As companies work hard to connect with their target audience, marketers must understand the nuances of buyer behaviour and preferences – especially regarding what they look for when making considered purchase decisions.

One significant factor is reviews; B2B buyers rely on these just as heavily, yet differently than their B2C counterparts.

To gain insights into this relationship between the two groups, we ran two surveys this summer: the State of B2B Software Reviews and the State of B2C Online Reviews.

In addition to the findings we shared in those survey reports, we also compared the survey responses and found three takeaways to help you better understand how buyers view reviews.

Read on to learn more about what drives both sets of buyers to read customer reviews before deciding.

3 key takeaways from comparing B2B vs. B2C buyers’ views on reviews

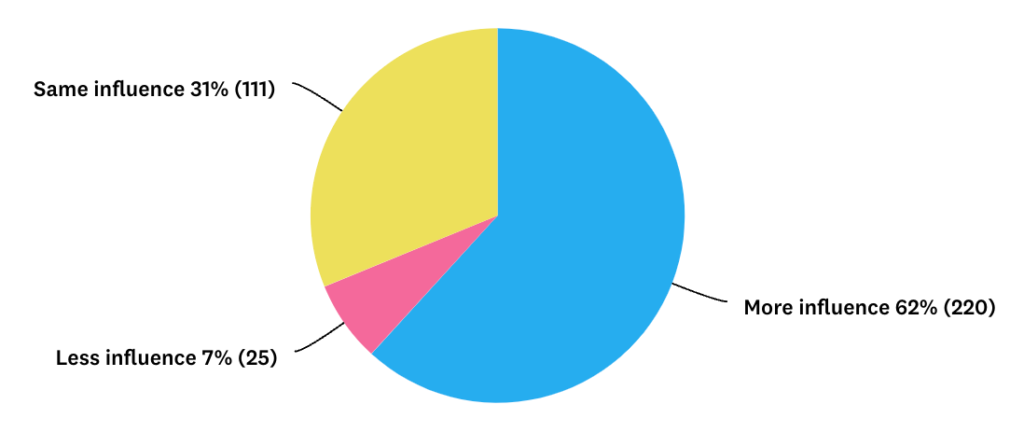

1. 62% of B2B buyers said online reviews are more influential in their purchase decisions for business software than consumer reviews

Thought-Provoking Takeaway 💡

This difference in influence reviews have for business software versus consumer products underscores trust and credibility’s critical role in B2B decision-making. It prompts us to question why businesses place higher importance on reviews when investing in software solutions. Perhaps it reflects the complex nature of business software, where functionality, integrations, and return on investment are vital, leading organizations to rely heavily on their peers’ experiences.

Actionable Takeaways 🎬

This finding highlights the importance of building a strong and authentic review presence for companies offering business software. As a B2B business, it’s crucial to actively encourage and collect genuine reviews that showcase your software’s tangible value, as this voice of the customer content will likely carry significant weight in the decision-making process.

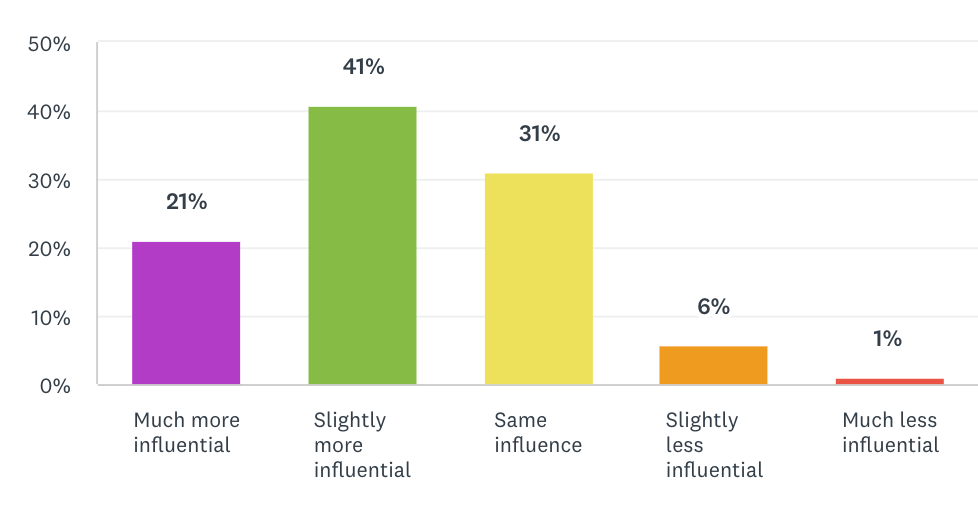

2. Most B2B buyers consider more options than B2C consumers, but both tend to consider 3-5 options.

Thought-Provoking Takeaway 💡

The decision-making process in B2B transactions is typically more considered than in B2C. While most in both sectors consider up to 4 vendors, the spread of consideration in B2B is wider. While 27% of B2B buyers consider 6 or more vendors, only 17% of B2C consumers do. This could reflect the more collaborative and multifaceted evaluation process in B2B buying decisions. However, there are limits to how many vendors any buyer will typically consider.

Actionable Takeaways 🎬

B2B marketers and sales teams must find ways to get into their buyers’ consideration set. Building a strong review site presence is one way to ensure that your brand shows up well at a crucial time in forming the buyer’s consideration set. If your brand is ranked too low to typically be considered in the top 5, consider exploring review site buyer intent data. It lets you know who’s in the market for your category of solution so you can reach out to them to make your case for them to consider you.

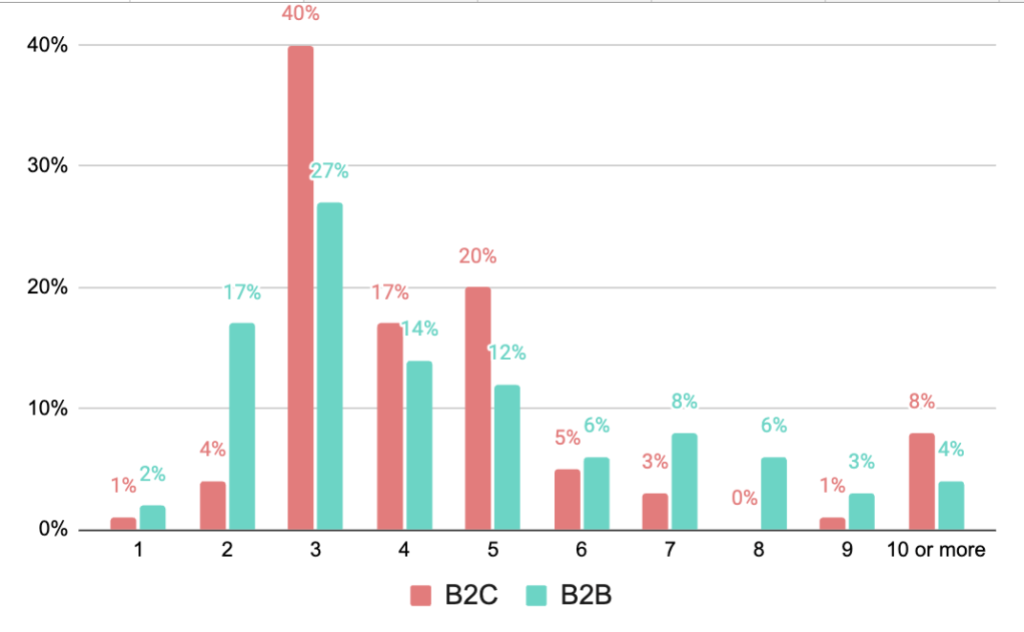

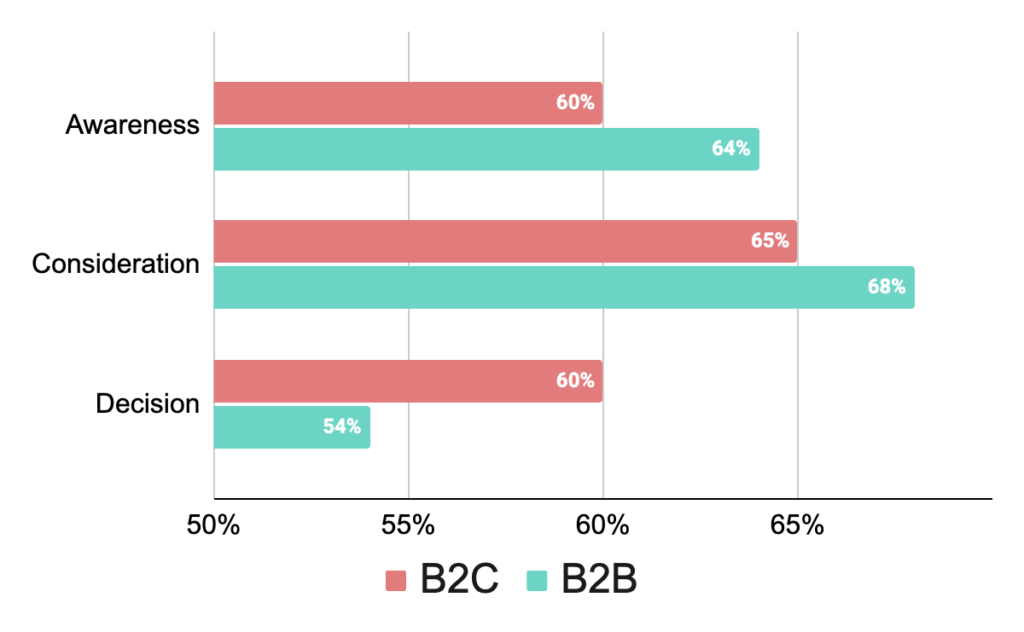

3. B2B software buyers use reviews more at the consideration stage than B2C consumers and less at the decision stage, though most buyers use reviews throughout the buying journey.

At various stages of the buying process, both B2C consumers and B2B buyers utilize business software review sites. Specifically:

- During the Awareness stage: 60% of B2C consumers and 64% of B2B buyers.

- During the Consideration stage: 65% of B2C consumers and 68% of B2B buyers.

- During the Decision stage: 60% of B2C consumers and 54% of B2B buyers.

Thought-Provoking Takeaway 💡

B2B Decision Divergence: While B2C consumers rely heavily on review sites during the decision stage, B2B buyers show a slight drop. This could indicate that B2B buyers might also turn to other sources (like asking their peers directly in communities) for final validation. Businesses targeting B2B clients should know this pattern and ensure they have strong closing strategies beyond review sites.

Peak at Consideration: The highest engagement for both segments is during the consideration stage. This underscores the importance of having detailed, positive, and recent reviews available when potential customers weigh their options

Actionable Takeaways 🎬

Consistent Engagement: The data suggests that review sites are not just a one-time stop. Both B2C and B2B segments engage with them consistently throughout their buying journey. Brands should ensure their presence and positive reviews on these platforms throughout the buying cycle.

Continuous Monitoring and Engagement: Given the significant reliance on review sites at all stages, businesses should actively monitor and engage with reviews, addressing negative feedback and encouraging satisfied customers to share their experiences.

Educational Content: Since the awareness stage also sees significant review site usage, businesses might consider partnering with these platforms to provide educational content like whitepapers, ebooks, and guides to help potential customers understand the industry landscape and where their product fits.

Next Steps

To further explore this topic and learn how buyers use online reviews to inform their purchasing decisions, read our survey reports: The State of B2B Software Reviews and The State of B2C Online Reviews.

Looking for more stats on online reviews in B2B and B2C?

Author

-

I'm the Founder and Editor-In-Chief of B2B SaaS Reviews and the Director of Demand Generation at PartnerStack, the leading platform for partner management and affiliate marketing in B2B SaaS. My experience spans several notable B2B SaaS companies, including Influitive (Advocate Marketing), LevelJump (Sales Enablement, acquired by Salesforce), and Eloqua (Marketing Automation, acquired by Oracle). I hold a Bachelor of Commerce in Marketing Management from Toronto Metropolitan University and a Master of International Business from Queen's University, with academic exchanges at Copenhagen Business School and Bocconi University.

![63 Online Review Stats: B2B and B2C [2023]](https://b2bsaasreviews.com/wp-content/uploads/2023/10/banner-63-1024x574.png)