In today’s fast-changing business software market, online reviews continue to play an important role.

Our “2023 State of B2B Software Reviews” study explores the importance of reviews today. Most buyers trust what their peers say on review sites more than what vendors say in their sales pitches.

However, trust in online reviews could be better. Many buyers limit their use of software review sites due to concerns over the authenticity of the reviews, making them cautious and skeptical.

This situation is tricky for businesses and review sites. They must build trust and support their bottom line while ensuring reviews are real and reliable, especially in an era of information overload and mistrust.

To shed more light on the role of reviews in B2B software purchase decisions, we asked 411 US-based buyers who read reviews when choosing business software about their use of review sites.

We wanted to know why they go to these sites, how they use them, and what stops them from using them more.

11 key points stood out from what they told us.

Table of Contents

Key Findings

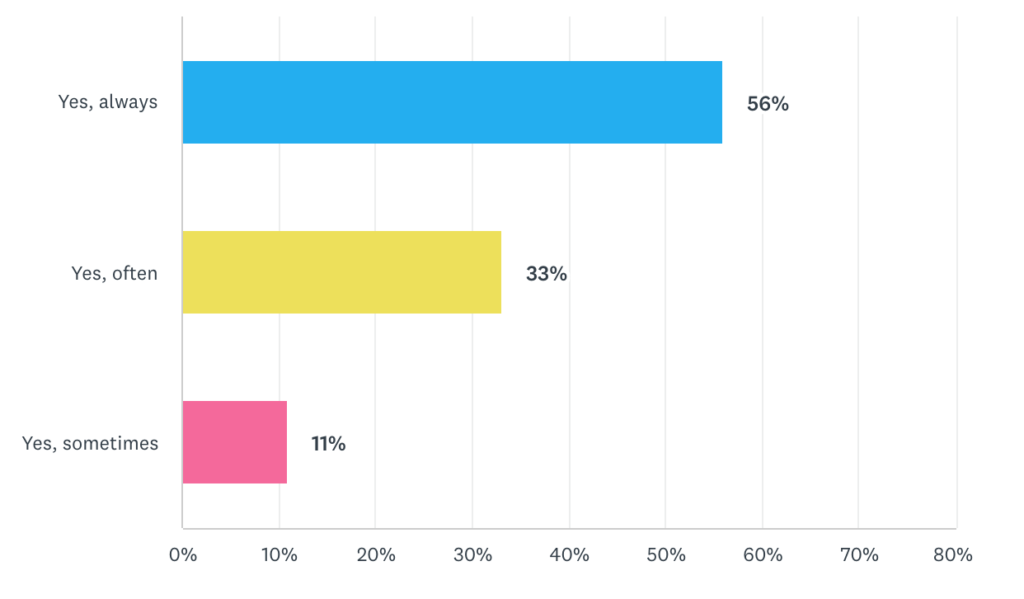

89% of B2B software buyers who read user reviews on review sites when buying business software products do so either “often” or “always”

Thought-Provoking Takeaway 💡

While not every B2B buyer reads reviews, the many B2B buyers who do read reviews do so regularly. The overwhelming reliance on user reviews reinforces their importance for many of today’s B2B buyers looking to their peers’ experiences when making purchase decisions.

Multiple studies have found that most B2B buyers use review sites. Clutch found that 94% of B2B buyers have used an online review to help make their purchase decisions. G2 found that 84% of B2B buyers use review sites. TrustRadius found that 55% of B2B buyers consult reviews to inform their purchase decisions.

Related Findings

Actionable Takeaways 🎬

Encourage Authentic Feedback – Vendors must proactively ask for reviews and provide incentives because there aren’t enough software users for most software products to rely on organic review generation.

Prioritize Review Management – Businesses should allocate resources to monitor and manage their online reviews across various platforms. Timely responses to user feedback, addressing concerns, and acknowledging positive experiences can help build trust,

Enhance User Experience – As user reviews significantly impact purchasing choices, survey your users to ensure that you’re building what they want. Satisfied customers are more likely to leave positive reviews, which can, in turn, attract new customers.

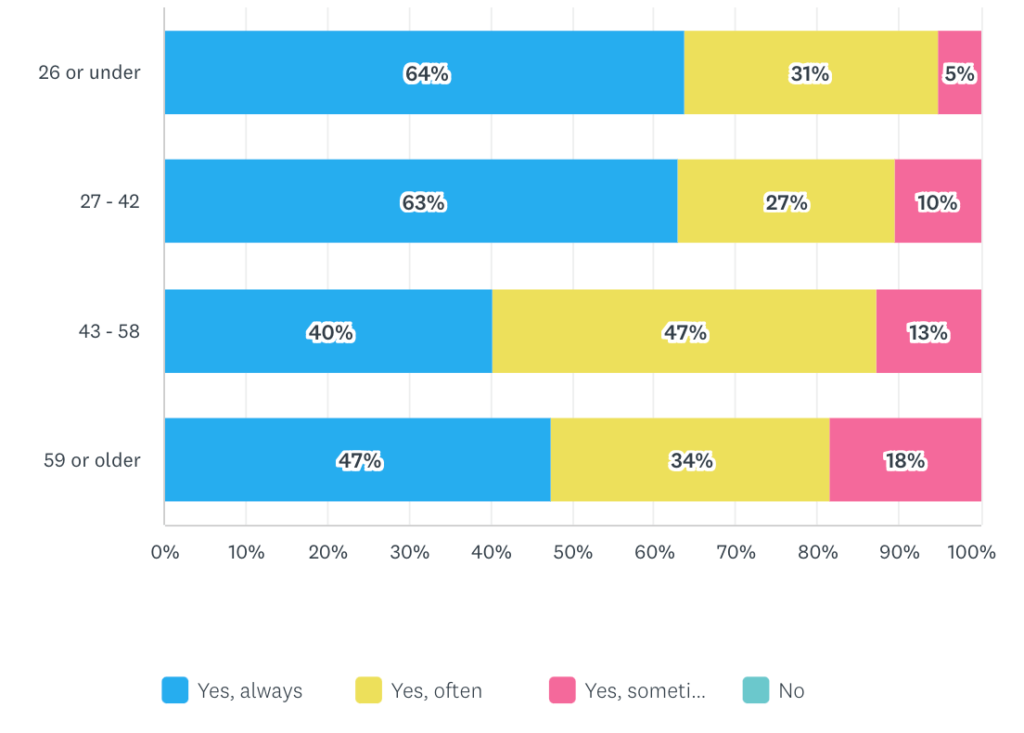

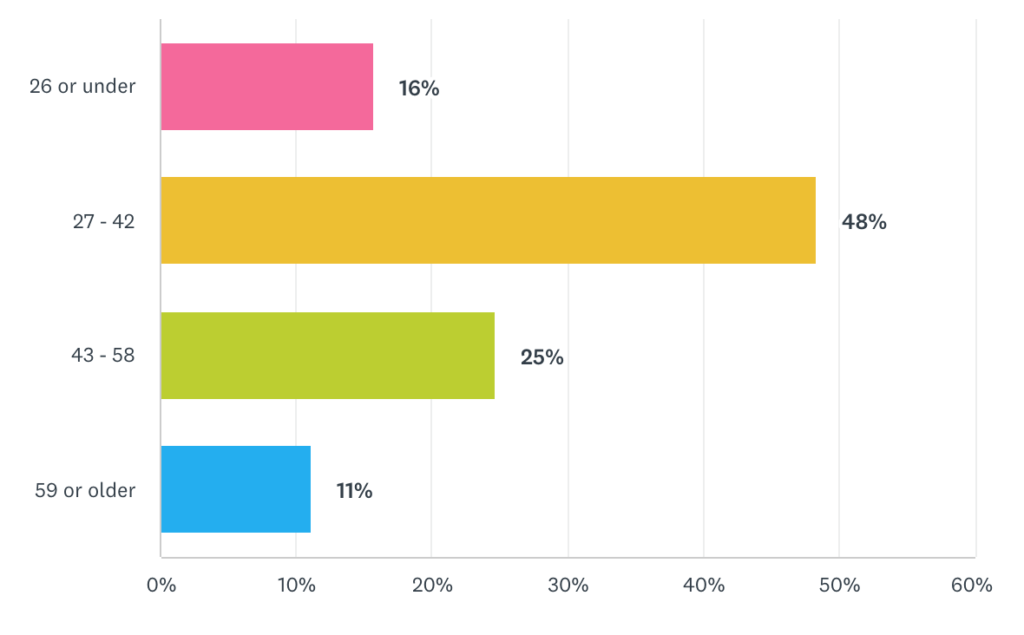

Younger B2B software review site users use reviews more often than older users

Thought-Provoking Takeaway 💡

This finding suggests a slight digital divide, where older users may rely more on traditional methods or personal networks to inform their software choices. In comparison, younger users leverage online reviews more often to guide their decisions. The data suggests that the demographic shift will favour reviews and review sites.

Actionable Takeaway 🎬

Diversify your channel mix: Vendors need to be where their potential buyers are, understanding that this means being in different places for buyers of different ages. Older buyers might predominantly depend on traditional sources such as analysts and sales representatives, while younger buyers might lean more towards review sites and influencers. Avoid relying on any one channel. Diversify your channel mix.

TrustRadius found that the first step in the buying journey for 41% of Gen Z and Millennials is, “check review sites.”

Related Findings

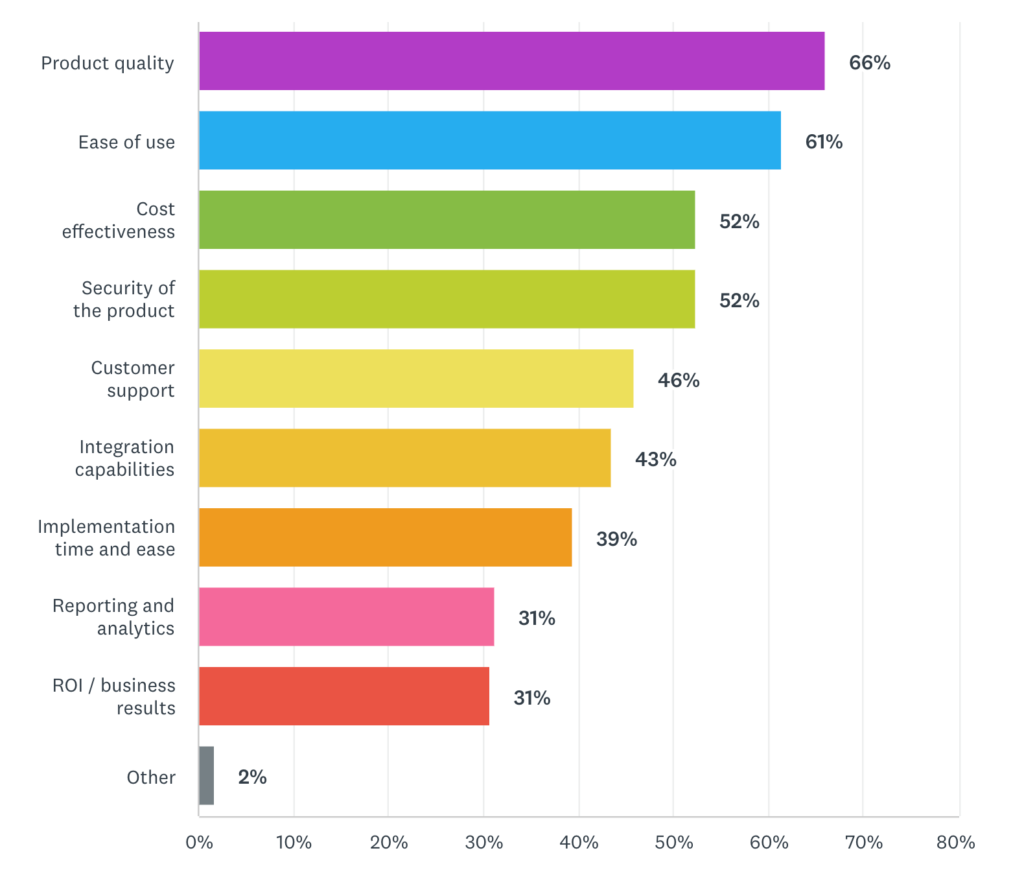

B2B Buyers don’t look for only one of two things in reviews; most look for four things: product quality (68%), ease of use (62%), cost effectiveness (53%), and product security (53%).

Key Finding: Most B2B Buyers focus on four key factors when reading reviews: product quality (68%), ease of use (62%), cost effectiveness (53%), and product security (53%).

Thought-Provoking Takeaway 💡

In B2B decision-making, this finding underscores the importance of a holistic approach.

While some factors stand out more, businesses should avoid fixating on a single aspect. For example, a laser focus on ease of use for users (individual contributors) might lead to underinvesting or oversimplifying the complex reporting needs of decision-makers who seek ROI and business results.

It’s also worth noting that 60% of the survey respondents are individual contributors or managers. There is a significant difference between the user and business decision-maker perspectives. According to our survey findings, C-Suite review site users are twice as likely to look to reviews for ROI/ business results than individual contributors.

There’s also a difference in how buyers from various company sizes prioritize their purchase decisions. G2 found in its 2023 Software Buyer Behavior Report that the top purchase consideration for small business buyers is the ease of implementation. In contrast, for medium-sized companies, it’s getting ROI within 6 months (of purchase).

Related Findings

Actionable Takeaway 🎬

Businesses should encourage all types of users to provide reviews: admins, users, consultants, and executive sponsors (decision-makers.) A comprehensive mix of reviewers helps provide insight into specific features and benefits different buyers seek.

TrustRadius found in its 2023 B2B Buying Disconnect report that the most important evaluation factor for buyers on review sites is, “reviewers are relatable to me.” So collect reviews from not only a range of users but also a range of industries, company sizes, and other demographics and firmographics to help your reviews be more relatable to your buyers.

Related Findings

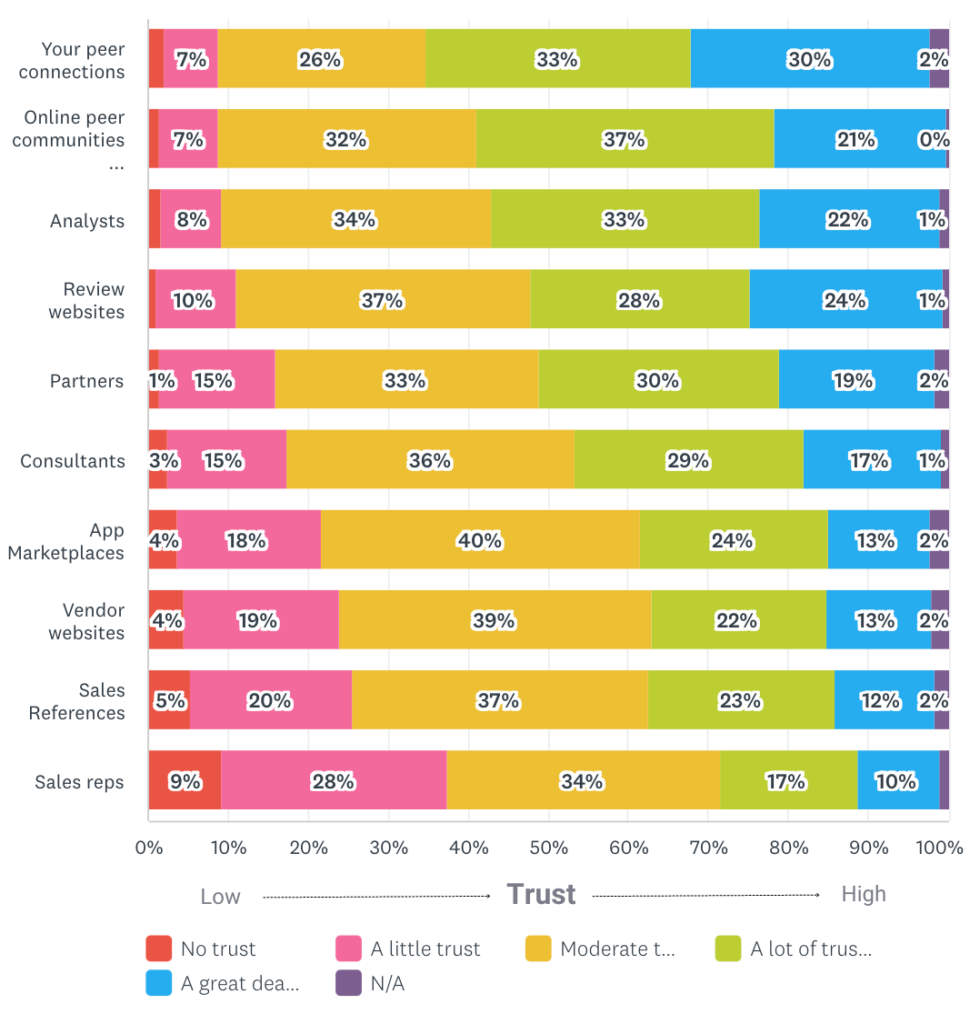

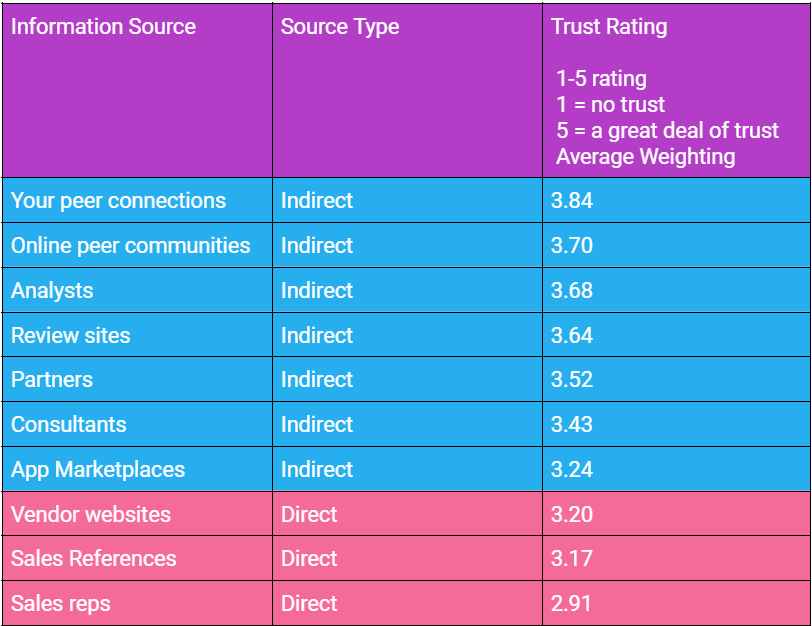

B2B buyers trust indirect information sources 16% more than direct information sources (from a vendor).

We asked B2B buyers how much they trust ten different sources of information.

We asked them to provide their trust on a scale of 1-5, with 1 being “no trust at all” and 5 being “a great deal of trust.” We categorized the information sources by type: direct (From the vendor, i.e. Marketing or Sales) or indirect (from a non-vendor source).

Trustworthiness by Direct Sources:

Among the direct sources, “Sales References” has the highest rating (3.17), indicating moderate trust. However, this rating is still lower than those of indirect sources, suggesting buyers are skeptical of vendor influence in the sales reference process.

“Vendor websites” and “Sales reps” have lower ratings (3.20 and 2.91, respectively), which could suggest that buyers are somewhat skeptical about information provided directly by vendors or sales representatives.

Trustworthiness by Indirect Sources:

“Your peer connections” have the highest rating (3.84) among all sources, suggesting that buyers place the highest level of trust in recommendations received directly from their peers, perhaps because of the lack of direct vendor influence on it.

“Online peer communities,” “Review sites,” and “Analysts” also have relatively high ratings (3.70, 3.64, and 3.68, respectively), indicating that buyers find information from these sources highly trustworthy, though slightly less than from their peers, which may be because each of these sources has a financial motivation to satisfy vendors, too.

“Consultants” and “Partners” have moderate ratings (3.43 and 3.52), suggesting a reasonable level of trust in their information, but tempered perhaps by the factor that consultants and partners typically stand to gain financially from buyer purchases.

“App Marketplaces” have a slightly lower rating (3.24). However, it is still above average, indicating that buyers trust information from them slightly more than direct sources, perhaps limited by a lack of familiarity with them.

Trustworthiness by source: direct vs. indirect

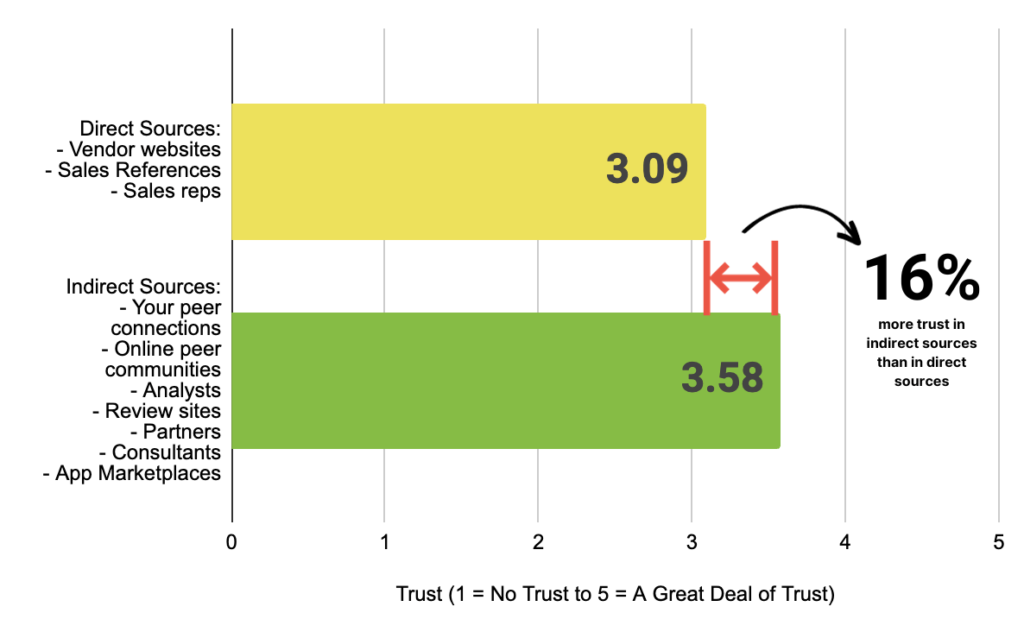

On average, indirect sources have higher ratings compared to direct sources. The average rating for indirect sources is around 3.58, while the average rating for direct sources is around 3.09 — a 16% difference.

This finding suggests buyers trust information from indirect sources more than direct ones.

Since vendors are inherently biased towards their products or services, buyers probably perceive indirect sources as more honest.

When comparing review sites to direct vendor information sources (vendor websites, sales references, and sales reps), we find that buyers trust review sites 18% more than the info they get from vendors.

B2B buyers have 25% more trust in reviews than sales reps.

Gartner Digital Markets found that software buyers spend at least 50% of their journey consulting independent, third-party sources of information (i.e. indirect sources).

Related Findings

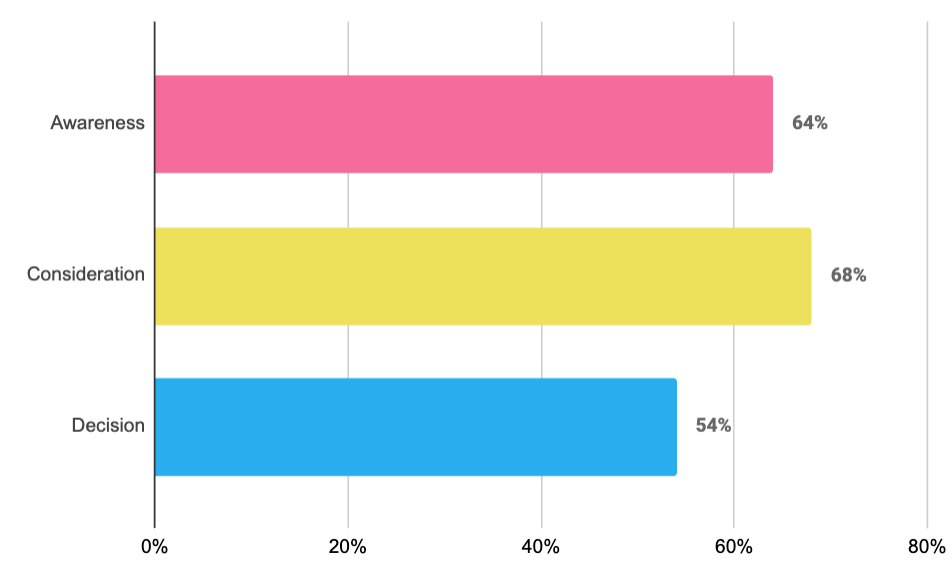

Most B2B SaaS buyers who use review sites use them throughout the buying process

The majority of B2B buyers who use review sites use them throughout the buying process (awareness, consideration, and decision stages.)

Here is how each stage was defined in the survey:

- Awareness – To do preliminary research of solutions that may solve a problem (64%).

- Consideration – To make a shortlist of products to evaluate or try (68%).

- Decision – To exercise due diligence before making a final purchasing decision (54%).

Thought-Provoking Takeaway 💡

Businesses must recognize that potential clients seek information during the final decision-making phase and actively engage with reviews earlier in the buying journey.

This finding indicates a shift towards more informed and thorough decision-making, where trust is built progressively rather than just at the point of purchase.

To capture and retain customers, B2B companies should consider establishing a solid presence on review platforms from the beginning of their buyers’ journeys.

Actionable Takeaways 🎬

Educational Content – Where possible, add educational content, such as whitepapers, case studies, and comparison guides, to your review site profiles to help buyers in the early phases of the buying process. This use of content will help increase the chances that your buyers will consider and select you once they’re ready to purchase.

Collaborate with Advocates – Identify and nurture relationships with satisfied customers who can serve as advocates on these review platforms. Go beyond reviews and upload video customer testimonials to your profile page to complement your written reviews.

Leverage Social Proof – Incorporate positive user reviews strategically in your marketing and sales messaging and collateral. The voice of the customer woven into your vendor messaging can add credibility and trust to increase your influence.

Trustpilot found that, on average, in the U.S. and U.K., 87% of consumers find advertisements with the Trustpilot trust mark more trustworthy than those without it.

Related Findings

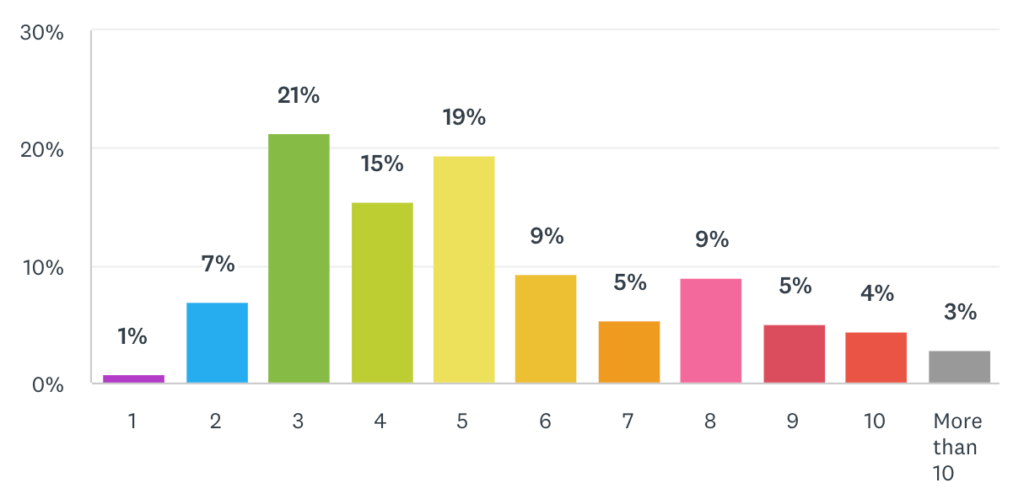

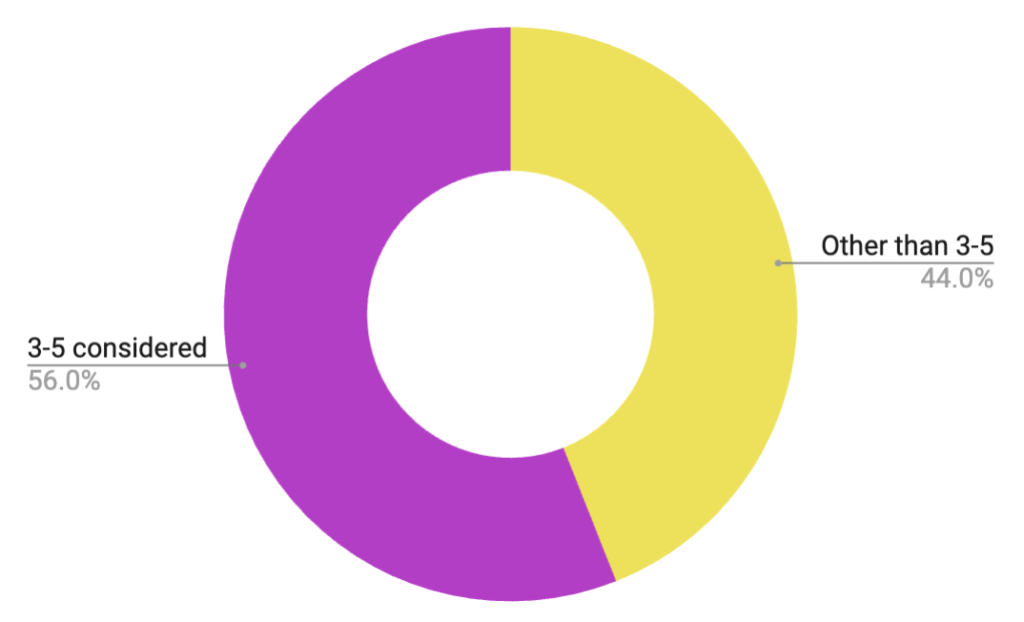

Most B2B software buyers (55%) consider between 3 to 5 vendors for evaluation.

Key Finding: Most respondents (55%) tend to consider between 3 to 5 vendors for evaluation.

“Consider for evaluation” in this context was defined in the survey as: “if you’re on a review site category page with a list of all the vendors in that space, how many vendor profiles would you visit to read reviews and gather info before deciding which vendors to put on a shortlist to reach out to or try?”

Thought-Provoking Takeaway 💡

In a world saturated with options, the fact that a significant majority of respondents narrow down their choices to 3 to 5 vendors highlights the importance of efficient decision-making.

This finding suggests consumers seek a balance between thorough evaluation and avoiding choice overload. Vendors can stand out early in the evaluation process by ranking highly.

Bain & Co. and Google found that 80%–90% of software buyers have a set of vendors in mind before they do any research, and that most purchasers will conduct further research and consider at least one more supplier.

Related Findings

Actionable Takeaways 🎬

Build a Strong Online Presence: Invest in maintaining a robust and positive online presence, which is crucial in influencing decisions. Encourage satisfied customers to leave reviews and ratings, as these can significantly impact whether your business makes the initial cut.

Prioritize Early Impressions: Recognize the limited window of opportunity to capture a potential buyer’s interest. Consider investing in review site buyer intent to know who’s in-market so that you can focus on those accounts to increase your chances of being considered by them.

Simplify Decision-Making: Offer easily digestible information, such as comparison charts, customer testimonials, and case studies, to help potential customers quickly understand your value.

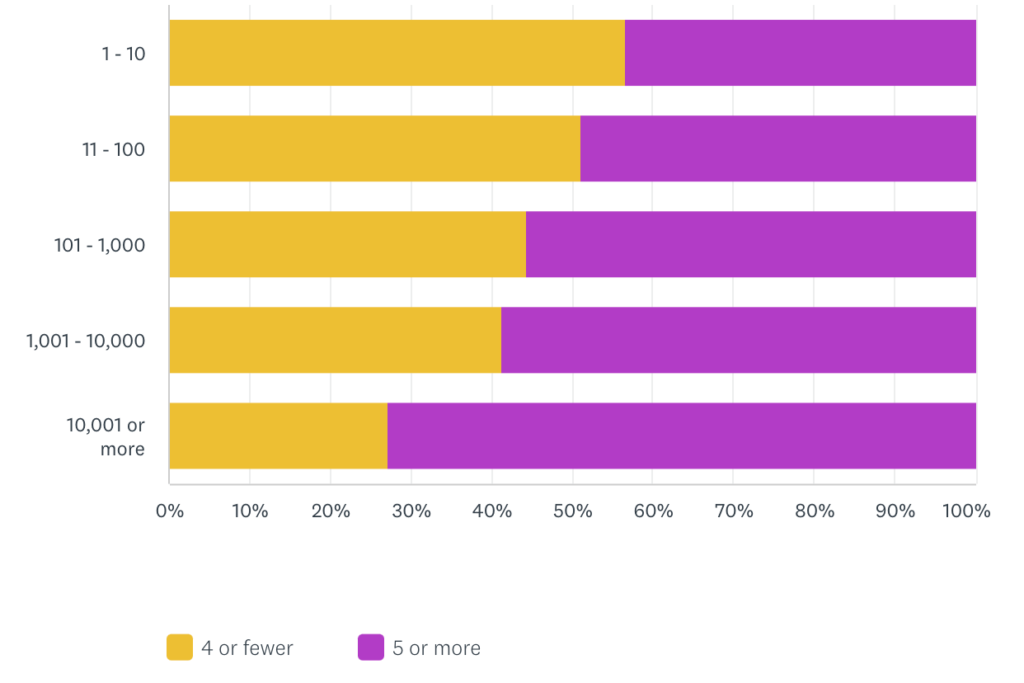

The larger the company, the more vendors B2B buyers usually consider.

Thought-Provoking Takeaway 💡

This finding reveals a direct correlation between the size of a company and the number of vendors considered when purchasing business software. This raises an interesting question: do larger companies entertain more vendors to leverage the best possible solutions, or is this a reflection of “more cooks in the kitchen” bringing more vendors to the decision-making table?

Vendr found that the average annual SaaS spend for an enterprise (>1,000 employees) is 10x that of an SMB (<100 employees.) Therefore, larger companies tend to consider more vendors as there is more at stake with each purchasing decision.

Related Findings

Actionable Takeaway 🎬

Vendors focusing on selling to larger companies should consider licensing the buyer intent data from the main review site(s) where their buyers go. These mid-market and enterprise-focused vendors may get extra value from this buyer intent data by leveraging it in their marketing and sales to persuade more in-market buyers to consider them. With their extensive and varied needs, larger companies typically explore multiple vendors to find the most fitting solutions, making the competition intense. Buyer intent data can help vendors break through the noise and into buyer consideration.

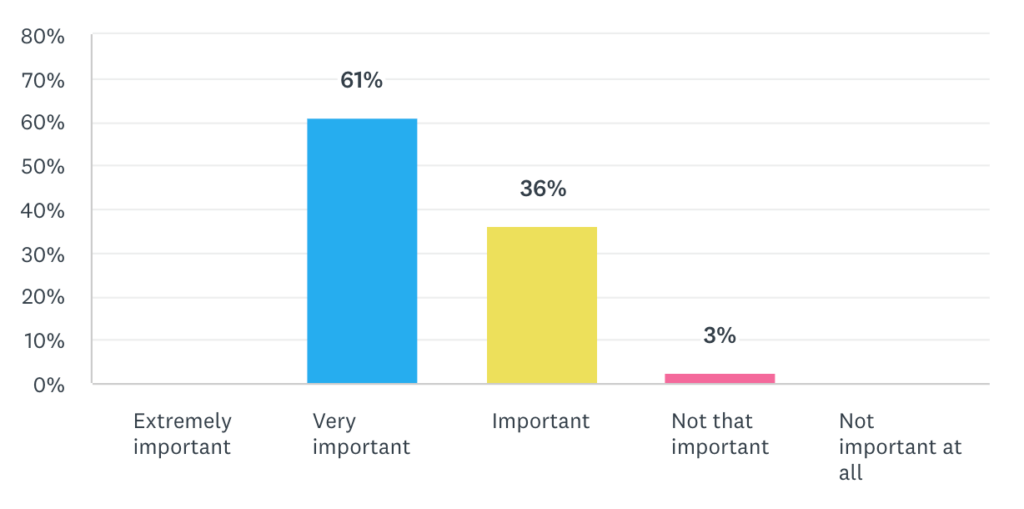

61% of B2B SaaS buyers said a business software product's average user rating (score) is “very important?”

97% of respondents said a business software product’s average user rating (score) is important.

Thought-Provoking Takeaway 💡

Despite their flaws, user ratings are still important to the typical B2B buyer. The overwhelming consensus on the importance of user ratings underscores the critical role of user experience in shaping the success of business software products. While buyers want to go beyond ratings to read detailed reviews from relatable peers, many rely on ratings to decide which vendors to explore further.

Ratings have become an integral part of a buyer’s online review experience. Although the decisions of B2B buyers are more complex compared to B2C consumers, it’s important to remember that all B2B buyers are also consumers in the B2C market. Consumer review sites have been utilizing ratings for over two decades, and business software review sites have been doing so for over a decade. Consequently, ratings and reviews are now inseparably linked, for better and worse.

In B2C, Bazaarvoice found that the #1 thing that improves shopper confidence online is an average star rating. However, in B2B, TrustRadius found this year that B2B tech buyers place more importance on the availability of self-service information, a product’s score for specific features or attributes, review content, and reviewers relatable to me than they do on product’s overall score. So while the overal product rating is almost to almost every B2B buyer, they place more importance on a few other aspects of reviews.

Related Findings

Actionable Takeaways 🎬

Adjust based on your current rating: For many B2B vendors, their rating will be in the four-point-something range that buyers are accustomed to seeing. Therefore, rating gains might only matter a little despite the importance of ratings for buyers. What may matter more is if your score is significantly different than your main competitors because many B2B review sites will prominently display product and feature ratings in head-to-head competitive comparisons.

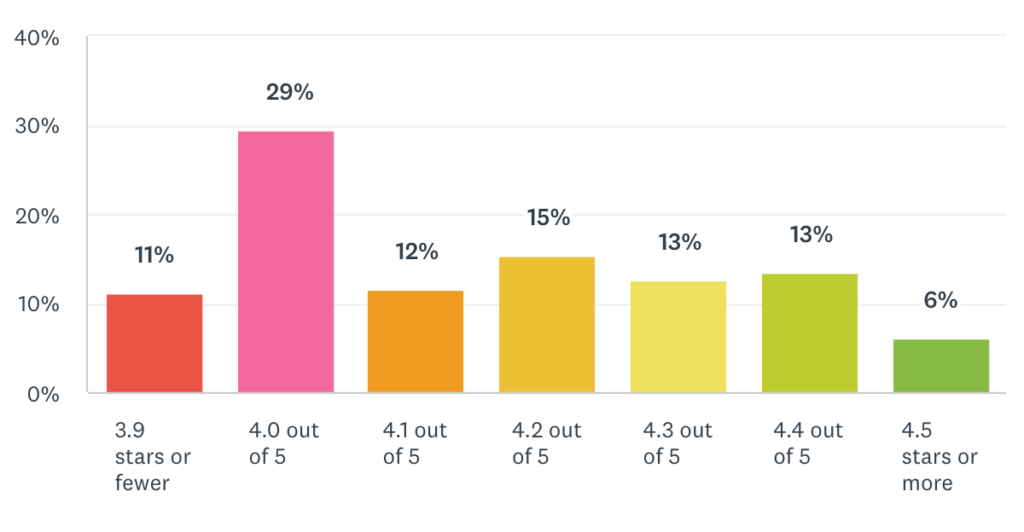

Business software vendors typically need a minimum average user review rating of 4.0 out of 5 to get a buyer’s consideration

When asked, “What is the minimum average user review rating of a business software product for you to consider it? (On a 5-star scale, with a 1 being the worst and a 5 being the best), the most common response was 4.0.

Thought-Provoking Takeaway 💡

While there’s no such thing as an exact score needed to be considered by buyers, this result suggests many buyers expect to see a four-point-something score.

Northwestern University’s Spiegel Research Center found a desirable range for ratings. They found that the likelihood of purchase usually peaks for ratings between 4.0 and 4.7 but starts to decline as they near 5.0. Review Trackers found that 70% of consumers have used rating filters when searching for businesses.

Related Findings

Actionable Takeaway 🎬

Given rating inflation and how many B2B SaaS products are rated in the 4.0-4.7 range, a good rating alone won’t win over buyers. However, you could risk missing the cut for consideration if it’s not good enough compared to the competition.

As a vendor, look into which review sites your buyers use. Then, figure out how these review sites rank vendors. Depending on if and how ratings matter, adjust accordingly. Balance the need for high scores and review counts with authentic reviews from relatable peers.

Address Negative Reviews Constructively – Negative reviews provide opportunities for improvement. Acknowledge and address negative feedback openly, demonstrating a commitment to enhancing the product and customer experience.

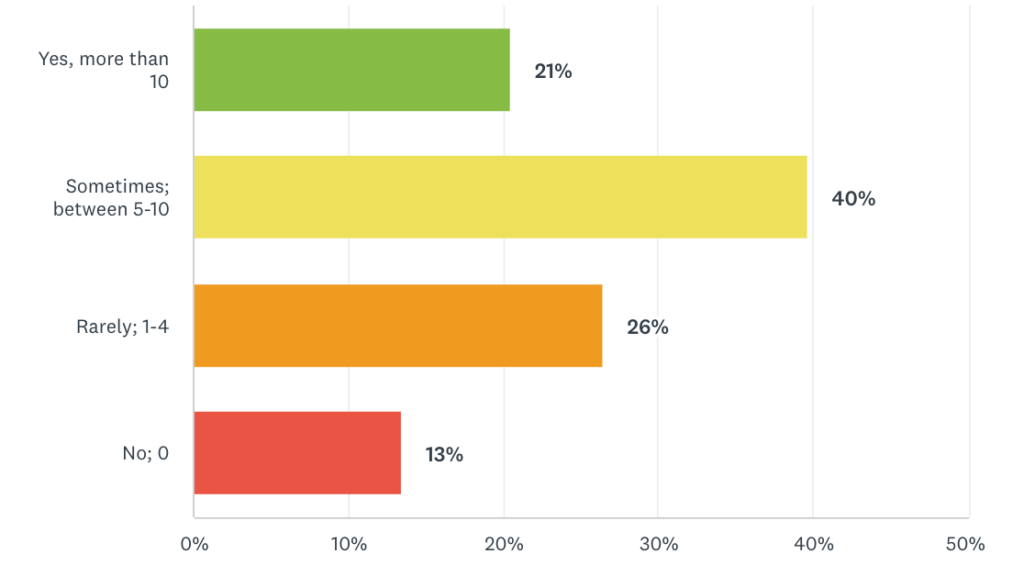

39% of B2B software review site users rarely or have never written a review.

Key Finding: 39% of B2B review site users rarely or have never written a review.

On the other hand, a high percentage of review site users have written a review: 87% of buyers have written a review.

Thought-Provoking Takeaway 💡

For those questioning the need for businesses to encourage users to write reviews, this result emphasizes the disparity between the number of reviews buyers read and the number they write.

Although B2B review sites provide important insights through user-written reviews, many users keep their opinions private. This raises questions about the barriers that might prevent customers from sharing their experiences and how businesses can overcome them to gather a more comprehensive and representative range of feedback. With the typical B2B company having a relatively small number of customers compared to a B2C company, the problem of insufficient customers writing reviews becomes exacerbated.

Yelp has said that the "1/9/90 Rule" applies to reviews on its site. That is, only 1% of users actively produce content. Another 9% engage by commenting, rating, or sharing. The remaining 90% observe and read without interacting. That means most people don’t write reviews; they read them. Other sources suggest more consumers leave reviews these days. BrightLocal found that 60% of consumers promoted to leave a review for a business by the business itself did so.

Related Findings

Actionable Takeaway 🎬

With few exceptions, B2B companies should regularly request reviews and offer incentives. If you have reservations about providing incentives, please take a look at this post by TrustRadius discussing its merits in a B2B context.

Offering gift cards of a nominal value ($25) is table stakes. Go beyond and think about how you can get your users who rarely or have never written a review to do so. Start with email, as it’s often the most efficient review collection channel. Then, layer on other channels, like in-app prompts, Slack messages from CSMs, and on calls. Speak to them about the review writing process to address any objections they may have can help. You’ll probably need to utilize every available channel to acquire the reviews necessary to excel in your category.

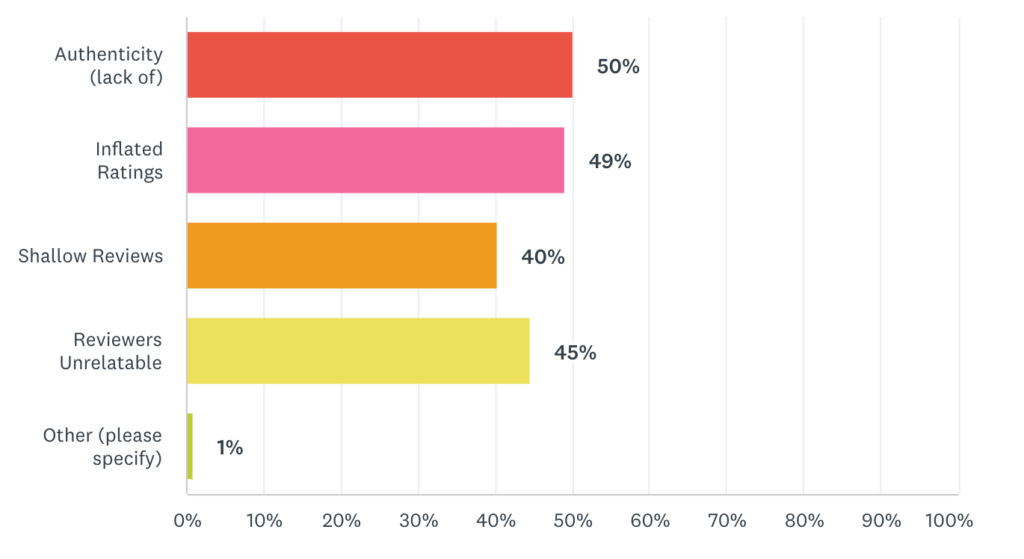

Half of B2B software review site users limit their use of them because of a perceived lack of authenticity

Thought-Provoking Takeaway 💡

It’s not all roses for B2B software buyers and review sites: far from it. Current users of review sites limit their use of them for the following reasons:

- 50% – (lack of) Authenticity of the review content

- 49% – Average user rating (score) of a product not an accurate reflection of the typical user experience

- 45% – Circumstantial differences between reviewers and you (i.e. use case, company size, role, etc.)

- 40% – Shallow review content

Users want reviews that reflect real experiences, are relevant to them, and offer in-depth insights. Will the review sites address these issues before business software buyers turn elsewhere for information?

Actionable Takeaway 🎬

Business software review sites need to address the “4.7 star syndrome” to gain more trust in user ratings and raise the perceived authenticity of reviews. More initiatives like the TrustRadius TRUE certification can help. Vendors and review sites must continue finding ways to get reviewers of all segments, industries, company sizes, roles, etc., so buyers can discover more relatable reviews.

In Summary

This survey provides insight into the behaviours and preferences of B2B software buyers, emphasizing the critical role of user reviews in their purchasing decisions.

Most of these buyers frequently consult review sites, with younger users doing so more often than their older counterparts. These buyers seek comprehensive insights from reviews, focusing on aspects like product quality, ease of use, cost-effectiveness, and product security, and they tend to trust indirect information sources more than direct ones from vendors.

Review sites are a constant companion for most B2B SaaS buyers throughout their buying journey, and they typically evaluate multiple vendors, with larger companies considering more options.

The average user rating is crucial for these buyers, with products usually needing to meet a minimum average rating for consideration.

However, many users seldom or never contribute reviews, highlighting a potential area for encouraging more user-generated content to aid in informed decision-making for B2B software acquisitions.

Methodology

Data for the B2B SaaS Reviews 2023 State of B2B Consumer Reviews was sourced from Centiment via an online survey.

In August 2023, via Centiment, we surveyed US software buyers who answered “yes” to this qualifying question: “Do you read user reviews on review sites when buying business software products?” We received 411 responses.

Respondents Overview

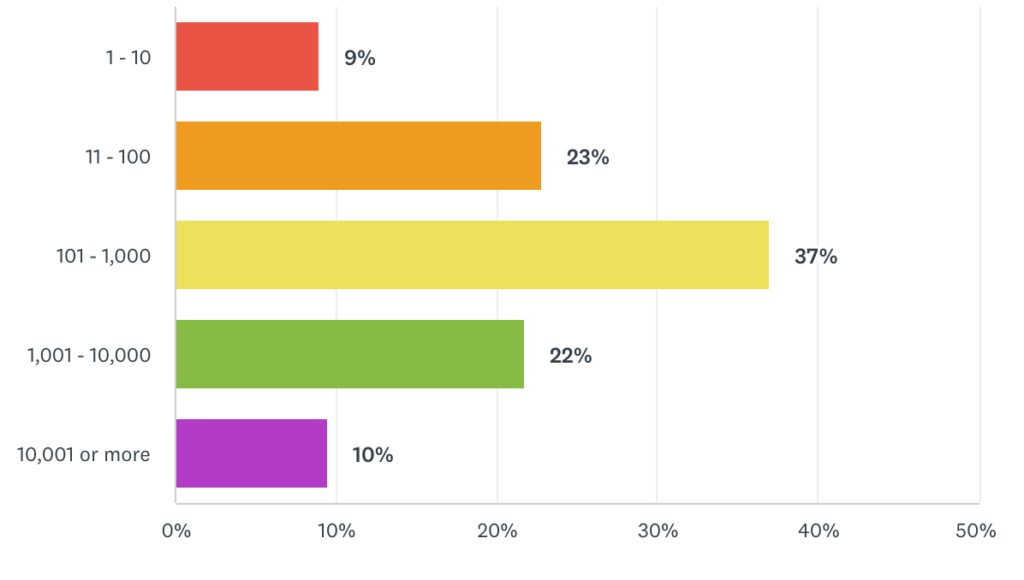

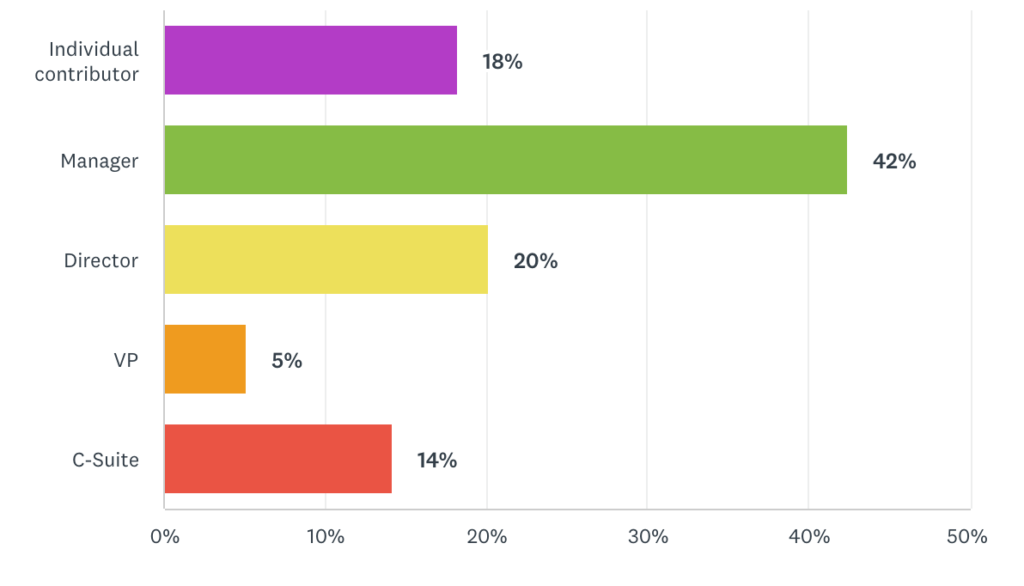

Here is a breakdown of the 411 respondents:

Company Size (# of Employees)

Seniority

Age

Looking for more stats on online reviews in B2B and B2C?

Author

-

I'm the Founder and Editor-In-Chief of B2B SaaS Reviews. I'm also the Director of Demand Generation at PartnerStack, the #1 platform purpose-built for partner management and affiliate marketing in B2B SaaS. Before PartnerStack, I worked for other go-to-market B2B SaaS companies: Influitive (Advocate Marketing designed to generate more reviews, references, and referrals), LevelJump (Sales Enablement) (acquired by Salesforce) and Eloqua (Marketing Automation) (acquired by Oracle).

![63 Online Review Stats: B2B and B2C [2023]](https://b2bsaasreviews.com/wp-content/uploads/2023/10/banner-63-1024x574.png)