There continues to be a transformative shift in how B2B software purchase decisions are made. As the number of B2B software products continues to rise rapidly, so has the information on these products. While today’s buyers use a variety of information sources to make buying decisions, software reviews are playing an increasingly important role. Learn why in this post.

Table of Contents

Why do online user reviews matter? Because the B2B times they are a-changin’.

I’ve only been in the world of B2B software since 2012. But ten years in software can feel like one hundred normal years when it comes to change.

Before diving into how online user reviews have become an integral part of B2B SaaS buying, let’s summarize the key points.

Why do online user reviews matter?

There are many reasons why reviews matter:

- Online information gathering in the B2B buying process will increase due to the demographic transition from Boomers and Gen X to Millennial buyers, as younger B2B software buyers rely more on online reviews than older buyers.

- B2B buyers are increasingly turning to their peers, but analysts remain relevant sources of information alongside review sites.

- The challenge for B2B buyers is still finding trusted information online that’s relevant to their buying decision.

- The road to B2B purchases is a long and loopy one. Reviews, especially those that prescribe a specific solution based on relevant experience, help B2B buyers throughout the process.

- Analyst reviews have a lot more depth than a typical peer review but are limited to one or two people’s opinions.

- “The internet has digitized word-of-mouth reviews and recommendations, making it much easier for people to rely on social proof as a shortcut for decision-making,” said Think With Google in its 2020 report, Decoding Decisions: Making sense of the messy middle.

- Peer reviews on B2B software review sites bring the benefits of the consumerization of B2C reviews but can still leave a B2B buyer looking for other sources of deeper information and “back channel” to corroborate what’s been said.

- B2B software review sites tend to see it as the early innings of reviews in B2B SaaS reviews, with much room for further growth.

- Perhaps this line from the 2021 G2 Software Buyer Behavior Report sums up not only why reviews matter in B2B SaaS, but also how they fit into the broader picture of buyer research: G2 found that while “86% of software buyers, across segments, use peer review sites when buying software” they also found, “There is no single source that is viewed as being ultimately trustworthy, at least significantly more than others, making third-party validation a key to building trust and demonstrating transparency. Resources including software review sites, vendor content and websites, online search, social media, industry influencers, and market research firms can complement each other and help the buyer build a well-rounded acquisition plan backed by trusted user validation.”

If you already know why reviews matter, consider jumping to one of the related cornerstone posts on this site: 10 Best Software Review Sites (the “where” of reviews) and How To Generate, Leverage, and Measure Reviews: A Practitioner’s Guide to B2B SaaS Reviews (the “how” of reviews).

If you’re ready to go deeper into why online user reviews matter in B2B SaaS, read on.

An erosion of trust leads to "information bankruptcy"

In 2005, long before many of today’s B2B Software professionals were in this field (including me), PR firm Edelman published its Sixth Annual Trust Barometer and highlighted a shift of trust from traditional “authorities” like CEOs to peers. Edelman reported:

People are replacing their trust in traditional authorities with trust in each other. They create personalized “webs of trust,” cherry-picking information from sources and people they feel they relate to—colleagues, friends, family. And they now require multiple exposures to a message from a variety of sources before they will accept it.

Fast forward to today, and we know this has changed how we get information for better and for worse. As information sources abounded, we’ve had more information at our fingertips via Google while also having more bad actors spreading misinformation.

In 2021, Edelman declared an “information bankruptcy” and a “failing trust ecosystem unable to confront the rampant infodemic” in which “people don’t know where or who to get reliable information” and “calling for institutions to provide trustworthy content that is truthful, unbiased and reliable.”

But the erosion of trust and the information bankruptcy is just one form of change in B2B software. There’s also a major demographic shift underway.

There's a new buyer in town, and it's a #millennial

Millennials (born 1981 – 1996) are now making a lot of B2B SaaS purchasing decisions, and they shop differently than their peers from previous generations. A Heinz Marketing and SnapApp study found:

Millennial buyers are far more independent than Generation X or baby boomer buyers during their path to purchase: They conduct extensive research on their own before making any purchasing decisions.

While Generation X and baby boomer buyers rely on salespeople for guidance, millennial buyers are more likely to rely on the opinions of peers or outside experts than to trust a salesperson: They actively avoid engaging with sales early on; nearly 60% say they don’t engage with a salesperson until they’re in the middle of a purchasing decision.

Gartner also talks about the rise of the millennial buyer. “As baby boomers retire and millennials mature into key decision-making positions, a digital-first buying posture will become the norm,” according to Gartner’s Managing Vice President Cristina Gomez.

Outreach, the Sales Engagement software vendor, is also thinking about how millennial buyers will transform sellers:

More decision-makers are millennials who want online access to information about your company (without talking to someone). They also tend to trust peer recommendations, referrals, and reviews. Customer reviews are gaining more weight, while B2B influencers are beginning to emerge.

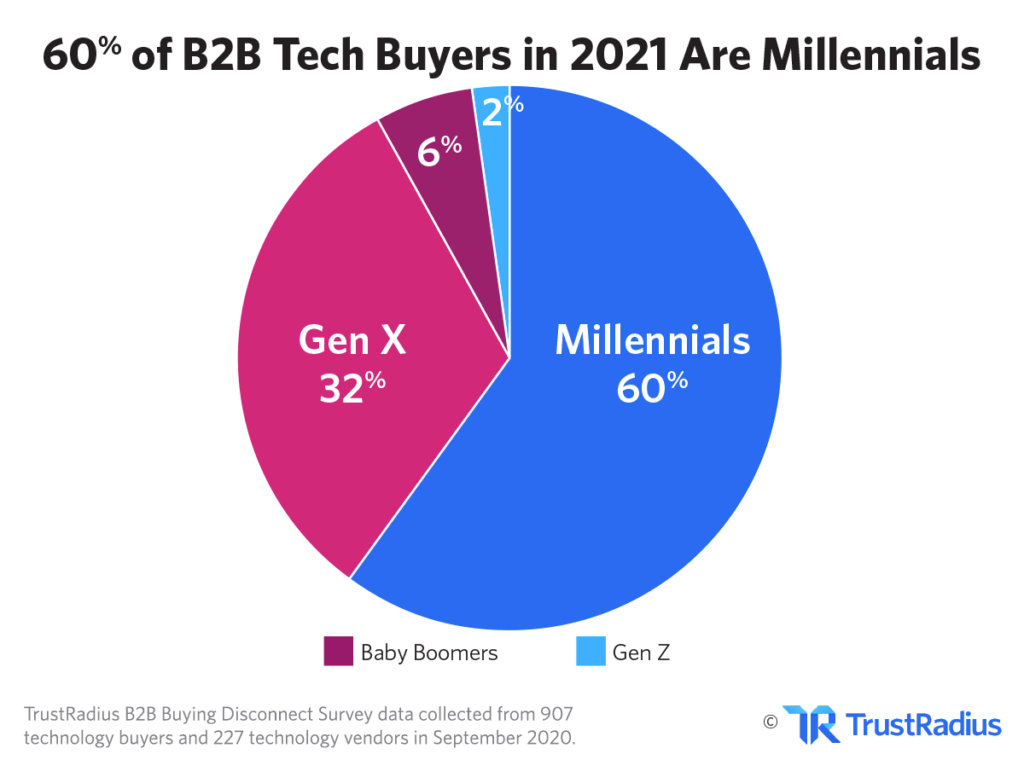

Finally, a TrustRadius survey indicates that “60% of B2B tech buyers in 2021 are millennials“. They also find that “Millennials are 2X more likely to discover products by searching online compared to older generations” and, “8 out of 10 millennials won’t make a purchase without reading a review first.”

If you’re targeting B2B SaaS companies, look through the LinkedIn profiles of a typical B2B SaaS startup and think about the average age. Millennials abound in decision-making roles, and Gen Zs are learning the ropes to be tomorrow’s decision-makers.

As a millennial (uncomfortably on the older side of it), I exemplify this approach to B2B SaaS purchasing decisions. I search extensively online for information before making a decision and would prefer to make a self-service purchase. I trust peer reviews much more than vendor content and promises. I avoid calls and like to discuss online. And not only do I now have some authority in B2B software decisions, but also I have Gen Zs on my team who are making their own B2B software decisions. In B2B SaaS startups, the shift to millennial and Gen Z buyers is upon us.

Even more noticeable than the demographic shift is the impact of COVID-19 on B2B buying…

COVID-19's impact on yet another thing

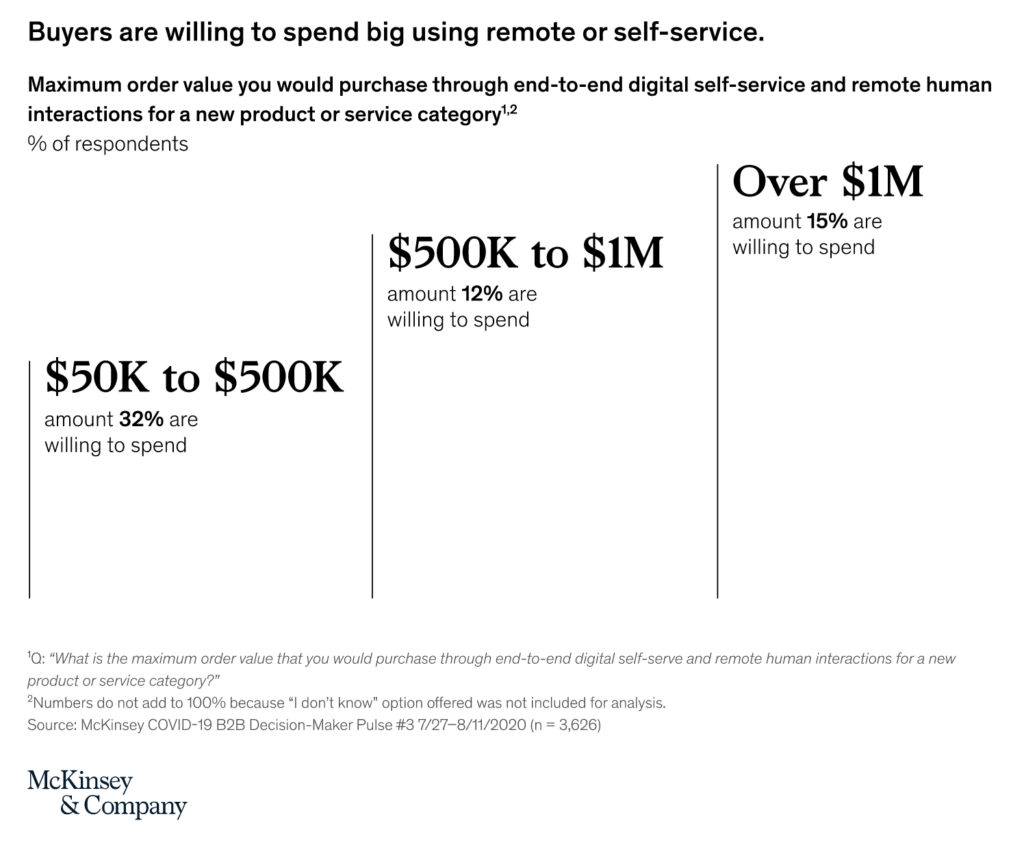

COVID has forced us to work in a more remote and digital world, leading to B2B decision-makers being more open to making new, large purchases on their own, online.

According to new McKinsey research, How COVID-19 has changed B2B sales forever, “70 percent of B2B decision-makers say they are open to making new, fully self-serve or remote purchases in excess of $50,000, and 27 percent would spend more than $500,000.”

But B2B decision-makers are moving slower, with more attention to detail, and turning to the familiar and reliable.

For instance, Forrester’s research revealed, “The number of interactions required to make buying decisions significantly increased in the past two years: from 17 in 2019 to 27 in 2021, indicating a new level of attention and due diligence for purchases during the pandemic.”

An Edelman-LinkedIn Pulse Study on how B2B companies are adapting customer engagement strategies during COVID also found that of 394 U.S. B2B executives surveyed, 61% said B2B customers are purchasing familiar/reliable products versus new or more innovative products.

In these uncertain times, buyer due diligence is on the rise, and buyers are doing it more and more online. I know I’m guilty of extra tire-kicking in shopping for B2B software in COVID times. These are anxious, uncertain times. And many of us are looking for people we can turn to for answers.

From a few experts to many voices

Rotten Tomatoes is well known for adding the user voice alongside the expert voice to provide television and film viewers with more holistic recommendations on what to watch. Before sites like Rotten Tomatoes, television and film reviews were left mainly to a few critics with whom individual viewers may or may not have agreed.

B2B software review sites have done something similar for B2B software buyers. Before B2B software review sites, B2B buyers were limited to the reviews by two or three major analyst firms, with each firm writing up the opinion of one of two “critics” or industry experts.

Nowadays, a B2B buyer can turn to either source: the analyst in one of their reports or a peer in the form of a user review.

In B2B, the traditional analyst firms – Gartner, Forrester, and IDC – have been the authorities on software for decades. They sell their knowledge in the form of reports and services.

Analyst firm knowledge comes from hiring seasoned professionals who have a lot of first-hand experience in their field and coupling that knowledge with research to generate valuable insights. Industry Analyst Richard Stiennon defined an industry analyst as, “a subject matter expert that knows the industry, its products, its people, and its trends.” (emphasis added).

The problems with software analysts (as I see it)

A great analyst can make life as a B2B software buyer much easier. If you see eye-to-eye, they can impart their wisdom and be your expert guide.

But I believe there are problems to overcome in working with analysts.

Each analyst firm tends to have only one or two analysts covering a software category. This concentrates an awful lot of power in the hands of just one or two individuals to provide an analysis of all software vendors in a software category.

For example, with Gartner’s Magic Quadrant, Gartner analysts assess each vendor’s “ability to execute” and “completeness of vision.” Half of a vendor’s “completeness of vision” is largely defined by Gartner as “...if the vendor’s view of how the market will develop matches Gartner’s perspective.”

What if the analyst’s vision is flawed and a vendor’s vision is right? That seems to be the case with sales engagement. As Outreach founder Manny Medina tells it, Gartner’s analyst for Sales software didn’t see Sales enablement as a category. G2 did, and helped make it one. As G2 founder, Godard Abel, stated, “… let’s give the power to the customer. And let’s do it more like Yelp. They were having a lot of success for consumer reviews. Let’s bring that to B2B software and make it possible to create a category much more quickly… we’re proud to have supported the creation of sales engagement.”

Adding to this discussion on category creation, Mark Organ, co-founder and category creator of Eloqua (marketing automation) and Influitive (advocate marketing), also believes that “categories are not created by analysts…the analyst just basically takes what’s already pretty obvious, and makes that a category… the people who create your category are your customers.”

While getting favourable coverage in an analyst report is not explicitly pay-to-play, the setup arguably favours enterprise vendors with the resources to invest in analyst relations.

Campaigning for favourable analyst coverage reminds me of film studios campaigning members of the academy to select their studio’s film(s) for the Oscars as Vox reported, “The campaign trail for the Academy Awards is expensive, exhausting, and not really about the movie.” Everybody knows how head-scratching the Academy’s selections can be at times.

In 2014, when G2 raised a seed round of funding to become “Yelp for Software,” they made an 80-second explainer video on the limitations of analyst firms and why review sites like G2 can help B2B software buyers and sellers.

The video’s main message gets at the root of the issue with analyst firms alone. Despite all of the research and calls that analysts have with people in the space, the analyst report is still defined by the analyst. With B2B software review sites, many peers are sharing their points of view, which might be equally if not more valuable than the analyst’s point of view.

In defence of software analysts

Still, many B2B buyers continue to rely on analysts. They seem to be favoured, especially by those at bigger companies and IT buyers.

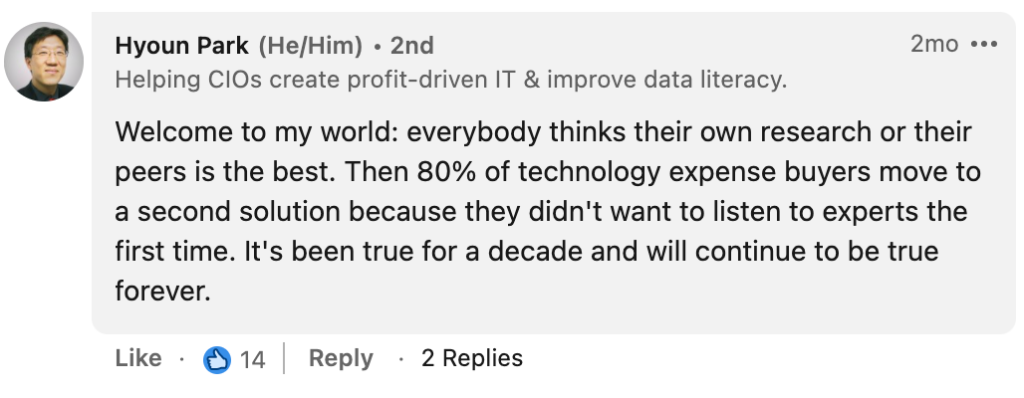

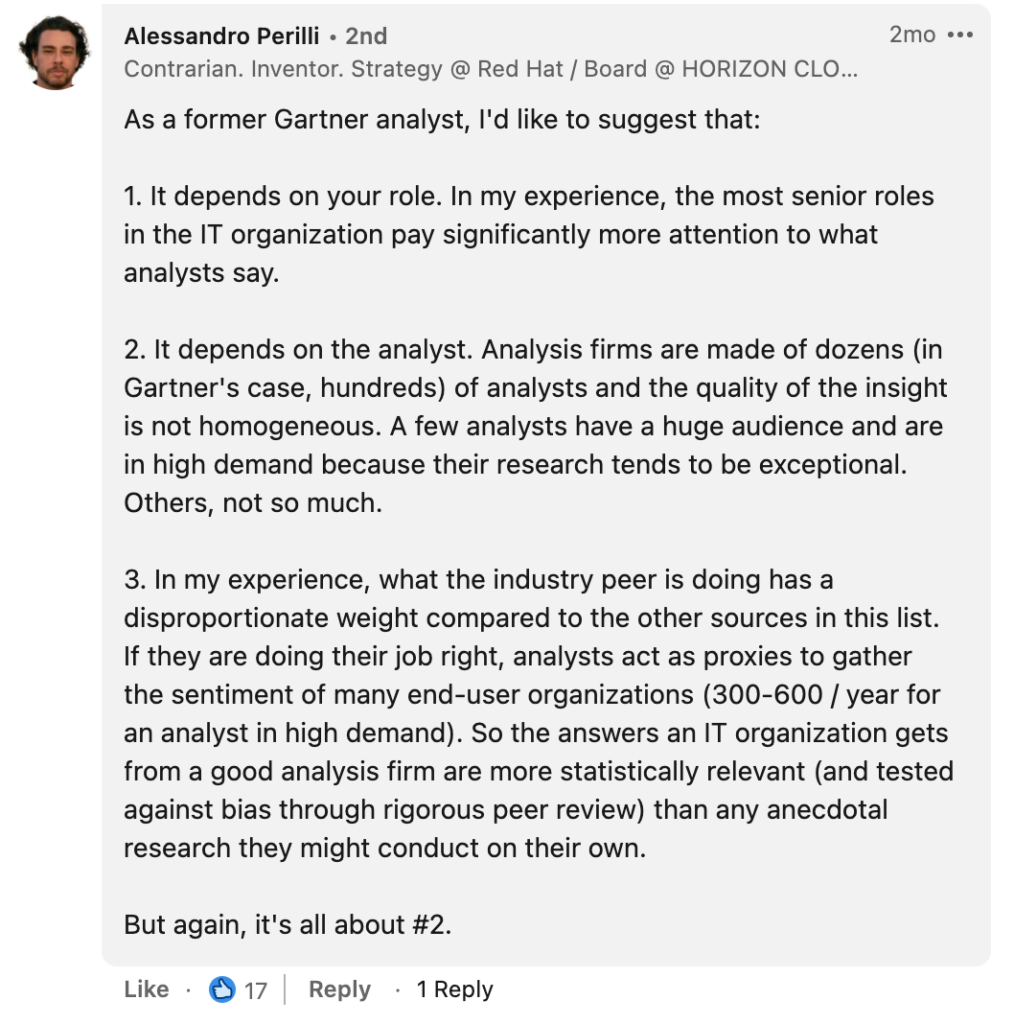

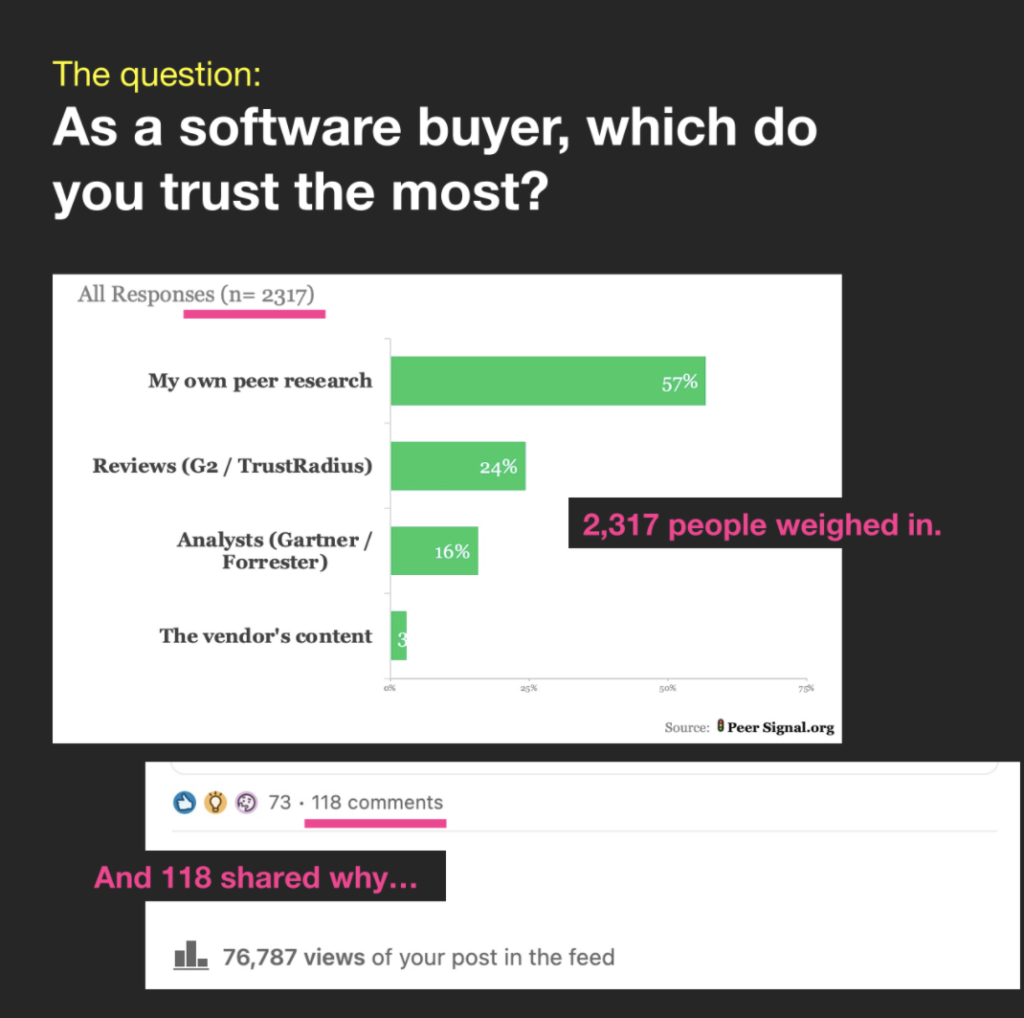

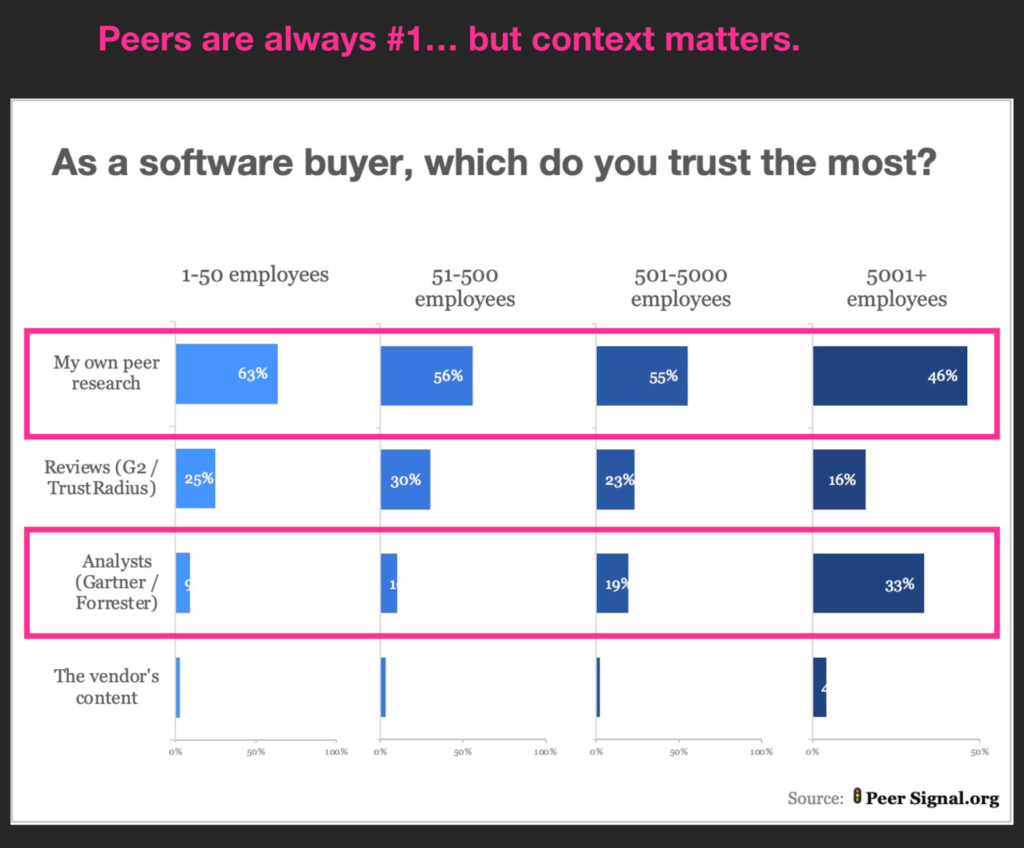

Consider a buyer trust survey with 2,317 software buyers conducted by Adam Schoenfeld, VP of Strategy at Drift and Founder of PeerSignal.org. A number of comments on Schoenfeld’s LinkedIn argued in favour of analysts over peer reviews.

Then again, these are analysts and former analysts defending their roles.

How about B2B SaaS professionals who lean more toward analysts than toward software review sites?

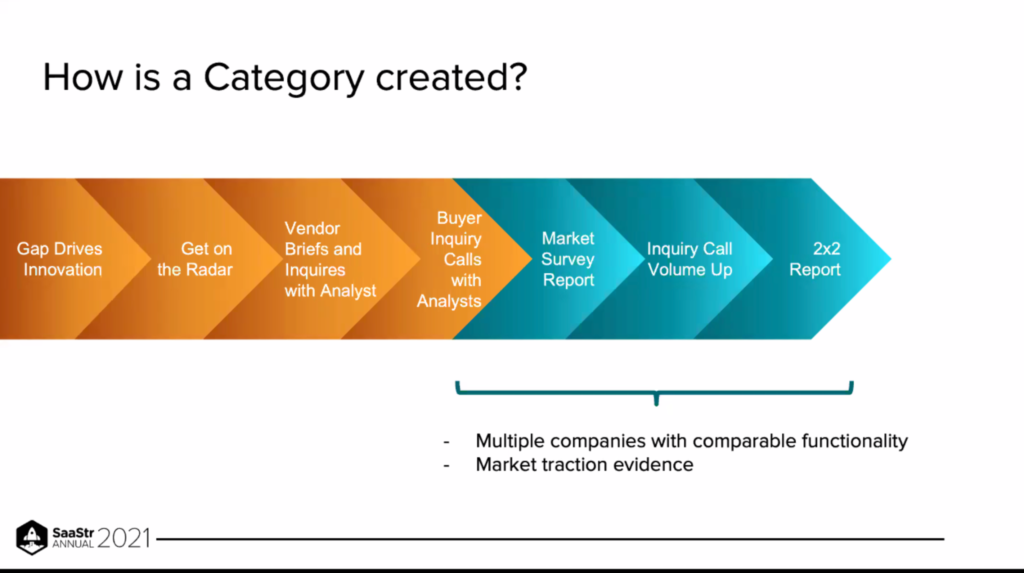

One example is Andres Botero, Chief Marketing Officer, BlackLine. Andres presented at SaaStr 2021 on “The Why and How of Category Creation and Leadership“. In this popular session (48,000 views and counting on the Twitter stream before the event ended), he argues that “Industry analysts from Gartner, IDC, Forrester and other firms are constantly shaping the market perceptions via Magic Quadrants, Waves, MarketScapes” and that “These reports inform buyers and shape shortlists.”

Andreas is a 20-year seasoned veteran of enterprise software marketing, helping achieve “top-right” (i.e. leadership) positions in 12 categories at Oracle Siebel, SAP, Steelwedge, Aria, CallidusCloud, and now Blackline (which does $400m in ARR).

He created the category “Sales & Ops Planning” at Steelwedge and “Financial Close Solutions” at Blackline not by working with B2B software review sites, but by working closely with an analyst firm (Gartner). The first Gartner Magic Quadrant for Financial Close solution appears to have been in 2018, whereas the first recordings of Financial Close categories on G2 and TrustRadius were in April 2020 and June 2020, respectively.

So how does Andres create categories with analysts? He shared his view of the steps to category creation with an industry analyst.

Andres explained that the main parts of a category are when six or more vendors have defined functionality and benefits that buyers use for comparison, and when analysts begin to get high volumes of inquiries from buyers on the category.

Also, to help make the case, vendors need to build long-term relationships with analysts. Take them out for breakfast. Learn the analyst’s vision for the space. Seek their advice on how your software can fit into their vision. Those are some of the main tips that Andres shared on how he’s influenced the influencers (analysts).

In Andreas’s live session, I asked him how does he see B2B software reviews sites such as G2 and TrustRadius fit into category creation?

He opened his response by saying that these review sites are newer to the role of category creation than analysts. He believes review sites matter, but in general, he believes that the more complex the software, the less the review sites matter. Also, he believes they cover different parts of the corporate ladder: he said analysts speak to the people writing the cheques (execs) about things like ROI, whereas review sites share the voice of the user on things like product usability. Therefore, he sees them as complements, not substitutes, for one another.

It didn’t seem he had considered B2B software review sites as the starting point in category creation. But with a track record as successful as his in working with analysts to create categories, he needn’t consider alternatives.

There are different means to the same category creation end. Some create categories with analysts. But for others, such as Outreach, B2B software review sites could be the answer. And still, for others, it could be some combination of the two.

From analysts to user reviews

For many B2B SaaS buyers, accessing peer knowledge is not only an integral part of the buying process but also one of the most important, if not the most important, parts of it.

“If I want to go spend $10 on a burrito in my neighborhood, I can find a restaurant with 585 Yelp reviews. If I want to spend $10m on a piece of enterprise software, I spend $5K on a report written by a single analyst a year ago?” said Michael Wolfe, Serial SaaS Founder, in 2011 on a Quora post in response to the question, “How relevant will Analyst Firms like Gartner (with its MQ) and Forrester be in the next 10 years?“.

Around the same time, this same line of thought spawned B2B software review sites such as G2, TrustRadius, and PeerSpot (formerly IT Central Station) that saw the value of reviews in the B2C space and an opportunity to bring the same user review voice to the B2B buying process.

Surely, G2, TrustRadius, and the other B2B software review sites also saw a lucrative opportunity to capture revenue from analyst firms.

As of March 2022, the analyst firm Gartner still dwarfs the business software review sites: Gartner’s market cap is roughly $24 billion and does over $4 billion in revenue annually, whereas G2 was valued at $1.1B in its June 2021 Series D raise. But that’s not to say that business review sites haven’t made large and quick strides. G2’s $1.1 billion valuation is higher than Forrester’s March 2022 market cap of roughly $1 billion, and G2 was founded less than ten years ago, in 2012, while Forrester was founded in 1983.

It’s been ten years since the “Why is there Yelp in B2C but nothing like it in B2B?” question was asked on Quora. Where are buyers turning to today in their buying journey?

There's room for both analyst reviews and user reviews in software, but they're not alone

Returning to Adam Schoenfeld’s buyer trust survey with 2,317 software buyers, he found buyers turn to both analysts and reviews, but also to their peers directly.

He also found that trust in analysts and reviews varies by the size of the company the buyer works for: buyers at enterprises still had more trust in analysts versus buyers at small and medium businesses that have more trust in reviews (they both agree, however, that their peer research is the most trusted source).

But with all this change in B2B software, whether you turn to analysts or peer reviews or both, one thing is certain: B2B software purchase decisions are hard to make.

Why is B2B SaaS buying so hard?

Let’s go back to the “information bankruptcy” and a “failing trust ecosystem unable to confront the rampant infodemic” in which “people don’t know where or who to get reliable information” that Edelman presented in 2021. How do we, as B2B buyers, find “truthful, unbiased and reliable” information?

From information to knowledge: what makes information trustworthy?

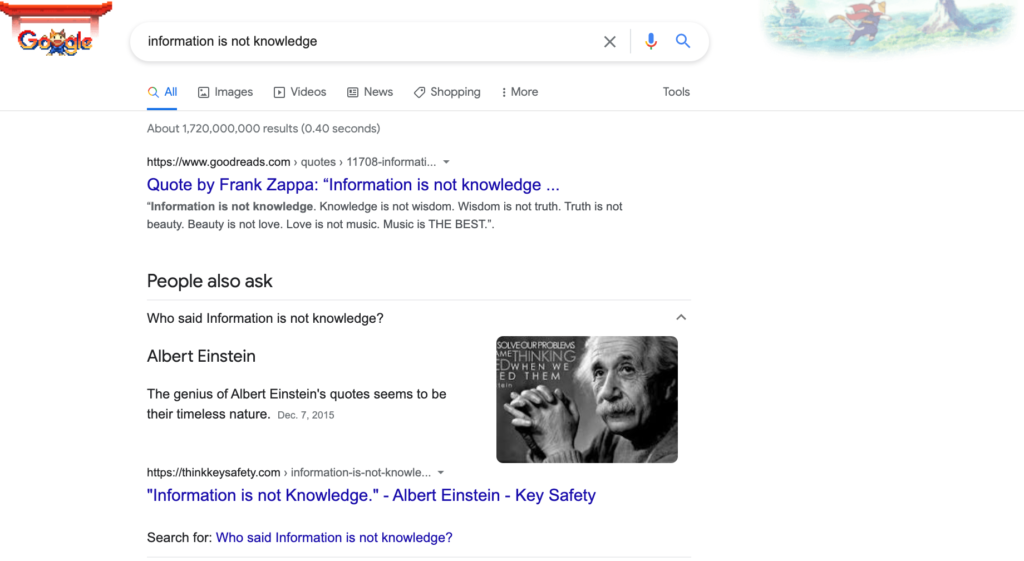

“Information is not knowledge,” said Albert Einstein.

This is true, at least the meaning of the quote is. But Einstein might have never said it. Multiple sources on the internet (mis)attribute the saying to him (Quora, Brainy Quote, even Google attributed the quote to Einstein by way of citing a supplier of industrial safety solutions), while other sources (Wikiquote) deny this as one of his (many) identifiable quotes.

So when we need to make decisions in a world of imperfect information, how can we gain knowledge?

If I had read the complete works of Einstein, I could rely on my experience (assuming my memory didn’t fail me) to answer whether he did or did not say, “information is not knowledge.” Alas, I have not, so I need to choose which information sources are more trustworthy to make a decision.

In the Einstein quote example, I concluded that the quote was misattributed because Wikiquote is part of the Wikipedia family, which has a community approach to fact-checking claims, whereas the sources attributing the quotes to him did not. This was a snap decision that wasn’t hard to make. But in B2B software buying, the stakes are higher. We look for increased certainty.

There’s no substitute for experience. In fact, prior experience is the information source that B2B buyers would be most disappointed to lose. But practically speaking, in the world of B2B SaaS, we often aren’t able to gain the particular experience needed for every product choice.

Many of us in B2B SaaS often lack experience with the software we’re considering because there are so many software categories and vendors in the market, and many of us in B2B SaaS is still a shade of green.

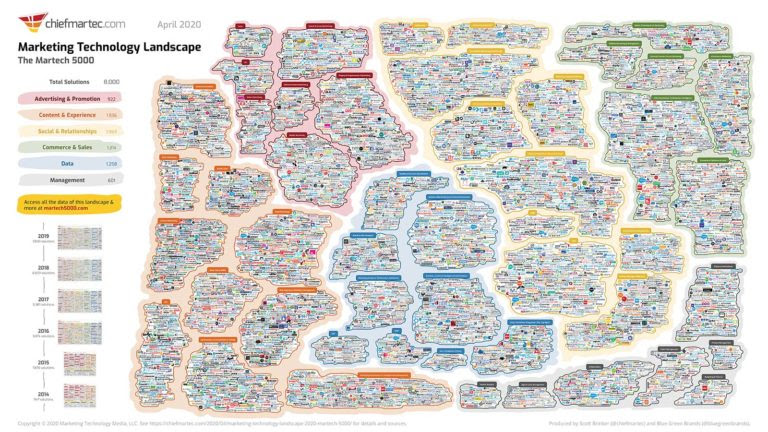

B2B Marketers know well the pangs of fear that come from a look at the annual Marketing Technology Landscape which has 8,000 martech solutions as of 2020.

It’s impossible for buyers to keep up with new SaaS options (awareness), know which ones they need (evaluation), and in which sequence to get them (prioritization). When we don’t have experience with the software in question, we benefit from access to the knowledge of people that do. But who has the knowledge that you need?

What is knowledge, who has it, and where can you find them?

By way of Harvard Business Review, The European Committee for Standardization’s official “Guide to Good Practice in Knowledge Management” says: “Knowledge is the combination of data and information, to which is added expert opinion, skills and experience, to result in a valuable asset which can be used to aid decision making.”

And it can get more complicated if you want to know what knowledge can mean.

Going back to the Harvard Business Review’s The Problem with the Data-Information-Knowledge-Wisdom Hierarchy, knowledge results from a:

…complex process that is social, goal-driven, contextual, and culturally-bound. We get to knowledge — especially “actionable” knowledge — by having desires and curiosity, through plotting and play, by being wrong more often than right, by talking with others and forming social bonds, by applying methods and then backing away from them, by calculation and serendipity, by rationality and intuition, by institutional processes and social roles. Most important in this regard, where the decisions are tough and knowledge is hard to come by, knowledge is not determined by information, for it is the knowing process that first decides which information is relevant, and how it is to be used.

In other words, you might not know which information to trust and how to use it. You might need a knowing process, like first finding someone you trust, such as a peer who has made this decision before, who has more knowledge of how to go about determining if something is right for you, and which information sources are trustworthy and relevant and also guide how to use that information. Or you might need to know how to find trustworthy information and determine which is most relevant to you.

When we don’t know something, we tend to turn to our family and friends, who we trust deeply. Unfortunately, when it comes to something niche like B2B software, they often lack the experience you need. Even when they do have it, they may have it in a very different context.

For example, I have close friends in Marketing, but none that work in B2B SaaS at a fast-growth Series B company. A peer B2B SaaS Marketer at a fast-growth Series B company that has used the software I’m considering would have the precise experience I seek. Even if I don’t know this person, I may take a leap of faith as to whether he or she is trustworthy because the nearness in experience (knowledge) is worth more than the closeness of the relationship (trust).

Companies have been a natural source of knowledge on matters related to their business. For example, HubSpot coined Inbound Marketing to explain how the internet changed how buyers get information from sellers. The knowledge held only by Sales reps in the pre-internet world has now been disseminated to employees, partners, and customers to share online. HubSpot has made a $20 billion+ business (market cap) by providing the gold standard for inbound marketing with their own marketing, and they have also helped companies share their knowledge (and also sell more). But many buyers have low trust in companies relative to third-party sources like their peers and industry analysts.

It can become a grey zone when the knowledge vs. trust balance is similar.

A question to keep in mind throughout this piece is when you’re making a B2B SaaS purchase, who would you turn to, an industry analyst in your field or a peer in your role?

Who and what can B2B software buyers trust?

Time and time again, we hear that trust is an integral part of the buying process.

Andrew Chen, Partner at Andreessen Horowitz, noted in the Cold Start Problem, “Product categories like marketplaces, dating, app stores, and food delivery ask us to review and rate (with a five-star scale!) because they are categories where trust [emphasis added], safety, and high quality are key to the experience.”

In B2B, where purchases are generally more considered than in B2C, trust matters even more.

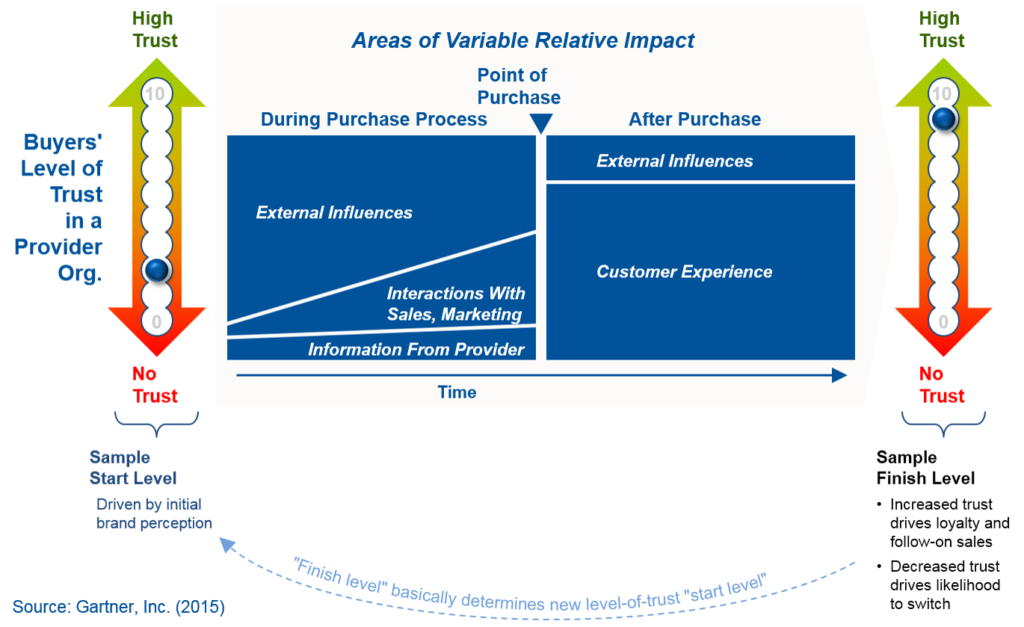

In 2015, a Gartner technology buyers survey found that trust drives the buying process and that, “as buyers engage in a buying effort, the biggest impact on them building trust … is what they read and hear from influencers they trust. Influencers could be analysts, academic experts, a neighbor, a peer, a columnist, a blogger, and others. But they are the first place buyers go.”

Trust levels rise as a B2B buyer gets to know a B2B vendor.

B2B vendors need to note how many external influences impact B2B buyers early during the purchase process.

In G2’s 2021 G2 Software Buyer Behavior Report, while they found that “86% of software buyers, across segments, use peer review sites when buying software”, they also found:

There is no single source that is viewed as being ultimately trustworthy, at least significantly more than others, making third-party validation a key to building trust and demonstrating transparency. Resources including software review sites, vendor content and websites, online search, social media, industry influencers, and market research firms, can complement each other and help the buyer build a well-rounded acquisition plan backed by trusted user validation.

As a B2B buyer, I find this early part of the purchase process to be the most challenging because there are so many ways to go about getting to know a software solution that can it can be overwhelming. There’s a lot that is overwhelming about the B2B purchase process.

B2B buying is complex and difficult

Buying B2B software is an inherently complex and difficult task. But as the industry matures, the complexity and difficulty of B2B purchases are increasing, on the whole, it seems.

This might come as a surprise given all the developments in the industry that have made it easier to buy, be it online transactions or more software to solve for different pains or user reviews. But the survey data suggests buyers are more uncertain and stressed by the B2B software decisions they must make.

In the 2021 G2 Software Buyer Behavior Report, “20% of survey respondents report that buying committees have increased in size since last year” and “One-third…say that decision-makers change frequently in the buying process.”

In 2019 research from Gartner, “New B2B Buying Journey & its Implication for Sales”, they highlight why “77% of B2B buyers state that their latest purchase was very complex or difficult”

The customer’s buying journey is hard. The typical buying group for a complex B2B solution involves six to 10 decision-makers, each armed with four or five pieces of information they’ve gathered independently and must deconflict with the group. At the same time, the set of options and solutions buying groups can consider is expanding as new technologies, products, suppliers, and services emerge. These dynamics make it increasingly difficult for customers to make purchases.

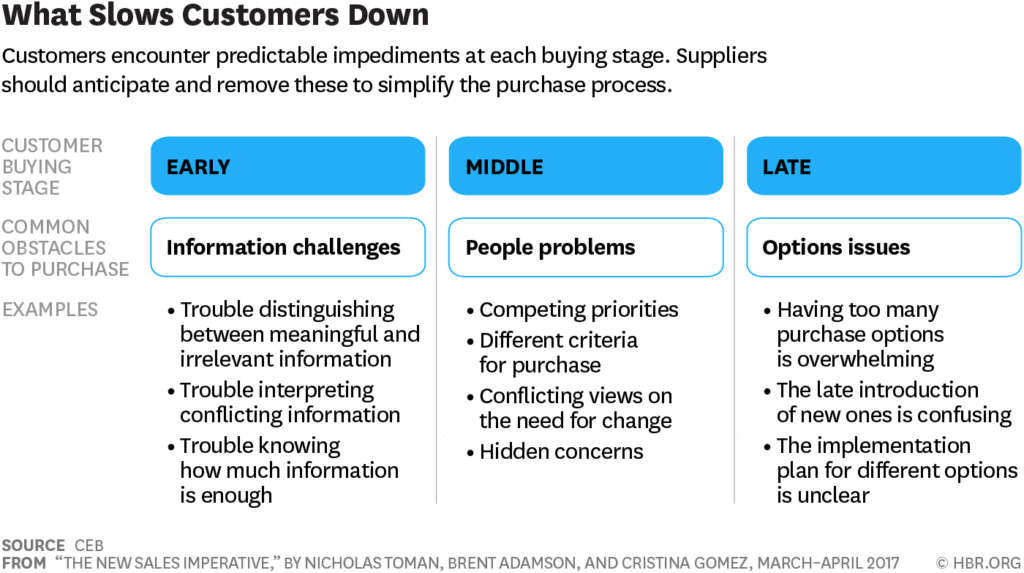

Harvard Business Review reported in The New Sales Imperative based on CEB research:

In our work with companies around the world, we’ve seen decision-makers pushed into unproductive, open-ended learning loops by the deluge of information. With each iteration they work harder to ensure that they fully understand the requirements and the alternatives. More information begets more questions, with the result that customers take longer and longer to make a purchase decision—if they ever do.

CEB argues that B2B purchasing has become too complicated because the buying committee has climbed from an average of 5.4 to 6.8 people who are overwhelmed by a plethora of software and information that has created an awfully long minefield that buyers must cross to make a purchase decision that takes 65% longer than buyers expected and results in 40% of buyers second-guessing their purchase.

CEB found common obstacles to purchases and the many ways they can take shape.

CEB recommends that vendors prescribe a solution to help increase purchase ease and decrease buyer regret.

I believe the challenge is that nearly every vendor is limited to prescribing their own solution or solutions, and buyers are frequently prescribed new solutions by a growing number of software vendors.

From a vendor point of view, the ideal outcome is to move a buyer down a linear path to purchase as fast as possible. It would make the lives of B2B vendors much easier if buyers behaved this way.

But as the cliche goes, people love to buy but hate to be sold. Buyers not only veer off the vendor-set path. Many buyers delay getting on this path as long as they can. And when buyers are on the path, given how complex and difficult it is to go down this path to its end with confidence, buyers go beyond making pit stops along the way; they chart their own course. And it often looks more like a series of loops than a straight line.

From paths to loops

In B2B software marketing, we tend to think in linear paths and funnels. Perhaps it helps us make sense of the chaos of B2B buying and focus on what we can do as vendors to influence it.

In the Demand Gen Report and Demandbase 2021 B2B Buyer Survey, they showed the B2B buying process as a linear timeline to help readers understand the steps on the journey.

It should come as no surprise that there are now so many steps along the buying journey before the buyer engages with Sales.

Nine steps may seem like a lot until you consider the “27 steps B2B buyers follow as they make their way along the software buying journey”, as outlined by TOPO (now Gartner). Trying to make sense of a journey with so many steps is hard enough in the theoretical linear path illustrations.

While Marketers often see the buyer’s path as something like a squiggly line, many know the buyer doesn’t progress from one stage to another in a single series of sequential steps.

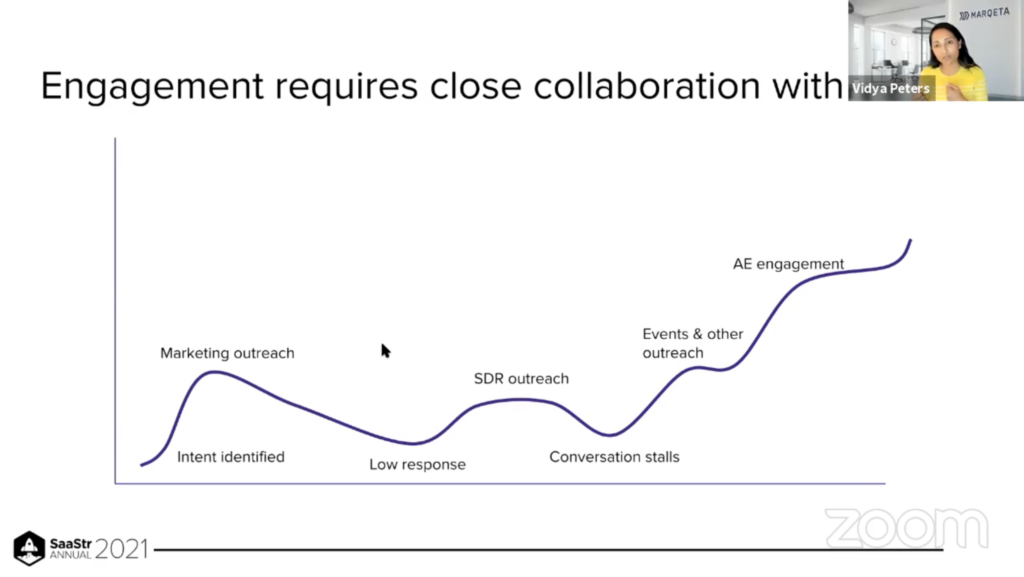

At the SaaStr Annual 2021 session, Why Intent is the New Lead, Vidya Peters, CMO of Marqeta, presented the buyer journey from the point of view of the Sales and Marketing teams and said:

“The Marketing-to-Sales hand-off used to be like fishing. Marketing would catch a fish, then hand it off to Sales, and then Marketing would go try to catch another fish. Now, the Marketing-to-Sales relationship is more like a game of soccer, with back-and-forth (passes)… it’s a constant flywheel between Marketing & Sales.”

Yet research continues to show that the buying process is less like a linear path and more like a series of loops, with buyers veering off course in every direction.

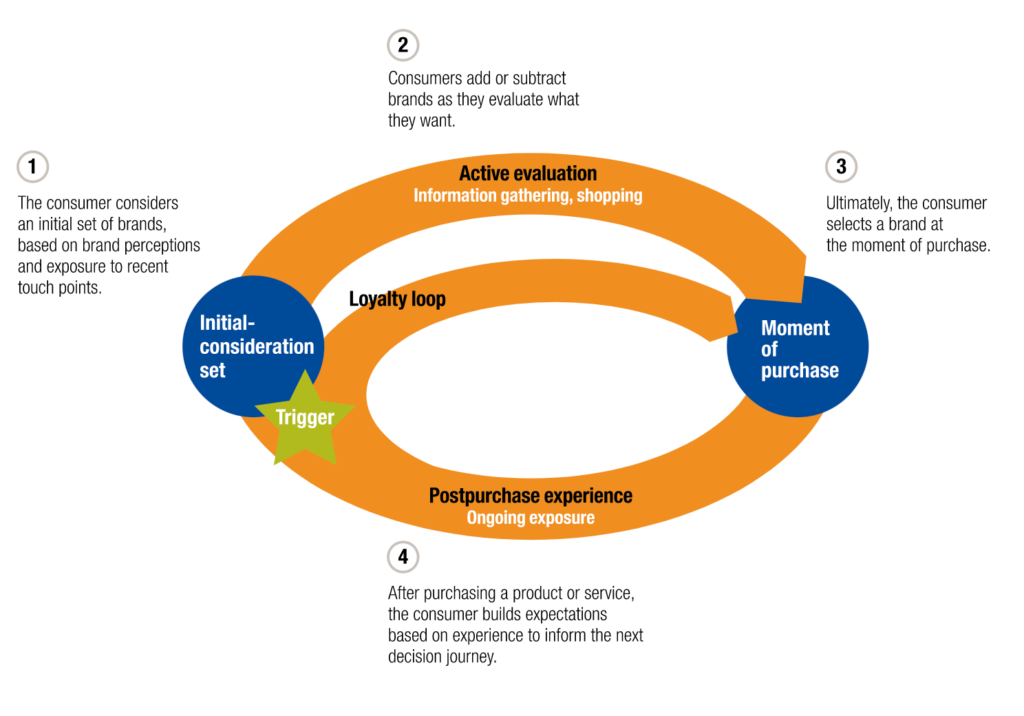

In 2009, McKinsey noted in The Consumer Journey, “Consumers are moving outside the marketing funnel by changing the way they research and buy products.”

Why?

“…because of the shift away from one-way communication—from marketers to consumers—toward a two-way conversation, marketers need a more systematic way to satisfy customer demands and manage word-of-mouth.”

The internet opened the information floodgates to allow for a shift in the balance of information “touchpoints” in the buyer’s journey.”

This meant the pendulum was shifting from marketers “pushing” information to buyers “pulling” information.

McKinsey found that “two-thirds of the touch points during the active-evaluation phase involve consumer-driven marketing activities, such as Internet reviews and word-of-mouth recommendations.” In other words, the buyer started driving two-thirds of their buying process, with only one-third from company-driven marketing like ads, emails, etc.

While the McKinsey loop illustrated a fairly straight line from the initial consideration set to the moment of purchase, more recent research has shown that there are loops even within this step of the B2B buying journey.

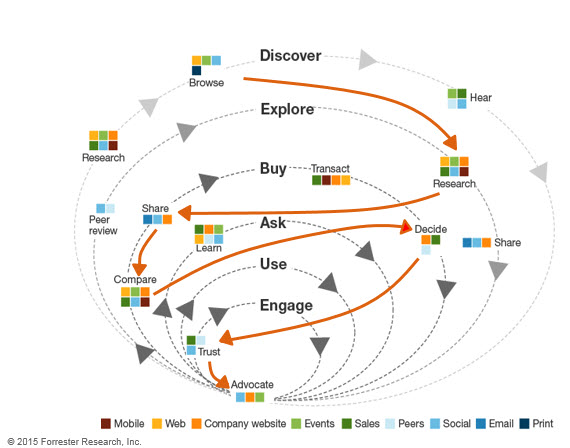

In 2015, Forrester shared a diagram of the buyers’ journey as a series of loops. It also has red arrows that show examples of how a buyer can chart their course through their buying process.

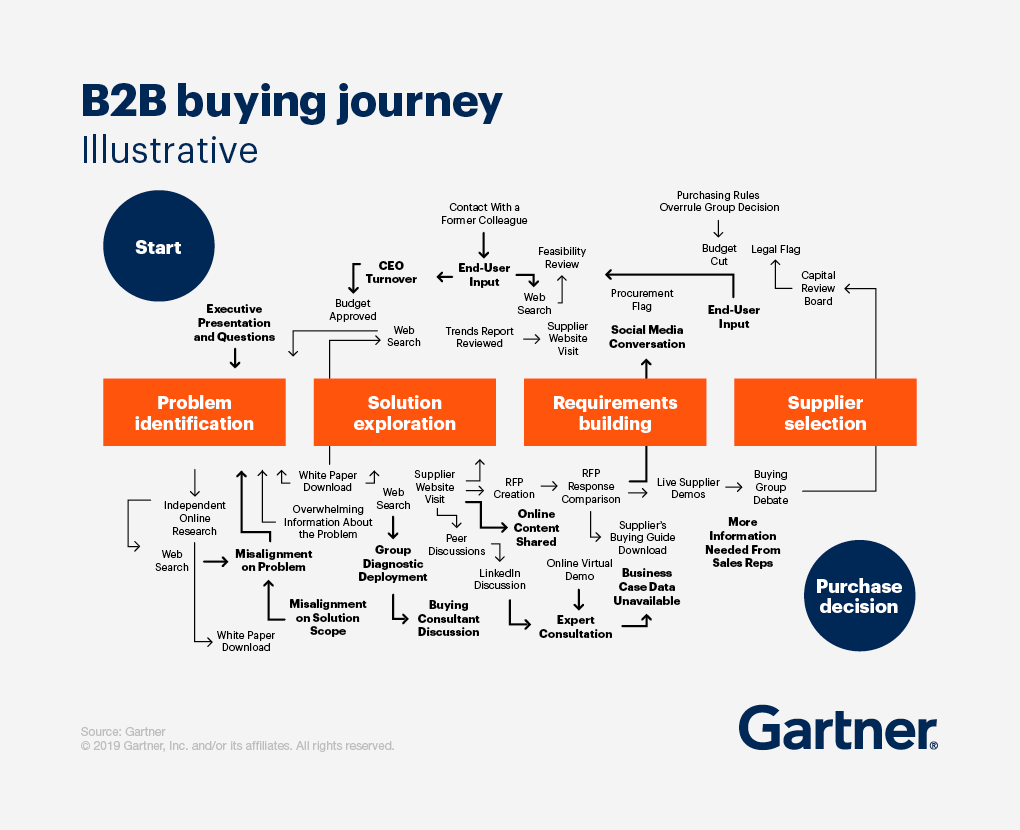

Gartner is also saying that “B2B buying doesn’t play out in any kind of predictable, linear order. Instead, customers engage in what one might call “looping” across a typical B2B purchase, revisiting each of those six buying jobs at least once.” In the illustrative B2B buying journey image, those six buying jobs are the four in the orange boxes, plus validation and consensus creation, which span the entire process.

At SaaStr Annual 2021, in Dave Kellogg’s Mastermind Masterclass: A CEO’s Guide to Marketing, he referenced this Gartner illustration of the B2B buying journey, adding that the “reality is anything but linear” when “reality hits in you in the face.”

As you can see, the B2B buying process is anything but straightforward.

The Messy Middle

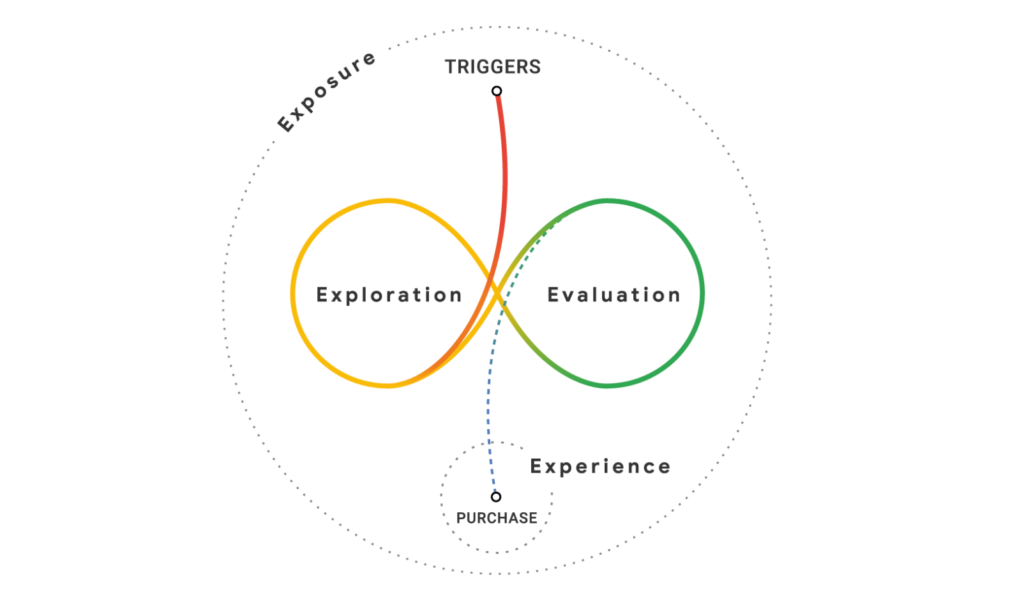

McKinsey and Gartner aren’t the only ones to have found that the buying process is more “looping” than linear. With all its data on how we use online searches to make purchases, Google has also found patterns of loops in the buying process.

In 2020, Think With Google published a 98-page report, “Decoding Decisions: Making sense of the messy middle.” In their research, they describe the buying journey as “the messy middle” because, as they found, it’s “a space of abundant information and unlimited choice” and that while in it, “consumers loop between exploring and evaluating the options available to them until they are ready to purchase.”

From the vendor’s point of view, Think With Google describes the messy middle as “a complex space between triggers and purchase, where customers are won and lost.”

People look for information about a category’s products and brands, and then weigh all the options. This equates to two different mental modes in the messy middle: exploration, an expansive activity, and evaluation, a reductive activity. When exploring, we add brands, products, and category information to mental portfolios or “consideration sets.” When evaluating, we narrow down those options.

Vendors need to understand the messy middle, and how buyers add brands to their consideration set, then remove them while they evaluate and move toward a purchase.

Moving out of the looping messy middle: triggers and purchase

In this loop of exploration and evaluation, triggers can lead to purchases. As Think With Google said:

…triggers are responsible for moving consumers from a passive state into an active purchase state. We’ve made them plural in our model to account for the fact that it is often not just one inciting factor that prompts the desire to purchase. In many cases an interconnected set of internal and external factors – feelings and memories, ads, and reminders – are responsible for triggering an active purchase state.

So what’s a B2B vendor to do? What can they do to trigger more purchases of their solution?

Consideration sets and how user reviews can help buyers exit the messy middle

A consideration set is the brands (or vendors) a buyer includes in their list of potential vendors.

A top objective for Marketing is to get into as many of the consideration sets of buyers in its Total Addressable Market (TAM) as possible. Doing so is getting harder as buyers become overwhelmed by choice.

McKinsey surveyed 20,000 buyers (in B2C and B2B) and found that “Faced with a plethora of choices and communications, consumers tend to fall back on the limited set of brands that have made it through the wilderness of messages. Brands in the initial consideration set can be up to three times more likely to be purchased eventually than brands that aren’t in it.” I imagine brand marketers would respond to this with an emphatic, “I told you so!”.

In B2B, SaaStr Founder Jason Lemkin has said, “In an established category, customers will pre-pick one of the Top 2–3 vendors based on brand, market share and research. Well before they even talk to a sales rep.”

An important part of that research process for many buyers is reading reviews on review sites to see the top vendors in a category.

Peep Laja, an expert in B2B conversion optimization, surveyed B2B SaaS revenue leaders. He had a very similar finding:

When B2B SaaS revenue leaders make tool purchases, how many alternatives are they seriously looking into? The answer: on average, 3. Few go the extra mile and strongly consider 7-8 vendors; the overwhelming majority go for 3. They start with a bigger shortlist but narrow it down to 3 to talk to….80% read third party reviews… Reviews matter. The average buyer reads 10. You don’t need 456 reviews.

Back to the Messy Middle with Google, buyers add and remove brands from their consideration set in part through online search.

Google stated that searches for “best of [software category]” tend to be more exploratory in nature, and searches for “[software category] reviews” tend to be more evaluative.

As Google said, “The modifier “review” provides us with a clear example of shoppers actively seeking out authoritative viewpoints to boost confidence during decision-making“.

Consumers explore their options and expand their knowledge and consideration sets, then – either sequentially or simultaneously – they evaluate the options and narrow down their choices. For certain categories, only a brief time might be required moving between these modes, while habitual and impulse purchases may bypass the loop altogether. But other purchases, typically more complex, encourage or even oblige us to engage in lengthy exploration, generating a healthy number of options to evaluate.

So how do buyers, especially of more complex B2B solutions, ever make a decision?

There are, of course, triggers that help buyers exit the land of the loops and enter Purchaseville.

Quantity or quality in review generation?

Reviews help buyers with solution exploration and evaluation

Reviews help buyers throughout their buying process to make decisions.

On a Modern Sales Pro webinar, Rise of Self-Service Buying: An Enabled Buyer’s Market, host David Weiss asked guest Tim Handorf, Co-Founder of G2, how people use a review site like G2 to make a decision. Tim said:

People come to G2 for one of two reasons: one is what I would call "discovery." They're looking for a shortlist of the sellers that they can trust. (It's) The transparency and what they find out from the other buyers (from the reviews.) The other one is "due diligence." (The buyer is thinking,) "We think we like (this vendor), but does everyone's experience match what they're telling me? If it does, we'll close the deal."

Tim Handorf, Co-Founder of G2 and Head of G2 Labs

See Tim’s response on how G2 helps buyers make decisions at the 31:00 minute mark.

Buyers turn to review sites to make a vendor shortlist or select a vendor because reviews are highly influential.

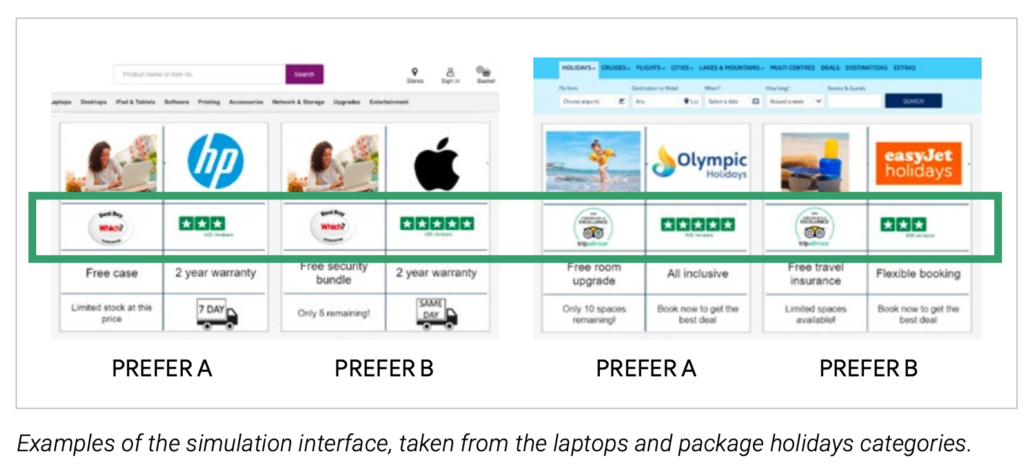

Studies have shown the power of this influence. For example, Google found that “social proof, as expressed as three-star versus five-star reviews, proved to be the most powerful behavioural bias, having either the largest or second-largest effect in 28 of the 31 categories we tested”, ahead of authority bias, scarcity bias, and the power of free.

Buyers love software reviews

An overview of reviews in B2B wouldn’t be complete without asking the audience to think of how they rely on reviews as a consumer.

Reviews in B2C are a few steps ahead of those in B2B. From Amazon to Yelp to TripAdvisor, for better and for worse, reviews are integral to some of the top sites that help us buy. Think of how often you turn to reviews online for hotels, restaurants, etc.

Review websites offer the “wisdom of the crowd.” Even if any single review isn’t accurate, “a large enough collection of reviews can be highly reliable.”

But as you should suspect by this point in the post, here come the survey findings to support my point.

Pew Research Center found that “82% of U.S. adults say they at least sometimes read online customer ratings or reviews before purchasing items for the first time, including 40% who say they always or almost always do so.”

Google has found that buyers are increasingly seeking reviews, even for low-consideration purchases. I can’t help but laugh at the finding that searches for “best toothbrush” doubled in two years. Many of us are reviews-obsessed.

It’s increasingly becoming the norm to search for “best” and “reviews” before making a purchase decision.

Even a cursory glance at search results for “best” and “reviews” searches can provide access to information highly valued by buyers.

Now stop to think for a minute about the buyer of a toothbrush versus the buyer of B2B software. If a very low-consideration purchase like a toothbrush is seeing a doubling in “best toothbrush” searches, what do you think is happening with buyers of your software category? They’re searching for information on the “best” software and “reviews” of products in your category.

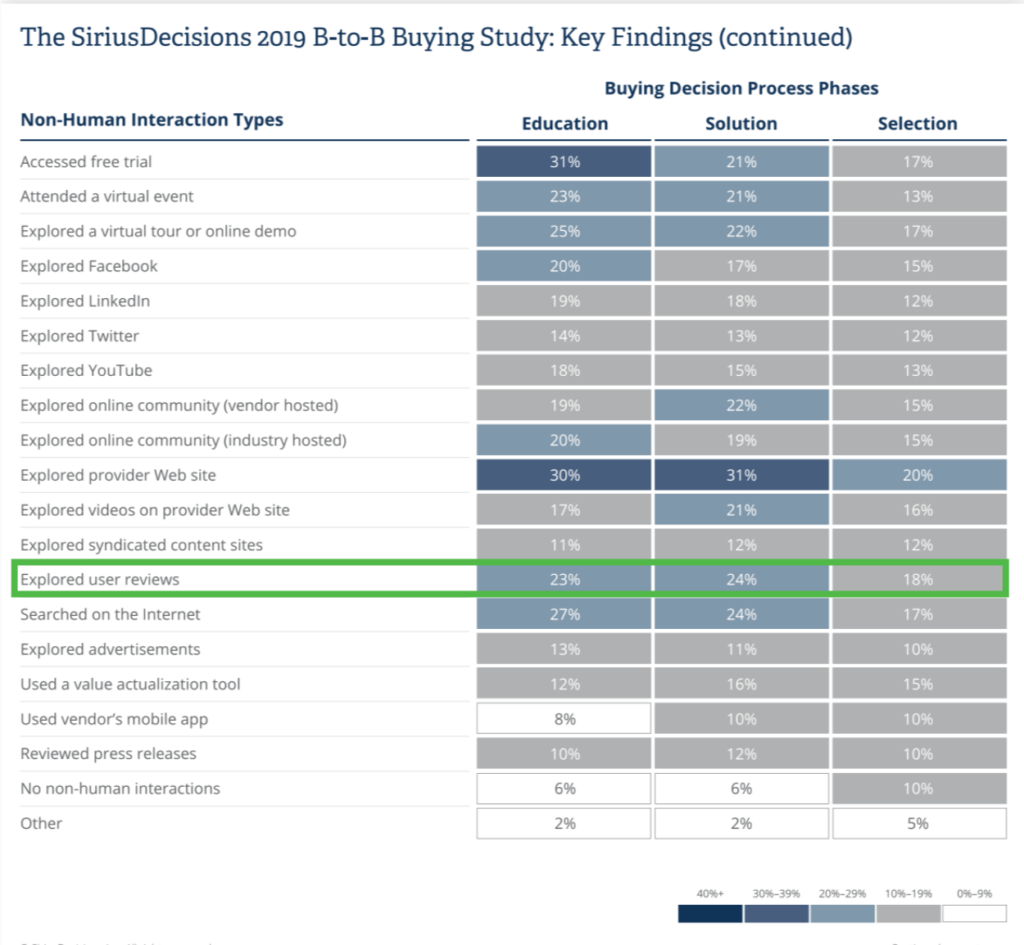

B2B buyers are exploring user reviews throughout the buying process – from education to solution through selection, as SiriusDecisions found in its 2019 B-to-B Buying Study.

Exploring user reviews becomes more important each step into the buying process, increasing relative importance to other sources of “non-human interactions.”

In other words, reviews are: good for buyer education, better for solution (evaluation), and best for selection.

The 2018 report by G2 and Heinz Marketing, The Impact of Reviews on B2B Buyers, covered how B2C has charted a course for B2B with reviews:

Until recently, selecting business solutions was hard, risky, and inherently biased. Buyers spent too much time sifting through search results, reading outdated reports, and sitting in on product demo after product demo, all to no avail. But as B2B reviews become more regular, the decision-making process has become much simpler, letting users’ voices be heard, and helping buyers make smarter, faster, and more impactful decisions.

I would argue that B2B is just getting started here. Selecting business solutions is still hard, risky, and inherently biased. But B2B reviews have helped on each front by improving the B2B buying process with more user voice in the form of reviews. I suspect G2 and the other players in this space would agree that B2B reviews sites are just getting started.

Let’s take a quick step back to where user reviews did get started to understand how they’ve evolved to the way we know them today.

An unofficial, brief history of user reviews online

- Before 1999, apparently, there wasn’t much in the way of reviews aside from Better Business Bureau

- In 1999 came consumer review sites like epinions with “nothing but user-written reviews…100- to 1,000-word critiques of thousands of products and services: restaurants, books, recipes, etc.” (The plug was pulled a few years ago after many years of decline)

- In 2000, TripAdvisor was started, and its founders stumbled upon user reviews. As founder Stephen Kaufer recalled: “We started as a site where we were focused more on those official words from guidebooks or newspapers or magazines. We also had a button in the very beginning that said, ‘Visitors add your own review,’ and boy, did that just take off.”

- By 2005, Yelp narrowed the scope of user reviews from epinions to review restaurants and other local businesses and clearly found a way to make it work. Andrew Chen described it in his book, The Cold Start Problem, “Yelp started out effectively as a directory tool for people to look up local businesses, showing addresses and phone numbers, but network eventually built out the database of photos and reviews.”

- As online user reviews evolved, “five main companies emerged as apparent leaders in online business. Yelp, Amazon, Google, Facebook, and TripAdvisor gained widespread influence and have had a tremendous impact on the evolution of online reviews.”

So how did business software user reviews come to be?

- Capterra was founded in 1999 as an online business software directory but then, in 2007, made the difficult choice to add user reviews.

- In 2012, G2 founders asked each other why it is easier to get unbiased information about a $100 hotel room than a $100,000 piece of software and founded G2 for business software reviews.

- Around the same time, TrustRadius thought similarly on user reviews: “Consumer purchasing behavior has been transformed by peer reviews, yet to date, no one has meaningfully applied the same principles to business.”

- PeerSpot (then known as IT Central Station) also drew inspiration from B2C reviews and Yelp around the same time

- Today, multiple sites cater to B2B reviews (see the post, 10 Best Software Review Sites [2022])

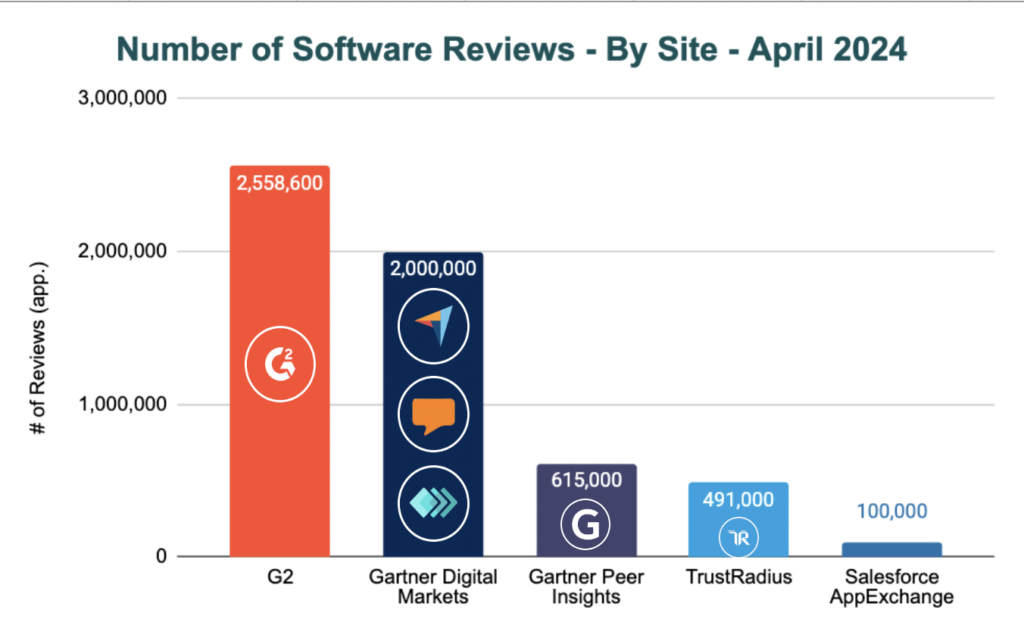

As of April 2024, here are the number of reviews by some of the top B2B software review sites:

- G2: over 2,558,600 reviews

- Gartner Digital Markets (GDM): 2,000,000 over reviews

- Gartner Peer Insights: over 615,000 reviews

- TrustRadius: over 491,000 reviews

- Salesforce AppExchange: over 115,000 reviews

Note: the numbers are as reported by each site. While Salesforce AppExchange is not a software review site, it is included for perspective on reviews in the rise of app marketplaces.

Beyond the B2B software review sites themselves, let’s dig a little deeper into why B2B buyers like software reviews.

Survey says: business software buyers trust peers and seek user reviews

There’s no shortage of B2B buyer surveys finding that buyers trust and seek user reviews. Here’s a roundup of some top findings supporting this B2B buying behaviour.

In LinkedIn and G2’s The Rise of B2B Product reviews report (and webinar), they found:

- 8 in 10 decision-makers seek information and counsel on B2B solutions outside the buying committee.

- Reviews, surveys, and usage stats from fellow technology users make up 51% of today’s trusted sources.

- 70% of technology buyers are likely to discuss solutions or vendors with their professional peers.

- 85% of technology decision-makers read up to 10 online reviews before making a purchase.

- 53% rely on peer recommendations.

In TrustRadius’s The 2021 B2B Buying Disconnect, they found:

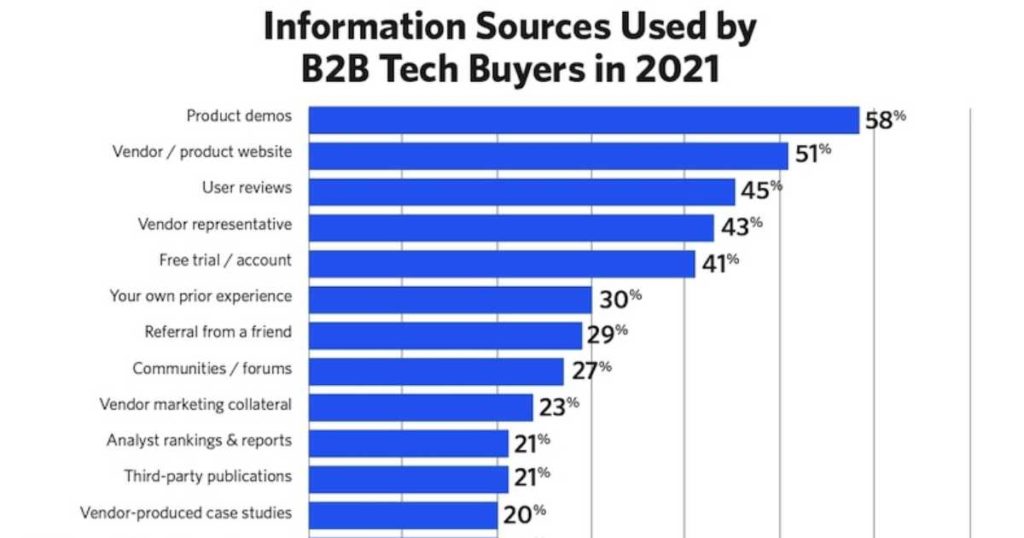

- Buyers consistently use these top 5 information sources to make purchasing decisions: Product demos, Vendor/product websites, User reviews, Vendor reps, and Free trials/accounts.

- 45% of buyers use reviews during their purchase process. Less than half that number (21%) use analyst rankings and reports.

- 87% of buyers want to self-serve part of their buying journey. 57% of buyers make purchase decisions without ever talking with a vendor representative.

- Gen Z and Millennial buyers are 2X more likely than older generations to discover a product by searching online.

- The average buyer uses 6.9 information sources to make a purchase decision, a 35% increase from the year prior.

- Due to the pandemic, 33% of buyers spent more time researching products before making a purchase this year.

Beyond the B2B Buying Disconnect study, TrustRadius rounded up lots of review stats from across the web on the importance of reviews in B2B SaaS buying decisions, such as 93% of buyers saying reviews are influential. Reviews are a top information source for many of today’s buyers.

While the surveys cited above are from review sites and naturally come with selection bias and confirmation bias, even analyst firm Forrester has found evidence in their B2B Buying Surveys that reviews are now integral to many B2B buying processes:

Forrester’s B2B Buying Survey found that vendors’ promises decreased as a significant decision driver from 17% in 2015 to 8% in 2019, review sites such as G2 Crowd and TrustRadius have become the equivalents of their consumer analogs Yelp and Rotten Tomatoes, respectively, for technology buyers — a required step before purchase.

Vendors, online reviews matter regardless of how your feel about them

Online user reviews matter to most buyers. Therefore, they ought to matter to most sellers, too.

In B2B SaaS, online user reviews have been a part of the buying process for over 10 years. So it may seem odd to be writing about why reviews matter in 2022 because it isn’t new, and to some, perhaps many, reviews have lost some of their shine. But for better and worse, reviews are integral to making purchases, including B2B SaaS products.

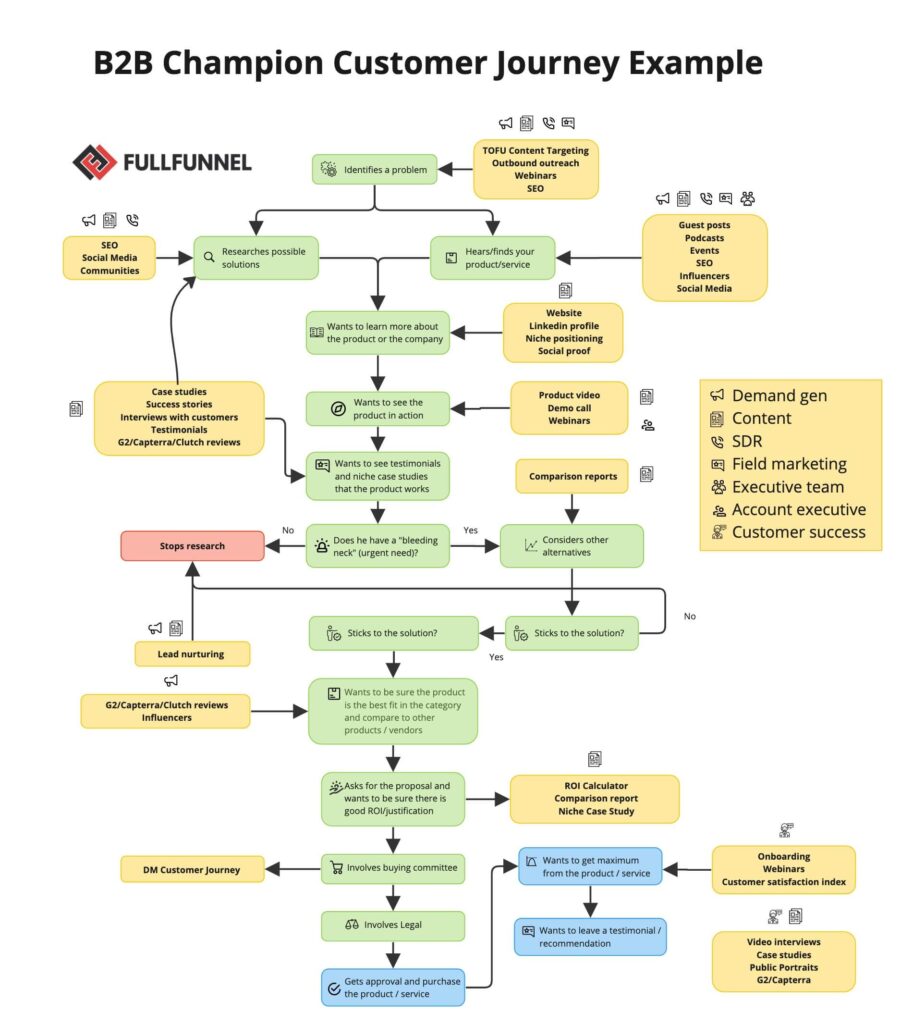

Reviews now play a role throughout the B2B SaaS buying journey.

As you can see in this diagram by FullFunnel.io, an ABM and full-funnel marketing agency for B2B SaaS companies, you can find reviews near the buying process’s start, middle, and end.

Buyers go to review sites when searching for possible solutions. Once there, the review content ratings and rankings can play a critical role in forming the buyer’s shortlist.

Later in the process, buyers often return to reviews as part of their due diligence. The buyer may compare their shortlisted vendors against one another, dive deeper into the review content specifics, and even reach out to a user or two through a side channel to validate their choice.

Given the search dominance review sites have on B2B SaaS buyer search terms, many buyers will turn to them at some point in the buying process.

That means they matter to B2B SaaS vendors and their go-to-market teams.

When vendors ask buyers to self-report how they heard about them, review sites come up a lot, as Growth Advisor Manuel Rietzsch has done:

Ultimately, it’s less a question of whether reviews matter in B2B SaaS. It’s a question of how important they are to your business, and what will you do about it?

Author

-

I'm the Founder and Editor-In-Chief of B2B SaaS Reviews and the Director of Demand Generation at PartnerStack, the leading platform for partner management and affiliate marketing in B2B SaaS. My experience spans several notable B2B SaaS companies, including Influitive (Advocate Marketing), LevelJump (Sales Enablement, acquired by Salesforce), and Eloqua (Marketing Automation, acquired by Oracle). I hold a Bachelor of Commerce in Marketing Management from Toronto Metropolitan University and a Master of International Business from Queen's University, with academic exchanges at Copenhagen Business School and Bocconi University.