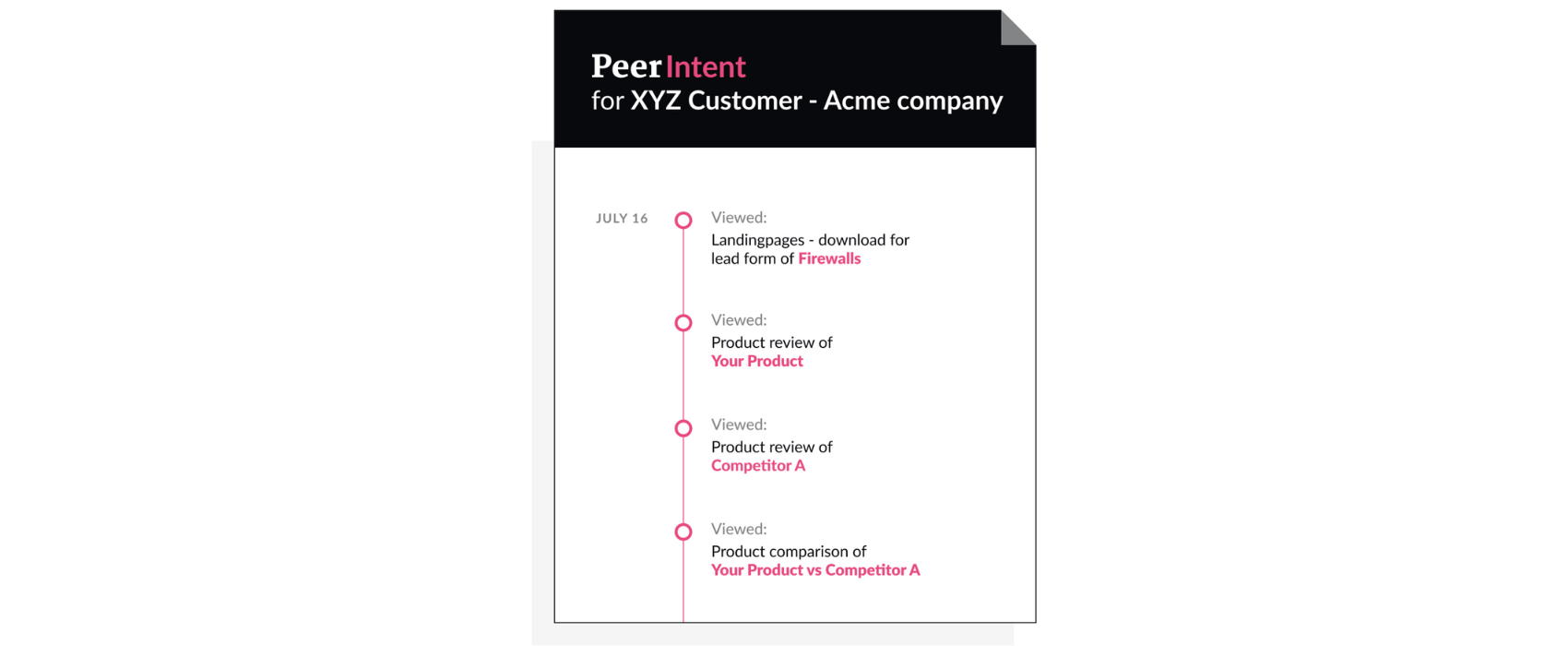

PeerSpot: For Second-Party Intent Data In Enterprise IT, DevOps, and Cybersecurity

PeerSpot provides second-party intent data in for businesses operating in enterprise IT, DevOps, and cybersecurity. Its comprehensive and verified

However, the utility of PeerSpot is limited to the IT sector. Also, like with all review-based intent solutions, it relies on web traffic from in-market buyers, which can be low in some categories. Nevertheless, for enterprise businesses in the IT sector, PeerSpot can help support your marketing, sales, and customer success.

How It Works:

- Behavior Tracking: Monitors user engagement with

reviews , comparisons, and discussions. - Intent Detection: Analyzes activities to identify users with strong intent to purchase IT solutions.

- Scoring System: Ranks users based on research intensity, indicating readiness to buy.

Pros:

- Comprehensive

reviews - Ideal for enterprise IT, DevOps, and cybersecurity sectors

- Supports sales development, ABM, and customer retention

Cons:

- Limited utility for non-IT sectors

- Low web traffic for some categories

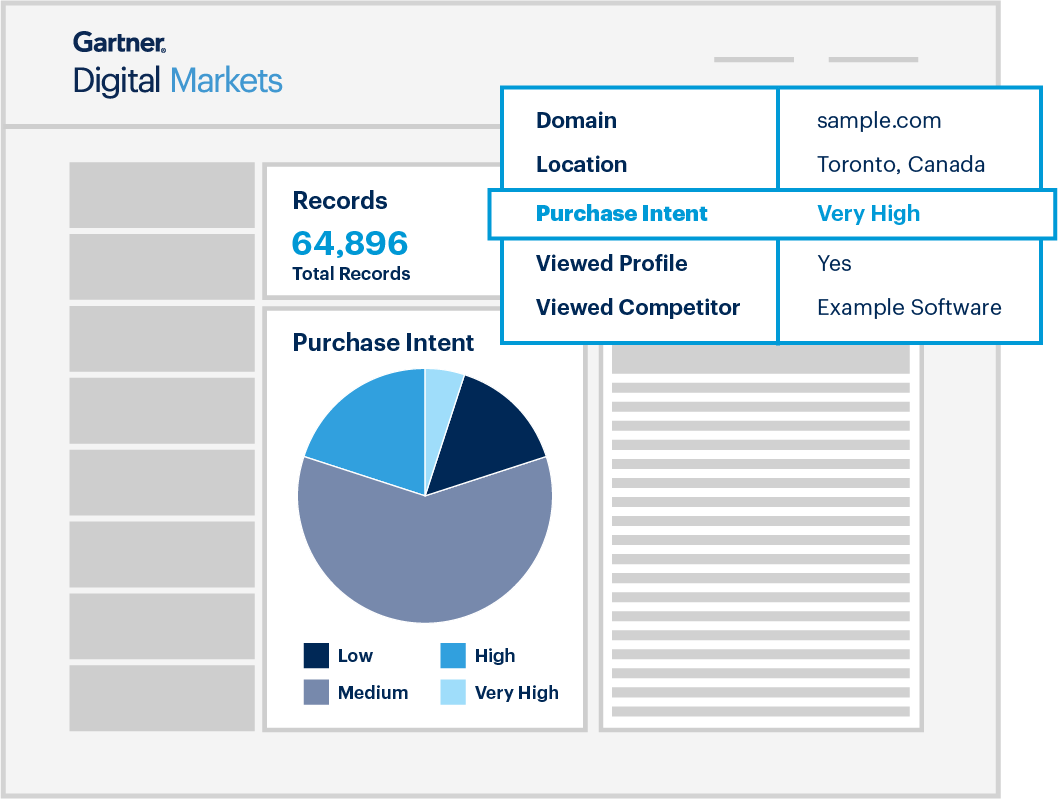

Gartner Digital Markets: For Capturing In-Market SMB Demand

While finding quality sales in SMB demand is challenging, Gartner Digital Markets — a group of four online

However, most companies who pay for Gartner Digital Markets offering go with their more establish pay-per-click and pay-per-lead offerings, which limits the appeal of buyer intent data if you believe you’re able to capture much of the demand on their sites without intent data. Also, its utility is limited to the SMBs the site generally attracts. But for those who target SMBs, don’t want to run PPC or PPL marketing campaigns, or feel like there are more qualified leads to be had beyond ad spend, Gartner Digital Markets intent data might be worth a shot.

How It Works:

- Activity Monitoring: Tracks software

reviews , comparisons, and content engagement to gauge interest. - Intent Analysis: Uses analytics to spot companies researching tech solutions, indicating purchase readiness.

- Prospect Ranking: Scores and ranks interested companies, aiding vendors in targeting high-potential leads.

Pros:

- Access to a large pool of in-market SMB buyers

- Now integrates with CRM, ABM, and sales tools (relatively new addition)

- Strong performance in search engine results pages due to their first mover advantage in software review sites

Cons:

- PPC and PPL options effectively capture demand on the site; how much more can be gained by layering on their intent data?

- Limited utility for companies targeting mid-market and enterprise

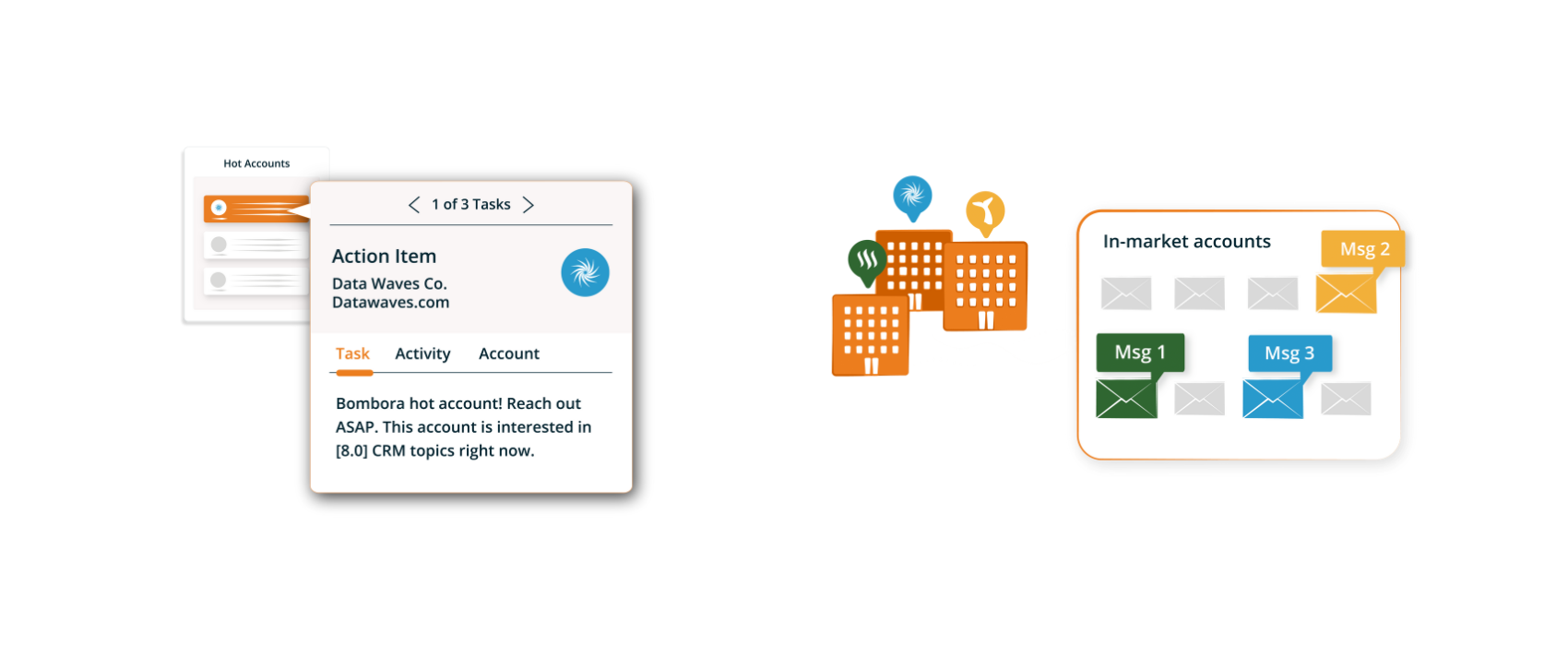

Bombora: Ideal to Capture A Large Pool of Third-Party Intent Data

Bombora’s ocean of data is a treasure trove for businesses looking to understand their target market’s behaviors and interests.

However, while their ocean of data is vast, navigating it can be challenging. Bombora provides more signals than other forms of intent but with more degrees of separation, the waters can get murky. But, for those looking for the largest amount of intent signals, Bombora might be the best bet.

How It Works:

- Bombora compiles an extensive dataset of third-party intent data by aggregating buying signals from nearly 4 million unique domains, with a monthly tally of 16.3 billion interactions across more than 5,000 websites through its data Co-op.

Pros:

- Access to one of the largest pools of intent data through a vast network

- Advanced machine learning techniques for data interpretation

- 13,000 B2B topics covered, including specific products for buyer intent on competitive tools

Cons:

- Lower fidelity intent signals relative to other sources

- Easier to lose the buy-in of sales teams on buyer intent data with third-party data than first or second.

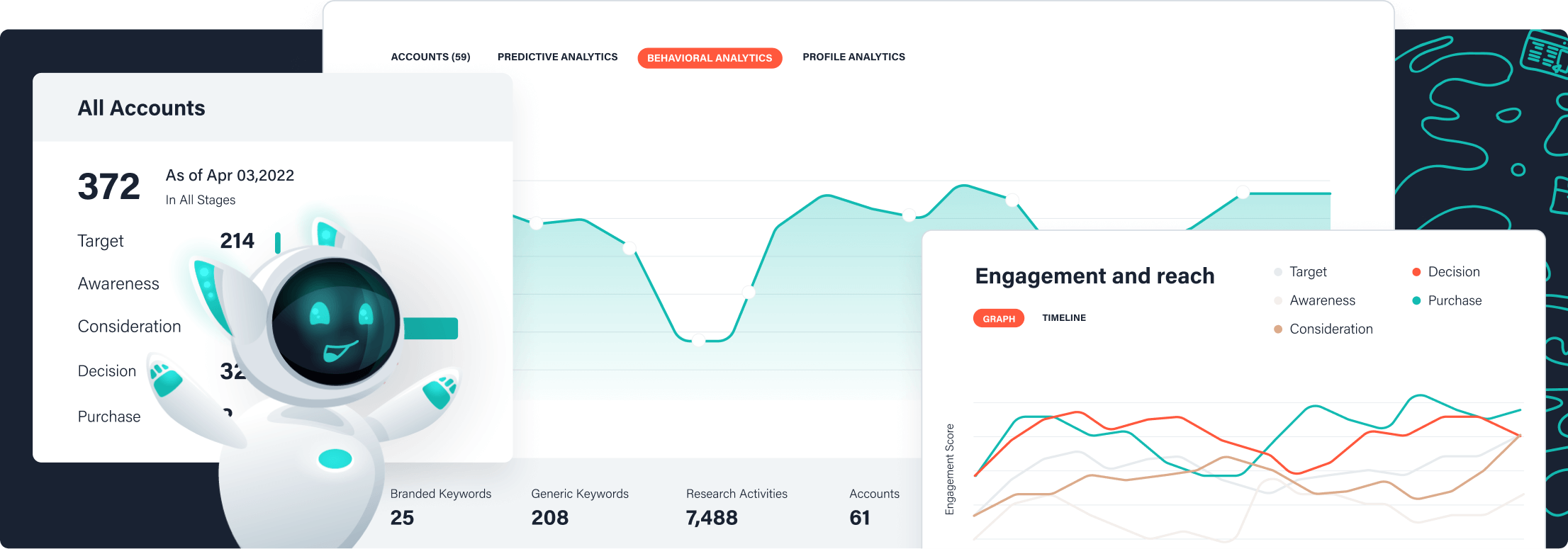

6sense: The Best To Combine Buyer Intent Data Sources For Account-Based Marketing

6sense functions as a compass for businesses, guiding their account-based marketing with its buyer intent signals. Its AI-driven predictive model identifies the most promising leads, providing business with deeper insight on buyer behaviour and engagement.

However, 6sense’s buyer intent is a package deal with its ABM platform, which adds up to a major investment. But for those who want to have intent data in a platform to action it, 6sense is a top choice — if you can afford it.

How It Works:

- Multi-party intent data: 6sense aggregates data from first-party (website, CRM), second-party (partnerships), and third-party (internet sources), tracking web interactions to identify interest in topics or solutions.

- AI Analysis: Utilizes AI and machine learning to analyze data, spotting patterns and signals of purchase intent, such as topic research or competitor engagement.

- Intent Identification: Detects in-market accounts by analyzing behavior signals, enabling proactive targeting of potential buyers.

- Predictive Modeling: Uses predictive analytics to identify and score accounts likely to purchase, helping prioritize the right accounts.

Pros:

- Bringing multiple intent sources together for better account intelligence

- Integrating tightly with marketing tools

Cons:

- High price

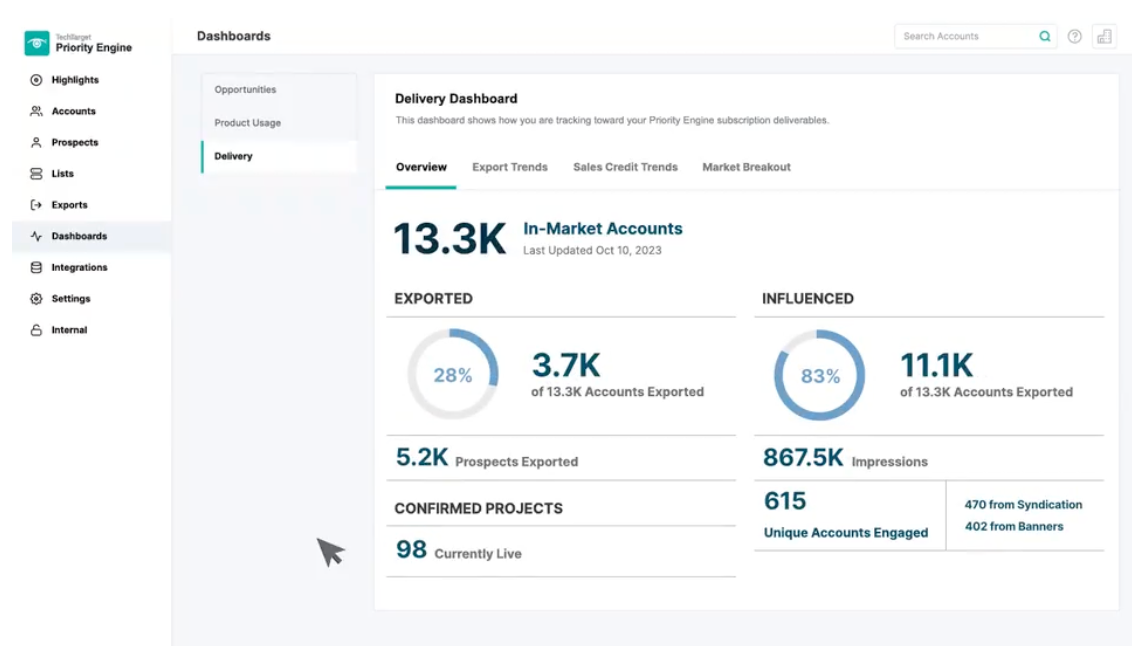

TechTarget: For Larger Teams Seeking A Targeted Pool Of Third-Party Intent Data on IT Professionals

TechTarget has a vast reservoir of third-party intent data for larger teams. It provides real-time buyer behavior data, allowing these teams to:

- Target their efforts accurately

- Personalize their messaging

- Identify high-value target accounts

- Prioritize leads

- Optimize their marketing campaigns

This valuable data helps teams make informed decisions and drive better results.

However, its utility is limited to larger sales and marketing teams who target IT professionals. But for the right organizations, TechTarget’s Priority Engine can be a good investment.

How It Works:

- Intent Data Collection: It collects data from TechTarget’s network, tracking organizations’ research activities on technology solutions.

- Account Prioritization: The platform ranks accounts by engagement level and buying signals, like research frequency and content interaction.

- Contact Insights: Provides details on key individuals within these accounts, including roles, interests, and contact information.

- Content Preferences: Identifies the topics and content types that are engaging accounts and contacts, allowing for tailored messaging.

Pros:

- Access to a large pool of third-party intent data

- Ideal for larger sales and marketing teams targeting IT professionals who consume content on their technology-focused publisher websites.

Cons:

- Limited utility for smaller sales and marketing teams and those who ICP doesn’t engage with TechTarget sites

- Requires integration with tech stack to unlock the value

Frequently Asked Questions

What is buyer intent data?

Buyer intent data reveals online behaviors of your target audience that indicate their potential actions, such as purchasing a product in your category or switching to a competitor. Despite its significance, it is often underutilized in business.

Why is Buyer Intent Data Important?

Buyer intent data is important as it provides intel on which prospects are actively looking to buy, allowing businesses to target those most likely to convert. On average, only 5% of buyers are in-market at a given time, so leveraging buyer intent enhances sales efficiency by highlighting where a prospect stands in their buying journey, enabling personalized outreach with content and solutions that match their needs. This focused strategy improves customer experience and significantly boosts the chances of successful transactions.

What are the benefits of using buyer intent tools?

Using buyer intent tools can help businesses understand their prospects better, tailor their messaging, and make more efficient use of go-to-market resources. They are valuable for focusing on the right buyers at the right time.

How can businesses use buyer intent data?

Businesses can use buyer intent data in several strategic ways. Sales teams can prioritize their outreach to leads showing strong buying signals, ensuring they engage with prospects most likely to purchase. Marketing teams can tailor content and campaigns to address the specific interests and needs of their target audience, increasing engagement and conversion rates. Additionally, businesses can use intent to enhance account-based marketing (ABM) strategies, focusing on key accounts with high buying potential. By integrating buyer intent data into CRM and marketing automation platforms, companies can automate personalized outreach, streamline their sales process, and ultimately drive more revenue.

How can I choose the right buyer intent tool for my business?

Choose the buyer intent tool that best fits your business’s specific needs, considering factors like breadth vs depth of intent signals, data quality, integration capabilities, and pricing. Consider how each tool addresses your unique challenges and requirements, especially how each will help you hit your targets. Ask vendors if they provide a trial or sample of buyer intent data, along with researching user

Author

-

I'm the Founder and Editor-In-Chief of B2B SaaS Reviews and the Director of Demand Generation at PartnerStack, the leading platform for partner management and affiliate marketing in B2B SaaS. My experience spans several notable B2B SaaS companies, including Influitive (Advocate Marketing), LevelJump (Sales Enablement, acquired by Salesforce), and Eloqua (Marketing Automation, acquired by Oracle). I hold a Bachelor of Commerce in Marketing Management from Toronto Metropolitan University and a Master of International Business from Queen's University, with academic exchanges at Copenhagen Business School and Bocconi University.