The annual Forrester B2B Summit is a popular conference for senior B2B professionals at medium-sized businesses and enterprises, many of which are in software. Research-rich presentations by Forrester analysts attract many decision-makers who take what they learn at the Summit and apply it in their B2B organizations. Here are five key takeaways for marketing in today’s B2B buying process.

Table of Contents

Whether you attended the 2021 Summit or not, this post will help you come away with some of the key learnings from the Summit on the B2B buying process. Marketers will get the most from the post, though there are takeaways for anyone interested in today’s B2B buying process.

1. B2B buying gets even more complicated: more buyers, more touch points, more time, and more information sources

Forrester’s 2021 B2B buying study (based on 950+ respondents) found that the complexity of B2B buying has continued to increase in multiple ways.

Firstly, there are more buyers in the process. A B2B “buyer” is now likely to be a group of 3 or more people. Forrester found that the number of buying decisions made with three or more people has increased from 47% in 2017 to 63% in 2021. Other sources at the conference suggested that 80% of B2B buying decisions have 3+ buying group members.

Secondly, there are also more touch points or buying interactions. These interactions jumped from an average of 17 per B2B purchase in 2017 to 27 in 2021.

Thirdly, the time to buy has also risen significantly. A buyer’s purchase timeframe of four months or longer has increased from 19% in 2015 to 32% in 2021. Many feel the crunch firsthand with longer sales cycles from the vendor’s perspective.

Need more proof that B2B Buying is becoming more complex? @bethcaplow and @bwinters_b2b shared interesting findings from @forrester B2B Buying Study about a big jump in number of interactions with providers.#forrB2BSummit pic.twitter.com/mi2ZQhvRq3

— Jennifer Ross (@Jenross17) May 4, 2021

Lastly, the number of buyer information sources has continued to rise. Forrester found that “buyers can find information about B2B products and services almost anywhere — and they do.” This means B2B vendors need to increasingly think about how they can engage buyers beyond their direct channels.

The more you understand buyers, the more you'll be able to engage them. #ForrB2BSummit @bethcaplow pic.twitter.com/8ufF2ZzkgI

— TechTarget (@TechTarget) May 3, 2021

My two cents:

As a Demand Gen-focused Marketer in B2B SaaS, I try to make sense of the B2B buying process each workday. Trying to understand it often feels like a Sisyphean task with the constant change that transforms how buyers buy and the need for Marketers to adapt to it.

The B2B buying journey is increasingly happening outside of the control of the B2B vendor. To adapt, vendors need to get even closer to their customers to stay in touch with their buying reality. If this site name doesn’t make it obvious, from what I’ve seen from B2B software buyers, I believe reviews are a big part of it 🙂

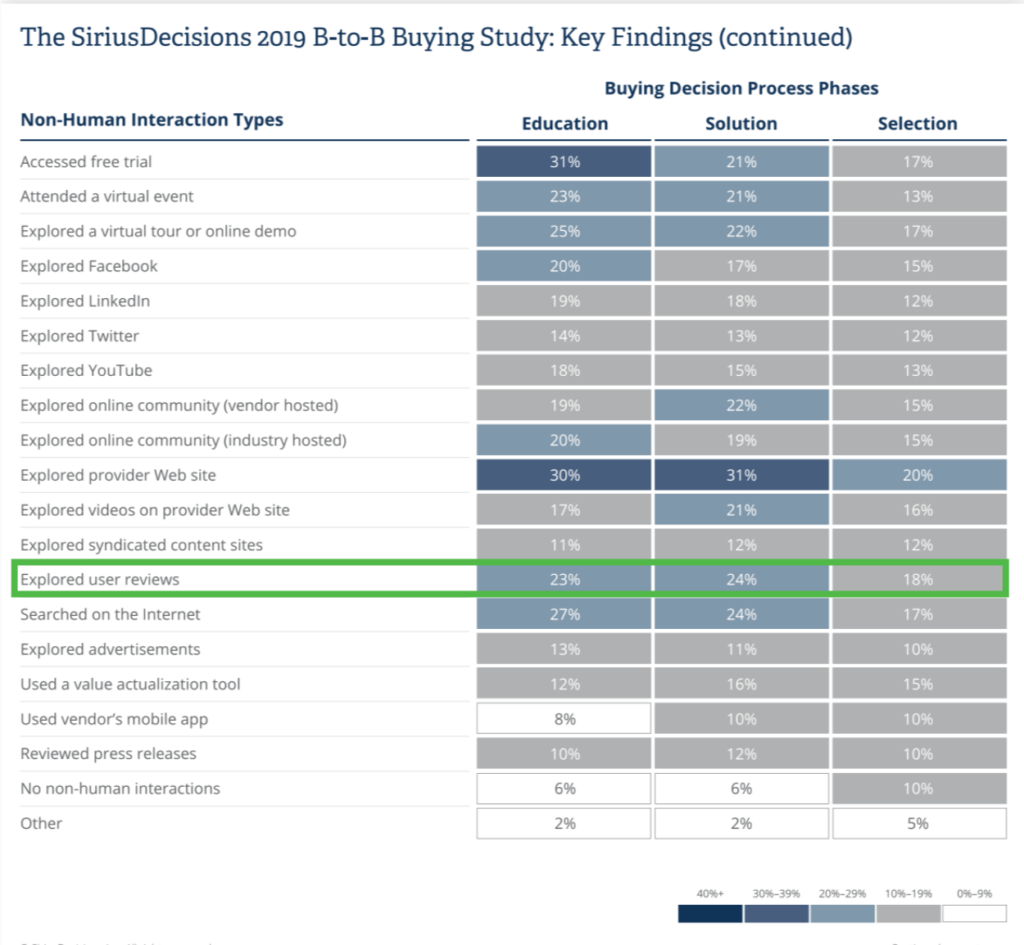

As SiriusDecisions (now Forrester) found in its 2019 B2B Buying Study, buyers explore user reviews throughout the buying process, from education to solution through selection.

In other words, reviews are good for education, better for solution (consideration and evaluation), and best for selection.

As buyers do more due diligence, they will likely turn to reviews even more.

It’s interesting to see how reviews are leveraged by B2B buyers across the buying process, i.e. throughout the process and increasing in use relative to other information sources as the process deepens. There does seem to be an opportunity for B2B software reviews to become even more relevant in the education phase. I suspect G2 is working on this with their G2 Track solution to help vendors manage and optimize their software stack and give G2 the data to recommend software to B2B buyers before they come to G2 to evaluate and select solutions. In other words, G2 would be able to proactively recommend software categories and vendors based on your current stack and what peers like you are adding next to their software stack.

2. Designing an aligned revenue technology stack demands an outcome-focused technology model

As B2B vendors, we know that leading with benefits or outcomes in messaging is best practice because it helps buyers make rational decisions based on their needs.

But we also know that B2B buyers aren’t purely rational decision-makers. They sometimes decide to buy a solution that will ultimately deliver less performance for them than alternative solutions, i.e. they make the wrong choice.

B2B buying is difficult. In their session, Forrester Analysts Katie Linford and Seth Marrs shared that, “42% of B2B marketing decision-makers put having too much or not the right technologies in their top five challenges to achieving their marketing priorities.”

There are many reasons why B2B buying is so difficult.

B2B buyers bring their emotions and preconceived notions into the buying process. They can also be swayed by what their peers are buying, which brands appeal to them most, and other factors that aren’t based on their needs.

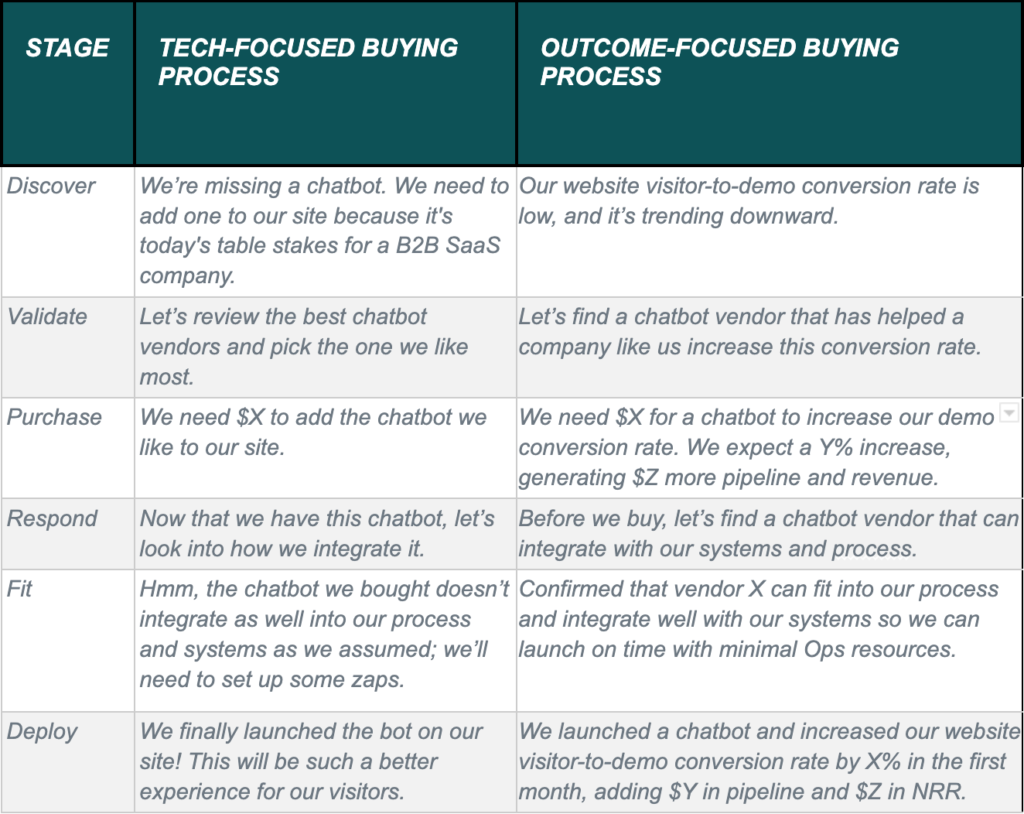

Forrester highlighted one such common pitfall: a tech-first approach to buying software.

In other words, following the hype and crowd into the latest product category and popular SaaS vendor. With a technology-first approach, buyers review features and then try to fit the tool they bought into their process. In contrast, with a solution-first approach, buyers look for solutions that meet their business needs and fit into their process before deciding.

My two cents:

I find an example can go a long way to support a theory.

One hypothetical example of a tech-driven approach is a B2B buyer purchasing a chatbot solution because the buyer has seen many of their peers talking about it.

TrustRadius found in its B2B Buying Disconnect Survey that, in general, B2B Marketers believe chatbots provide more value than B2B buyers get: only 10% of buyers are fairly or very likely to respond to a chatbot (when the message is relevant), but 42% of vendors believe they (chatbots) are an effective marketing strategy.

I suspect this is partly due to how well chatbot vendors have marketed their category relative to other B2B software solutions for Marketers. Drift is renowned for its strong branding, positioning chatbots as a better way than forms, and has likely marketed their way into many B2B buyers’ consideration sets more from the movement that they’ve created than from the performance of their solution.

In defence of chatbots, Forrester’s Tech Tide™: B2B Marketing Technologies, Q4 2020 put chatbots in their category of “invest,” meaning that it believes chatbots to be a “low maturity” product, but one with potential for “high business value.”

Here’s my understanding of how a tech-first approach vs an outcome-first approach would look:

Hypothetical Example: Different Approaches to Buying a Chatbot Solution: What The Buyer May Be Thinking

3. Shifting from a lead-centric to an opportunity-centric approach for B2B buying groups making larger considered purchases

In the session, “Goodbye MQLs, Hello Opportunities! Why Sales Needs Marketing To Make This Change”, Forrester highlighted the challenges of a lead-centric orientation and why there’s a shift to opportunity and account-centric marketing.

Lead-centric systems see the buyer as one person. A lead-centric approach is volume-driven, converting at an average rate of just 1% from lead-to-customer.

But Forrester has found that 80% of B2B purchases have 3 or more buyers who play different roles: champions, decision-makers, influencers, and users.

most important thing to know in b2b for today… pic.twitter.com/fjrHrgiNH7

— Kerry Cunningham (@Cunning_Kerry) May 5, 2021

My two cents:

Transitioning is easier said than done.

If you have a 6-figure average annual contract value (ACV), switching to an account-centric orientation is easy because your target addressable market (TAM) is likely to be small and your buying groups large and complicated which lends itself more to an account-based approach.

If you have a 3 or 4-figure average ACV, perhaps it’s easy to stick with a lead-centric orientation because your TAM is likely large and your buying group small, which lends itself more to a lead-based approach.

But if you have a 5-figure average ACV (the B2B software world I’m in), it can feel like there’s merit to both orientations.

If you feel the same way, you could juggle both lead and account approaches, but it’s far from easy and sucks you into more ops work than you might have bargained for. But striking the balance of casting the net while spearfishing might be your best bet to take Engagio’s analogy.

TOPO (now Gartner) introduced a “double funnel” approach that would be a way to measure performance by both leads and accounts.

In a Metadata.io webinar with TOPO on the double funnel, TOPO shared their finding that win rates for B2B SaaS growth companies have averaged around 20% for opportunity-to-win, but with an account approach the number of opportunities goes down, but the opportunity-to-win rate goes up to an average of 50%.

The catch seems to be that you would need to also double your tech stack, as the marketing automation platforms most of us have as our foundation were built with a lead-centric orientation. Even campaigns in Salesforce are lead-centric. An account-centric orientation would call for an ABM platform, which costs the same as your marketing automation platform…

Chris Moody of TOPO shared in the Metadata.io webinar that Gartner is finding that Demand Gen gets 70% of the budget and Account-Based gets 30% in high growth B2B software companies. With tons of investment pouring into ABM platforms, former Marketing Automation leaders such as Jon Miller of Marketo and Andre Yee of Eloqua transitioning from lead-centric marketing automation systems to account-centric systems like Engagio and Triblio, we may see a 50-50 split in the not too distant future. This aligns with what Integrate (Demand Acceleration Platform) shared as a takeaway from the event: Demand Gen and ABM are converging.

Lead-centric demand processes fail to recognize the important dynamic and influence of buying groups.

— TechTarget (@TechTarget) May 19, 2020

How to move from targeting individual leads to buying groups for increased conversion rates.

👉 https://t.co/npoYYKwwtg#LeadGen #B2BMarketing #Marketing @forrester pic.twitter.com/yjCVr0tmDR

4. Forrester shares their view of the six most essential technologies (categories) at an emerging company

In the session, How To Integrate The Six Most Essential Technologies At An Emerging Company, Forrester shared guidance for B2B buyers at “emerging” companies in Sales and Marketing roles.

An emerging company is defined by Forrester as “typically earning less than $100M in annual revenue and experiencing double-digit growth.”

The six most essential technologies include three for Sales and three for Marketing.

Forrester finds that 50% of emerging tech companies have all six technologies.

Note: the vendors listed below are my best interpretation of the vendors that may be included in the six categories outlined by Forrester.

- Salesforce automation – Commonly known as CRM Software

- Vendor examples: Salesforce, Microsoft, Oracle, Freshworks, HubSpot CRM, ActiveCampaign, Pipedrive)

- Sales intelligence – According to SiriusDecisions, “Sales intelligence technologies aid sales organizations with forecast/actuals, pipeline opportunity management, activity, demand, rep management, deal pursuit, win/loss, and what-if analyses”

- While I’m not entirely sure which platforms are part of this technology category, here are platforms that come to mind / my best guesses are: LinkedIn Sales Navigator, Gong, Chorus, Zoominfo, InsideView, Lusha

- Sales engagement – Software to engage prospects and to gain insight into which sales touch-points buyers engage within Sales cadences

- Vendor examples: Outreach, Salesloft, HubSpot, Groove, and Freshsales, VanillaSoft, Reply.io.

- Marketing automation – Marketing’s system of record, these platforms help automate tasks across multiple online channels, manage leads, and report on marketing performance.

- Vendor examples: HubSpot Marketing Hub, (Adobe) Marketo, (Salesforce) Pardot, (Oracle) Eloqua, ActiveCampaign, Keap, Act-On, Thryv, Omnisend, Drip, and Maropost

- Content management – Creation, management, and delivery of content assets (i.e. any content that the Go To Market (GTM) teams may need / use).

- Vendor examples: SEO tools like Serpstat, Semrush, Ahrefs, and Moz, Content Experience tools like Uberflip, PathFactory, and Showpad, and Webinar tools like Zoom, On24, GoToWebinar, and Livestorm, and web content management tools like WordPress, Hubspot, and Webflow, and conversion rate optimization software like Unbounce, Leadpages, Intellimize, and Mutiny

- Marketing analytics – Software that provides more insight into Marketing performance than what is available in marketing automation platforms

- Vendor examples: Website and product analytics tools analytics like Google Analytics, Pendo, Amplitude Analytics, and Mixpanel, performance analytics tools like Looker and (Google) Tableau, and Sisense, Customer Data Platforms like Segment, Exponea, and Emarsys, and Account-based analytics tools like DemandBase, Terminus, and 6Sense.

My two cents:

Intercom (another chatbot vendor with strong marketing) did a great job with their piece, The ultimate marketing technology stack for 2022 with Marketing tech stack examples from prominent B2B SaaS vendors. In it, they categorize marketing technology into three categories:

- Attract

- Engage

- Analyze & Optimize

Intercom featured HubSpot as one of its marketing technology stack vendors. Here’s HubSpot’s own marketing tech stack:

Even HubSpot, which naturally uses its own “all-in-one” marketing platform, has 18 technologies in its marketing technology stack. To round out their own enterprise marketing needs, they also use tools like Canva, Gong, and Semrush.

This approach by Intercom is another, broader way to categorize the marketing technologies in Forrester’s six essential technologies into these three categories:

- Content management

- Marketing automation

- Marketing analytics

Comparing Intercom’s categorization side-by-side with that of Forrester, they line up roughly as:

- Attract = Content Management

- Engage = Marketing Automation

- Analyze = Marketing Analytics

Intercom’s approach provides a sequential, action-oriented categorization: attract, engage, and analyze. The downside is that these three categories are quite broad, with many sub-categories and vendors. While their use of real-world tech stack examples helps a lot, adding Forrester’s six essential technologies provides additional guidance on the main technology categories that can help achieve the outcomes by attracting, engaging, and analyzing.

5. An update of the SiriusDecisions / Forrester Waterfall

Forrester updated its renowned waterfall model to the new Forrester B2B Revenue Waterfall™.

What’s new?

What did we change in Forrester's B2B Revenue Waterfall?

— Forrester (@forrester) May 3, 2021

🌊 Added sales stages

🌊 Replaced leads w/ opportunities

🌊 Changed the shape to match performance

🌊 Added renewals#ForrB2BSummit @Cunning_Kerry @JStevenSilver pic.twitter.com/Ldn4HgabqL

Forrester shared why they updated the model with Demand Gen Report. In short, Forrester said the update is to “help accelerate opportunity development and revenue growth.”

My two cents:

A recent MarketingWeek article called the sales funnel “the cockroach of marketing concepts.” Dating back to 1924, the funnel metaphor has partly hung around because it helps marketers and sellers easily visualize their approach, even if it may misrepresent the typical buying process, especially nowadays with more steps, buyers, and loops per purchase.

The updated Revenue Waterfall™ helps with Sales alignment by adding sales stages and replacing leads with opportunities. It also helps with CS alignment by adding renewals to increase the focus on customer marketing.

Adapting to the waterfall updates can be hard because they require a shift in mindset, strategy, tactics, and approach. The new waterfall model seems to require a top-down approach to work, i.e. a Marketing / Revenue Leader who will re-architect the model their function uses. Moving from the lead-centric waterfall to a revenue-centric waterfall is probably much easier said than done (enter Forrester’s consulting services :).

All the waterfall, B2B go-to-market talk can get confusing, which may in part explain why so many people love this tweet:

B2B GTM is easy: once you understand your ICP and have PMF, generate more MQLs with ABM at a reasonable CPL, while building PLG to increase TOFU and lower CAC, with the help BDRs and SDRs.

— Matt Turck (@mattturck) August 16, 2021

The B2B Summit North America 2022 & 2023

Forrester’s 2022 B2B Summit North America took place May 2-4. I couldn’t make it to the 2022 event, so here are the event takeaways by a few others: Forrester, Integrate, and 360insights.

If you’re interested in learning more about Forrester’s 2023 B2B North America Summit, it’s taking place June 5 – 7, 2023 in Auston and online.

To learn more about other Forrester events, please visit their events page.

Author

-

I'm the Founder and Editor-In-Chief of B2B SaaS Reviews and the Director of Demand Generation at PartnerStack, the leading platform for partner management and affiliate marketing in B2B SaaS. My experience spans several notable B2B SaaS companies, including Influitive (Advocate Marketing), LevelJump (Sales Enablement, acquired by Salesforce), and Eloqua (Marketing Automation, acquired by Oracle). I hold a Bachelor of Commerce in Marketing Management from Toronto Metropolitan University and a Master of International Business from Queen's University, with academic exchanges at Copenhagen Business School and Bocconi University.